Debating Inheritance Tax: A Contentious Topic

Inheritance tax and wealth redistribution have become heated topics of debate in recent times. With elections looming, political rhetoric is at its peak, and various proposals are being thrown into the ring. While it’s essential to understand the context, it’s equally crucial not to get swept up in the political frenzy.

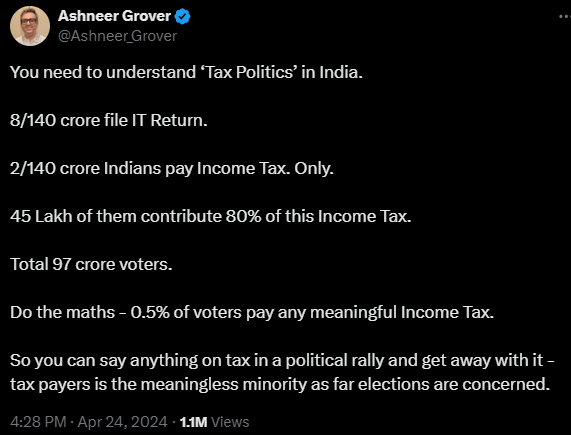

Understanding Tax Politics

A deeper dive into tax politics reveals some eye-opening facts. For instance, only a minuscule percentage of voters actually contribute a meaningful amount in income tax. This disparity allows politicians to make grand promises without facing significant backlash from the majority of voters who are unaffected by such tax policies.

The Zero-Sum Game of Wealth Distribution

A poignant quote from Adrian Rogers highlights the inherent flaw in wealth distribution through taxation. It emphasizes that redistributing wealth without creating it leads to a zero-sum game. When one segment of society relies on the efforts of another without contributing, it spells trouble for the nation’s long-term prosperity.

In the midst of election fervor, proposed tax reforms are making headlines. President Biden’s proposal for a 44.6% capital gains tax, along with other measures targeting high-net-worth individuals, has sparked discussions. While such reforms may resonate with the masses, their implications for market stability remain uncertain.

The Resilience of Markets

Despite the political noise surrounding tax policies, markets have remained relatively unaffected. This stability is reassuring, indicating that investors are taking a pragmatic approach and not succumbing to short-term fluctuations driven by election rhetoric.

Disclaimers and disclosures : https://tinyurl.com/2763eyaz

If you have any questions, please write to support@weekendinvesting.com