Below is a captivating chart showcasing the illustrious journey of the Nifty 50 index over the past three decades. Spanning from 1990 to the present day, this logarithmic chart provides invaluable insights into the market trends that have shaped India’s financial landscape. Through minor fluctuations and short-term corrections, one overarching narrative emerges—the market’s upward trajectory, a testament to the enduring India story that has unfolded over the years.

Steady Rise Amidst Whiplashes: The India Story

Despite occasional whiplashes and corrections, the Indian market has demonstrated a remarkable resilience, consistently charting an upward course over the past 30 to 35 years. This trend may well continue into the foreseeable future, underscoring the inherent growth potential of India’s economy. The key lies in navigating the market with prudence, avoiding major pitfalls, and aligning with the prevailing market momentum.

A parallel narrative unfolds when we juxtapose the Nifty index with the price of gold, particularly in the context of the Indian rupee. While gold exhibits a smooth and steady upward trajectory over the years, mirroring the stability of the Nifty index, the two assets offer complementary avenues for wealth accumulation. Both charts depict a consistent growth pattern, with the Nifty boasting a commendable 12% compound annual growth rate (CAGR) over the long term.

The Power of Compounding

What emerges from these charts is the power of compounding, wherein even modest returns can yield significant wealth accumulation over time. With a 12% CAGR, investors can steadily grow their corpus, outpacing inflation and laying the foundation for financial security. Moreover, by implementing strategic investment strategies that aim to surpass benchmark returns, investors can unlock even greater growth potential and accelerate their wealth accumulation journey.

WeekendInvesting Strategy Spotlight

A strategy to overcome this problem !

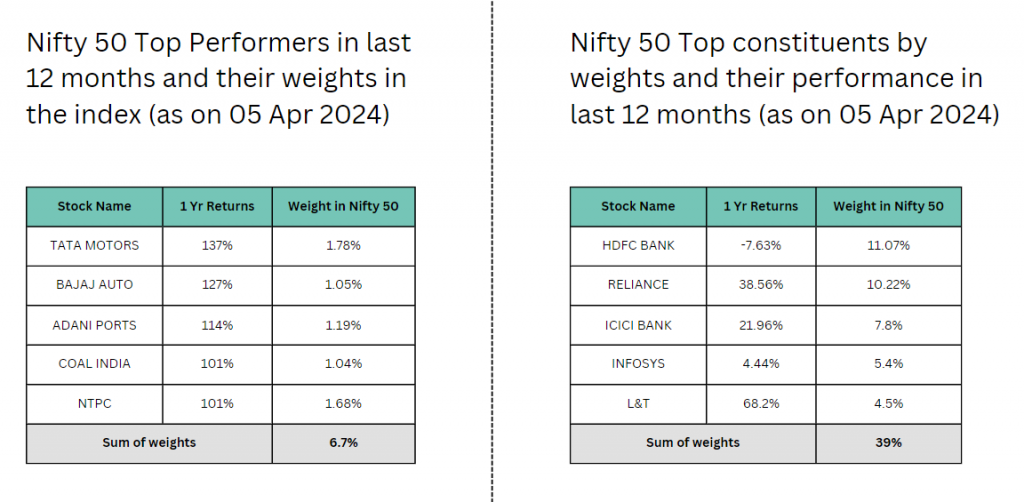

Here’s an interesting data point for your better understanding of how index performance works.

The table on the left denotes the stocks with highest gains within the Nifty 50 universe in FY 2024 & their corresponding weightages in the index.

The table on the right denotes the list of largest weighted stocks in Nifty 50 and their corresponding performances in FY 2024.

It is rather surprising to note that all top 5 performing stocks from Nifty 50 have clocked in excess of 100% gains collectively hold only a mere 6.7% weightage in Nifty 50.

Whereas, the top weighted stocks which occupy almost 40% weights in Nifty 50 have had mixed results in FY 2024.

What this suggests is that – For Nifty 50 to do well, the heavyweights (HDFC BANK, RELIANCE, ICICI BANK< INFOSYS & LT) need to put on a great show.

The spirited performances clocked by the likes of TATA MOTORS, BAJAJ AUTO, COAL INDIA , ADANI PORTS & NTPC have not been able to impact Nifty 50 in a major way owing to their miniscule weightages.

Is there a way to ;

– Determine the strongest stocks within the Nifty 50 universe ?

– Allocate a bias free equal weights to all strongest stocks ?

Mi India Top 10 does exactly that

Use code FY2025 to subscribe to Mi India Top 10 at a flat 25% discount.

Disclaimers and disclosures : https://tinyurl.com/2763eyaz

If you have any questions, please write to support@weekendinvesting.com