Long Periods of Low Real Returns

A recent analysis of long-term market data has revealed a surprising trend: many developed countries have experienced extended periods during which equity markets offered minimal real returns. Real returns are calculated by subtracting inflation from nominal returns. For example, if equity returns are 4% and inflation is 3%, the real return amounts to just 1%. When this analysis is conducted across various countries, the results are unexpected.

Surprising Numbers from Global Markets

Denmark experienced 15 years of negligible real equity returns, while Canada and the United States faced 16 years each. Australia also had a span of 16 years without substantial gains. The UK saw 22 years, and Belgium had a staggering 76 years of minimal real returns.

This data, collected from 1900 to 2024, encompasses 125 years of historical information, illustrating that even in robust equity markets, there can be prolonged periods where investors see little gain after accounting for inflation.

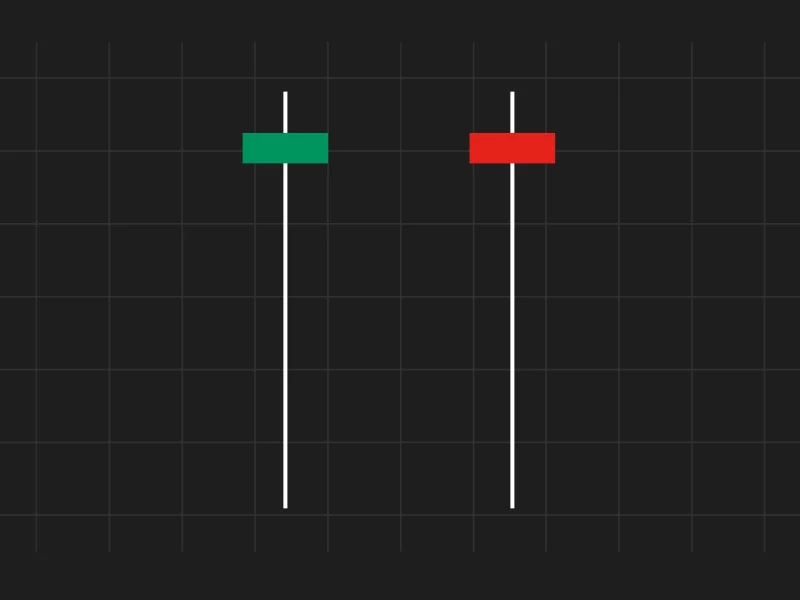

Nominal Returns vs. Real Returns

Many investors focus on positive returns and assume they are doing well, but this perspective is only true in nominal terms. Once returns are adjusted for inflation, the situation changes. Inflation diminishes the value of money, which is why real returns matter more. In some countries, inflation has eroded most of the equity gains over the years.

Bond Markets Tell the Same Story

This trend is not limited to equity markets; bond markets have also endured lengthy periods of negative real returns. Some countries have experienced 80, 88, or even more years with either zero or negative real bond returns. This suggests that investing in bonds primarily helps investors keep pace with inflation rather than grow their wealth.

Indian Context and Real Returns

This issue is also significant in India. When individuals invest in fixed deposits or government bonds, they may feel secure. However, in real terms, their investments could be yielding little to no growth—or even causing losses. Inflation erodes their returns, and after adjusting for it, many of these investments do not provide any real increase in value.

A Wake-Up Call for Investors

These findings serve as an eye-opener. Many people assume that equities will always deliver strong long-term returns, but history demonstrates that even the best markets can undergo lengthy periods without real gains. This highlights the importance for investors to remain vigilant and mindful of how inflation impacts their wealth over time.

How do you plan to beat inflation in the long run? Share your views in the comments! IF YOU FOUND THIS BLOG USEFUL, PLEASE SHARE IT WITH OTHERS TOO!

WeekendInvesting launches – The Momentum Podcast

In this episode of the Momentum Podcast by Weekend Investing, Alok Jain sits down with Mr. Thomas, a passionate retail investor, to uncover his remarkable journey—from exiting the markets at the worst possible moment during the 2020 crash to finding clarity and consistency through momentum investing.

Topics Covered:

✅How a train journey sparked his interest in the stock market

✅Emotional investing mistakes & lessons from the COVID crash

✅Why he shifted from value to momentum-based strategies

✅The Weekend Investing system that gave him peace of mind

✅How he balances aggressive bets with long-term wealth-building

Whether you’re just starting out or navigating your own investing style, this episode is packed with relatable stories and actionable insights.