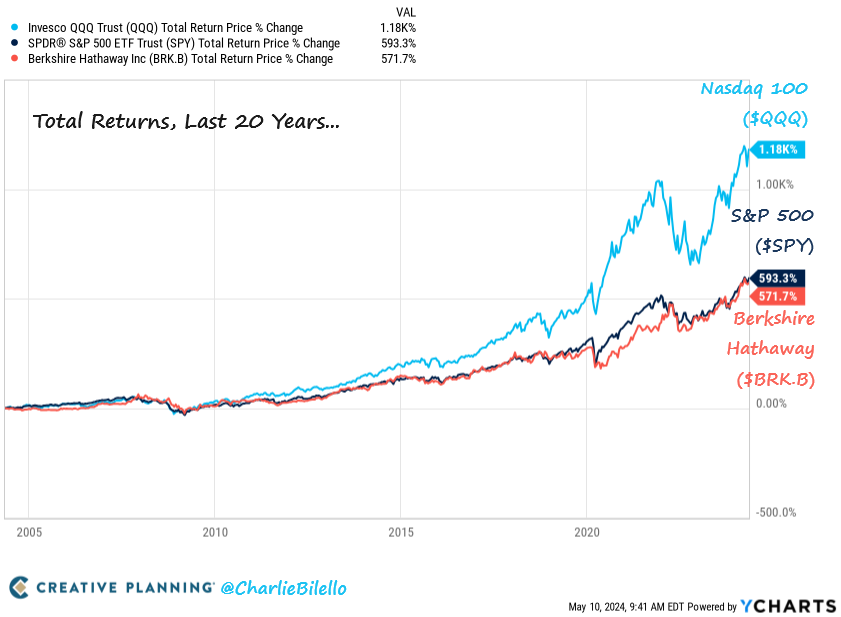

Comparing S&P 500, Berkshire Hathaway, and Nasdaq 100 Returns

A fascinating chart by Charlie Bilello reveals the performance of three major investment options over the last 20 years. The chart compares the S&P 500, Berkshire Hathaway, and the Nasdaq 100. The black line represents the total returns of the S&P 500, including dividends. The orange line shows the total percentage change in Berkshire Hathaway’s stock returns, and the blue line represents the total returns of the Nasdaq 100, also known as QQQ.

Berkshire Hathaway vs. S&P 500

Interestingly, the chart shows that Berkshire Hathaway has delivered returns almost identical to the S&P 500 over the past 20 years. Despite being an actively managed fund led by legendary investors Warren Buffet and Charlie Munger, Berkshire Hathaway has not outperformed the broader index. There were even periods, such as the mid-2000s and post-COVID, where Berkshire’s returns lagged behind the S&P 500. This raises a crucial question: If the best managers in the world can’t consistently beat the index, why not opt for a low-cost index ETF?

Given that Berkshire Hathaway’s returns are on par with the S&P 500, investors might wonder if paying for active management is worthwhile. Low-cost index ETFs, which track the S&P 500, offer a compelling alternative. These ETFs come with lower fees and have historically provided solid returns. The choice between an actively managed fund and a passive index fund becomes more apparent when considering the cost-benefit aspect.

The Exceptional Performance of Nasdaq 100

Another significant insight from the chart is the exceptional performance of the Nasdaq 100. Over the same 20-year period, the Nasdaq 100 has gained 1,180%, compared to the S&P 500’s 590%. This impressive growth highlights the potential of selecting the right index to invest in. However, merely choosing a high-performing index is not enough. Investors need a strategy that can consistently outperform that index.

The Importance of a Winning Strategy

Investing in an index like the Nasdaq 100 can be decent, but it requires a strategy that can outperform the index itself. The same applies to the S&P 500. Having a robust investment strategy is crucial for achieving returns that exceed those of the broader market. This principle holds true across different markets, including India.

In India, several indices serve as benchmarks for investors, such as Nifty, Nifty Next 50, CNX 500, Small Cap 250, and Mid & Small Cap 400. These indices provide a solid foundation for evaluating market performance. However, to maximize returns, investors need a managed strategy that can outperform these indices. This managed approach is the key to unlocking higher returns and making the most of investment opportunities.

Disclaimers and disclosures : https://tinyurl.com/2763eyaz

If you have any questions, please write to support@weekendinvesting.com