Over the past few decades, Japanese investors have witnessed remarkable growth in their equity and gold portfolios. For those who entered the workforce around 2000, their journey has been marked by a staggering 1100% increase in gold and only a mere 150% rise in equity. This experience shapes their investment preferences and decisions, especially as they approach middle age.

The investing landscape is heavily influenced by generational experiences. In India, where equity has outperformed gold with an impressive 11.5% growth rate, the preference for asset classes is evident. Contrastingly, in countries where equities remained stagnant while gold soared, investors naturally leaned towards the latter. Historical experiences, whether positive or negative, significantly impact investor behavior and choices.

In India, the real estate boom also played a significant role in shaping investment behavior. The lessons passed down from one generation to the next are often based on personal experiences. If the previous generation faced losses in equities, they might advise against investing in stocks, drawing from their own setbacks. This experiential learning shapes long-term investment attitudes and strategies.

Fortunately, the current market conditions in India are favorable for investors across various asset classes. Unlike Japan’s tumultuous equity history, Indian investors are witnessing widespread growth. This presents a unique opportunity for wealth accumulation without requiring extraordinary efforts.

The key to building wealth in India lies in positioning oneself correctly and avoiding major financial missteps. With the economy poised for continued growth over the coming decades, investors simply need to stay aligned with the upward trajectory of the market. By making informed decisions and staying disciplined, investors can capitalize on the wealth-building opportunities available.

WeekendInvesting Strategy Spotlight

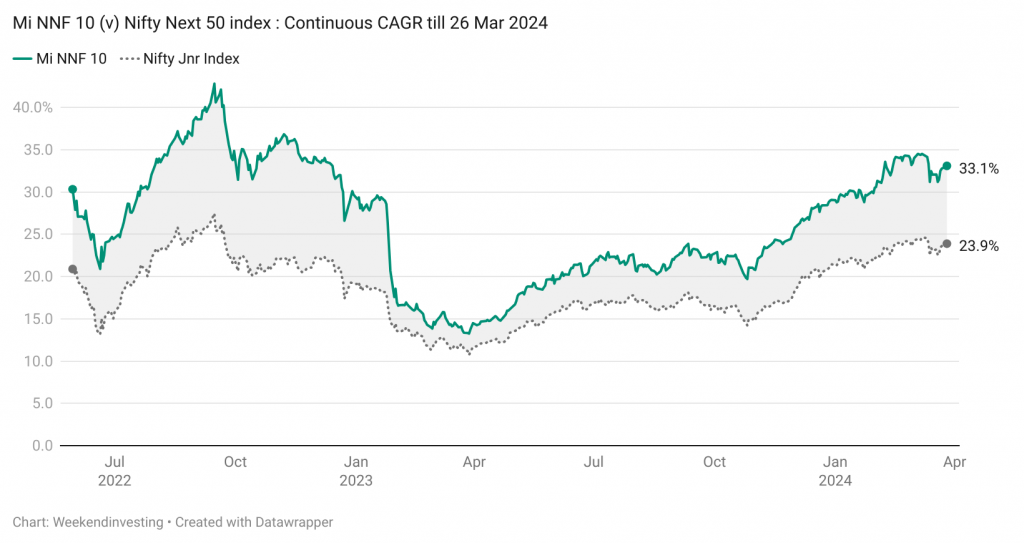

This chart denotes the CAGR of both Mi NNF 10 and its benchmark, the Nifty Jnr Index on which the strategy is based. The strategy has recorded a CAGR of 33% compared to 24% on the Nifty Jnr (Period : 12 Nov 2020 to 26 Mar 2024 – 3 years and 4 months)

The sheer consistency in outperformance of the strategy is essentially an outcome of ;

– Picking and riding the strongest stocks within its universe in a non discretionary – rule based manner.

– Allocating a standard 10% weightage to all stocks without any bias towards market capitalization

– Riding winners as long as momentum exists and dumping losers as soon as momentum fades away

The subscription fee for Mi NNF 10 shall be increased to Rs 9,999 from current fee of Rs 7,499 effective – 0

99 effective – 01 Apr 2024 onward. Go ahead and make use of this opportunity to subscribe to to Mi NNF 10 before the price increase.

If you have any questions, please write to support@weekendinvesting.com