Investors often debate whether it’s more profitable to focus on large-cap stocks or small-cap stocks. Large-cap stocks are generally associated with stability and lower risk, while small-cap stocks are seen as more volatile but with higher growth potential. In this article, we will take a closer look at the long-term performance of small-cap stocks compared to large-cap stocks and explore some valuable insights into their cyclical nature.

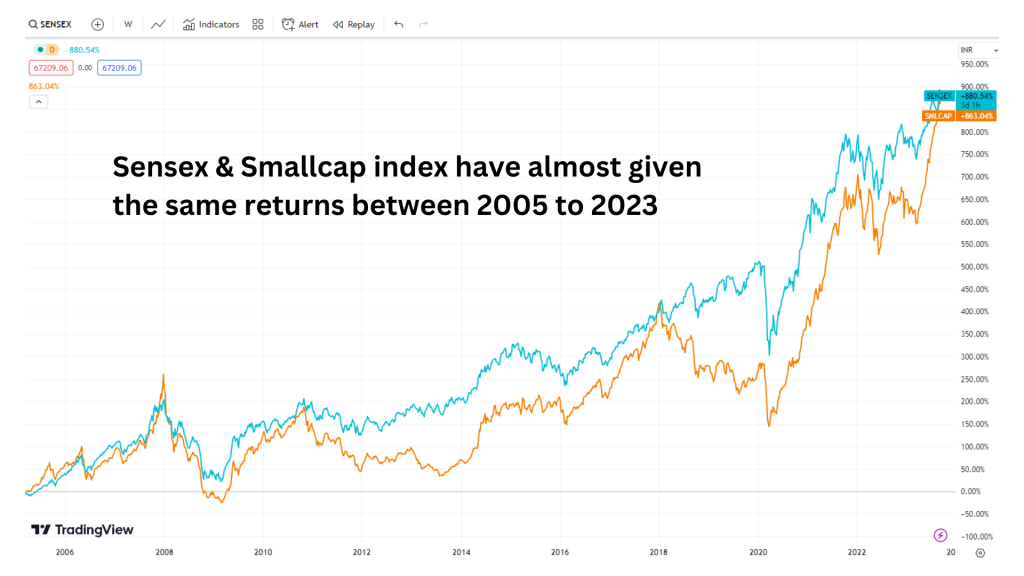

To analyse the performance of small-cap and large-cap stocks, we will refer to the Sensex (a benchmark index of the Bombay Stock Exchange) and the Small Cap BSE index. While the Sensex represents the performance of large-cap stocks, the Small Cap BSE index focuses on small-cap stocks.

A Surprising Revelation: Similar Returns Over 20 Years

When examining the charts of these two indices over a period of nearly 20 years, one startling observation emerges – both indices have delivered similar returns. Despite the perception that small-cap stocks generate higher returns due to their growth potential, the data reveals that the returns of small-cap stocks have been on par with those of large-cap stocks.

This finding challenges the common assumption that small-cap stocks consistently outperform their larger counterparts. Investors often view small-cap stocks as riskier but potentially more rewarding investments, assuming they will generate superior returns in the long term. However, the historical data suggests otherwise.

Analysing the Divergences

To gain a deeper understanding, let’s explore the periods when the performance of small-cap stocks diverged from that of large-cap stocks. By examining these divergent periods, we can uncover patterns and potential opportunities for investors.

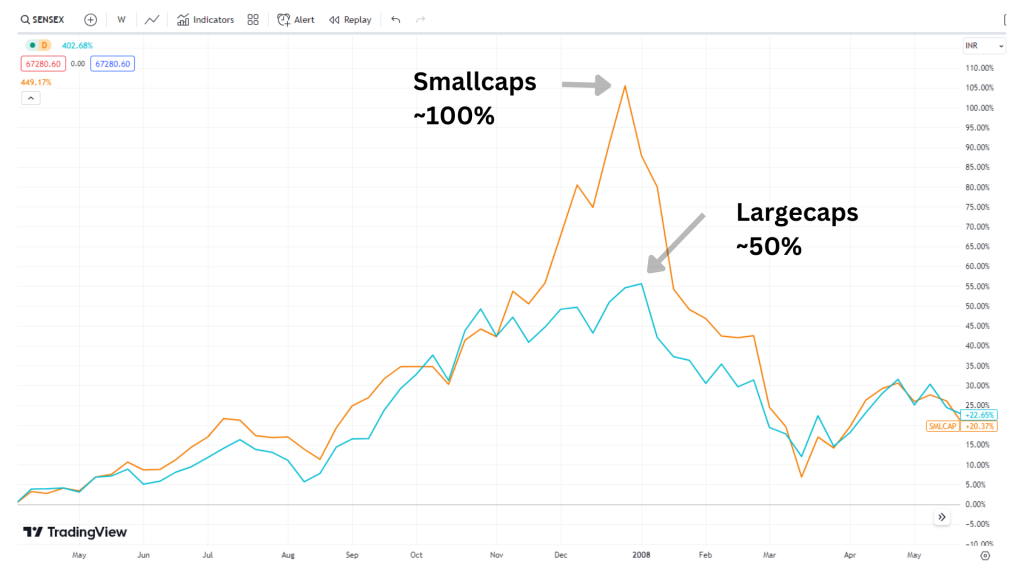

Period 1: 2007-2008

Towards the end of a major bull rally in 2008, small-cap stocks began to outperform large-cap stocks significantly. From May 2007 to January 2008, small-cap stocks surged by nearly 100%, while large-cap stocks increased by only 50%. However, this period of outperformance was short-lived, as small-cap stocks eventually fell back in line with large-cap stocks.

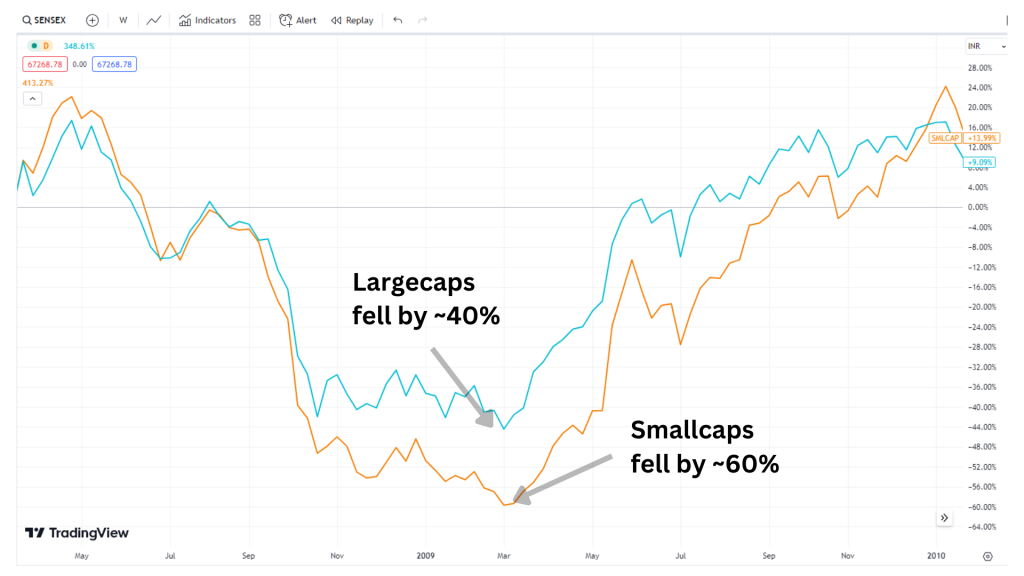

Period 2: GFC Fall in 2008

After the major market downturn in 2008, small-cap stocks experienced a more significant decline compared to large-cap stocks. While large-cap stocks fell by 40%, small-cap stocks plummeted by 60%.

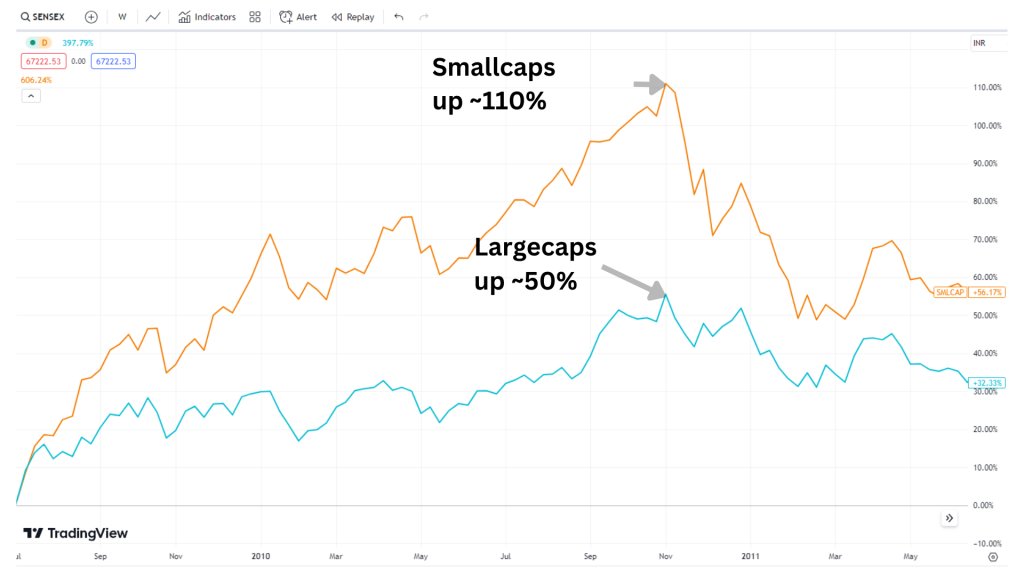

Period 3: Recovery post GFC Crisis in 2009

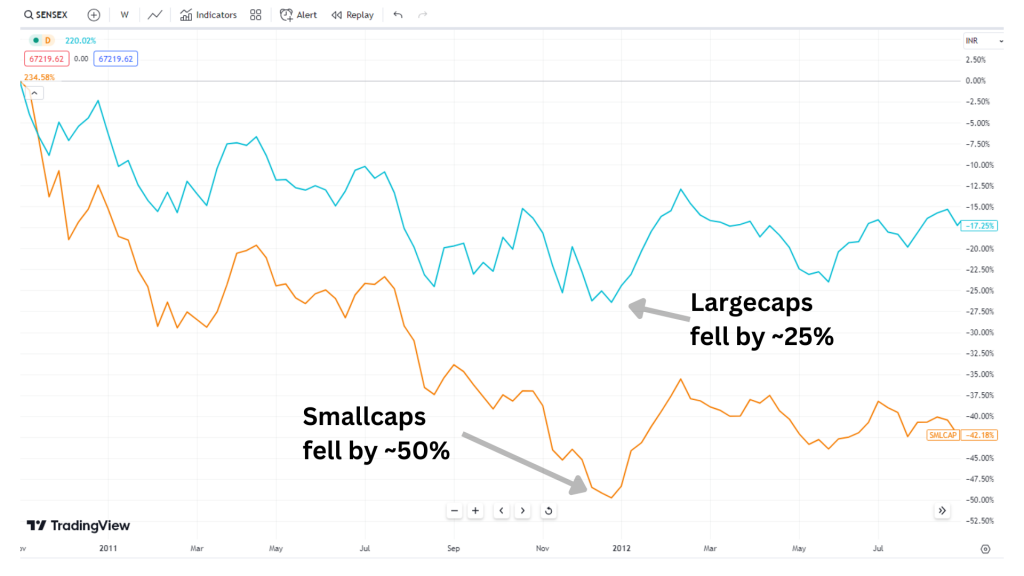

Following the market recovery in 2009, small-cap stocks again took the lead and surged by 100%. In contrast, large-cap stocks only rose by 54%. However, this pattern showcased the cyclical nature of small-cap stocks, as they subsequently fell by 50% while large-cap stocks declined by a more modest 25%.

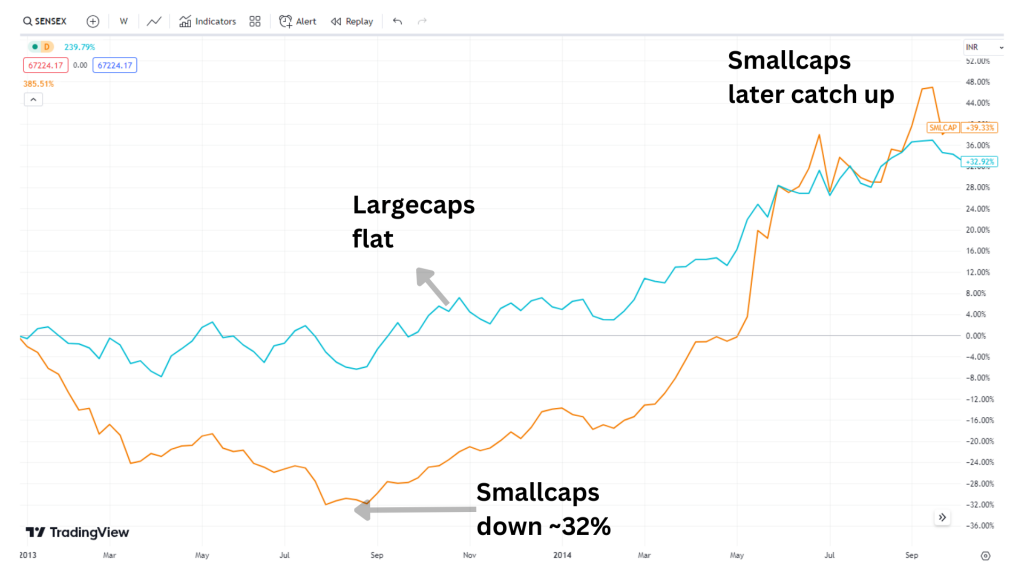

Repetition of the Cycle

This pattern of small-cap stocks outperforming large-cap stocks, followed by a subsequent decline, continued throughout the years. Similar divergence occurred in 2013, followed by a catch-up period, and later in 2016, indicating a repetitive cycle of performance swings.

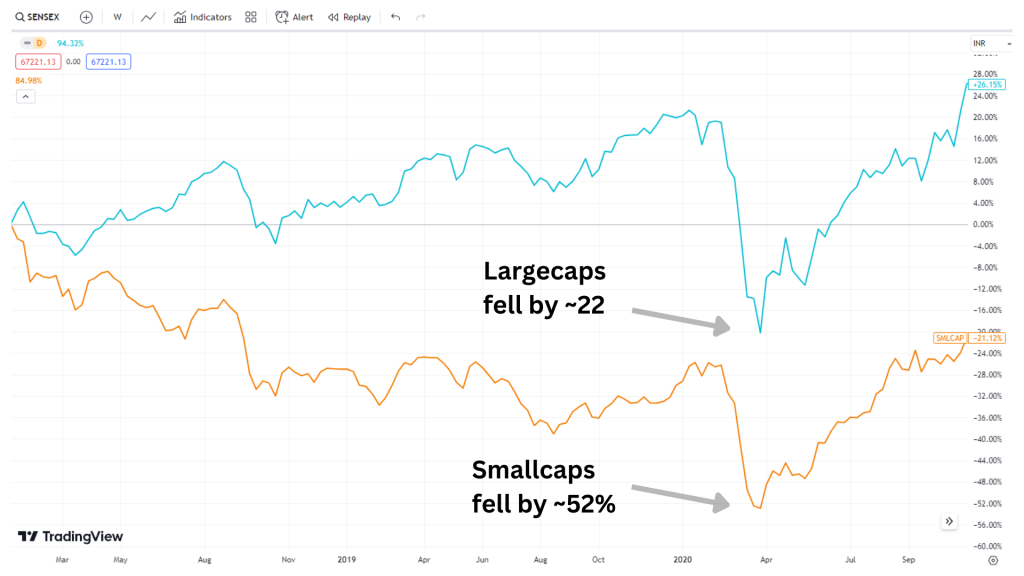

We also saw a big divergence in 2018 when Smallcaps dropped 52% compared to 22% on the large caps

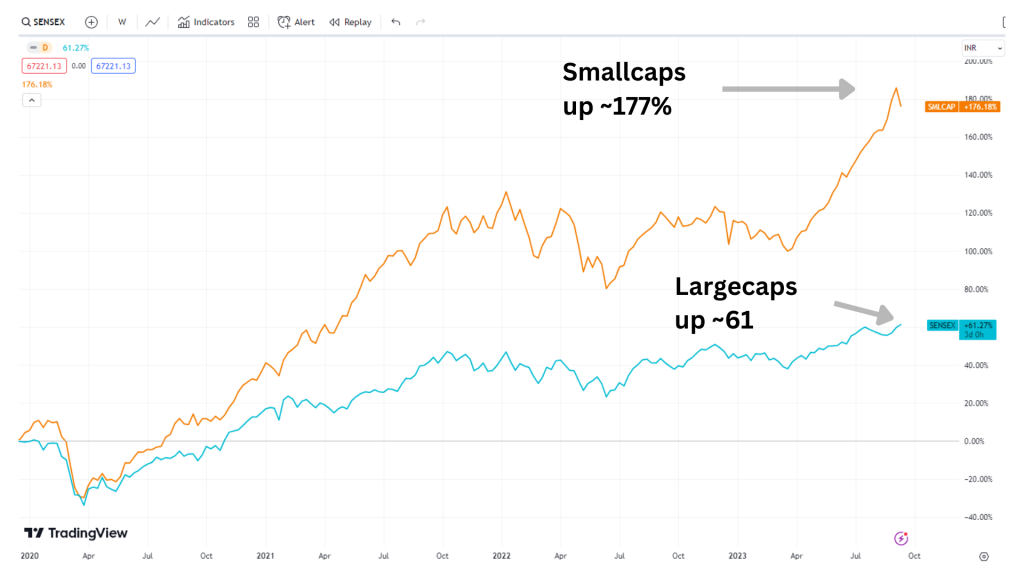

The COVID-19 pandemic once again highlighted the cyclical nature of small-cap and large-cap stocks. Since the pre COVID highs, small-cap stocks have gained 177%, while large-cap stocks have risen by 61%. These recent returns indicate that whenever there is a significant market event, small-cap stocks tend to outperform in terms of percentage gains.

Implementing a Strategy for Outperformance

While the long-term performance of small-cap and large-cap stocks tends to be similar, there is an opportunity for investors to potentially outperform the market by implementing a well-thought-out strategy that capitalises on the cyclical nature of small-cap stocks.

Mi 25 is a niche smallcaps focused strategy that aims to capitalize on the alpha one can see with the Smallcaps while offering downside protection during weakness by allocating to cash.

Download the WeekendInvesting App

If you have any questions for us. please write to us on support@weekendinvesting.com. You can also get on a 1-1 meeting with us should you need more clarity about the strategies or processes.