The Paytm Case Study

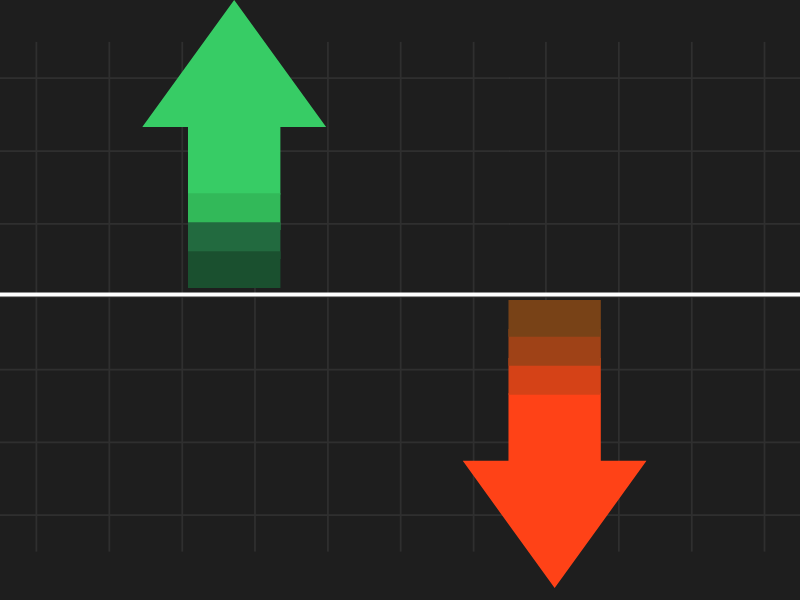

Over the past two and a half years, Paytm’s chart reflects a consistent downward trend, with occasional minor fluctuations. Despite this clear pattern, many investors remain bullish on the stock, raising the question: what drives the rush to buy?

Embracing Realistic Investment Models

To navigate the complexities of the stock market, investors must shift from predictive models to more realistic price behavior models. This involves adopting the “Bhav Bhagwan Che” principle, where one allows the stock’s movement to dictate investment decisions. Instead of forecasting future performance, focus on interpreting the stock’s current behavior as a guide.

Challenging Conventional Thinking

This transition requires a fundamental shift in mindset. While it may seem counterintuitive, questioning why a stock is falling is essential to informed decision-making. Rather than relying on popular sentiment or blind optimism, investors should critically evaluate the rationale behind their investment choices.

Comparing Paytm’s performance to that of Zomato highlights the importance of momentum indicators in investment decisions. Zomato’s upward trajectory, following a period of consolidation, illustrates how interpreting price signals can inform timely buy or sell actions. Investors should evaluate their investment style and incorporate historical data to refine their approach.

Reflecting on past market conditions, such as the pre-COVID era or the financial crisis of 2008, provides valuable lessons for navigating uncertainty. By simulating different scenarios and assessing potential responses, investors can better prepare for future challenges and opportunities.

WeekendInvesting Strategy Spotlight – Mi EverGreen

Russia faced a currency crisis in August 1998 when the government defaulted on its debt and devalued the Russian ruble (RUB). The crisis stemmed from a combination of economic mismanagement, declining oil prices, and the Asian financial contagion.

Having exposure to GOLD is no more a choice in this rapidly evolving world, it is an absolute must. Mi EverGreen is a delightful mix of 20 strongest stocks from CNX 200 universe combined with 25% fixed allocation to GOLD to protect you from unpredictable events.

Use code GOLDRUSH to avail a flat 20% discount on your subscription to Mi EverGreen.

Offer ends today !

Disclaimers and disclosures : https://tinyurl.com/2763eyaz

If you have any questions, please write to support@weekendinvesting.com