Hatsun Agro Products, a stock that lingered between 400 to 600 for years, saw a remarkable turnaround post-COVID. Despite a gradual decline, it surged beyond its previous highs in late 2020, reaching an all-time high by September-October. This caught the attention of one of our momentum strategies (HNI Wealth Builder), leading to a making an entry around 700 levels.

The momentum strategy capitalized on Hatsun Agro’s upward trajectory, yielding significant gains as the stock soared to 1500. Exiting near 1200, the strategy avoided potential losses as the stock fluctuated between 800 and 1200. Currently trading at 1100, this approach exemplifies the importance of seizing opportunities with a simple rule based approach.

Optimizing Capital Utilization

In investing, capital is our raw material, and effective utilization is key to generating profits. By leveraging momentum strategies, investors can extract gains from market movements without letting capital sit idle. This targeted approach ensures that capital remains available for other investment opportunities.

Rather than holding onto stagnant stocks for years, momentum strategies enable investors to act decisively based on price movements. By entering positions during periods of upward momentum and exiting when signs of exhaustion emerge, investors can safeguard their capital and pursue more promising opportunities.

The essence of momentum strategies lies in their ability to extract value from dynamic market conditions. Rather than passively waiting for stocks to perform, investors can proactively engage with opportunities as they arise, maximizing returns while minimizing risk.

WeekendInvesting Strategy Spotlight

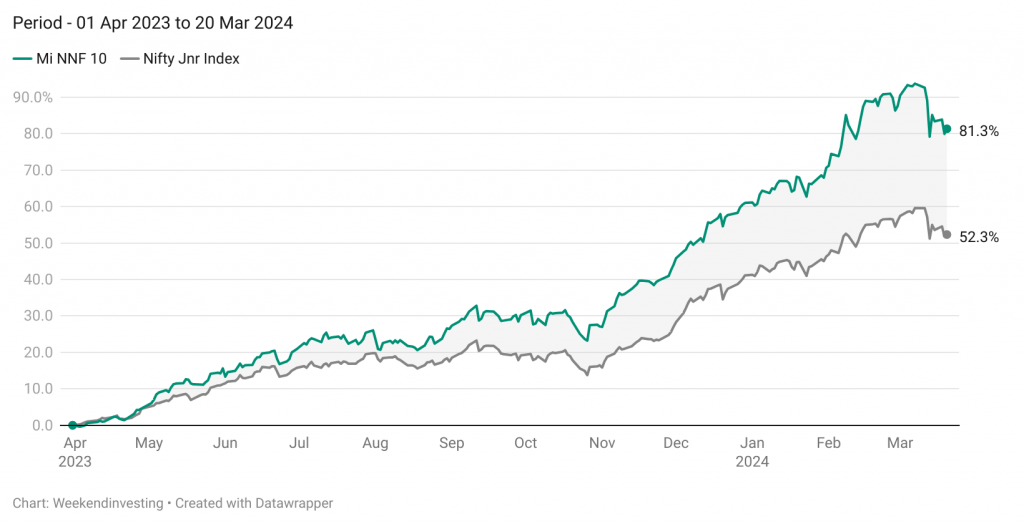

Mi NNF 10’s performance has been a great example to showcase the immense ability of a robust non discretionary, momentum strategy based on large caps, specifically – the Nifty Next 50 index.

With about a week to go for the end of FY 24, the strategy has achieved 81% gains so far compared to 52% on the Nifty Next 50 Index demonstrating solid outperformance. The CAGR since going LIVE (12 Nov 2020) stands at 31% compared to 22% on the Nifty Jnr Index.

The subscription fee for Mi NNF 10 shall be increased to Rs 9,999 from current fee of Rs 7,499 effective – 01 Apr 2024 onward. Go ahead and make use of this opportunity to subscribe to to Mi NNF 10 before the price increase.

If you have any questions, please write to support@weekendinvesting.com