Navigating the Illusion

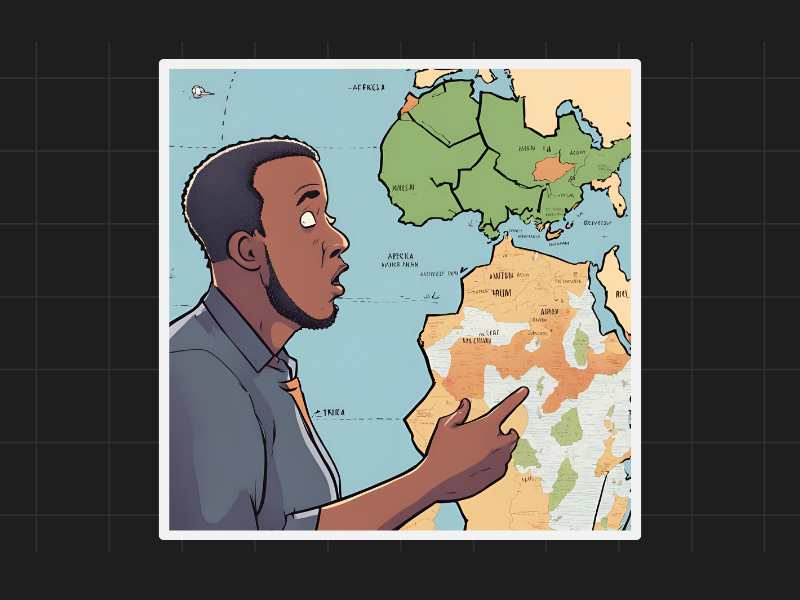

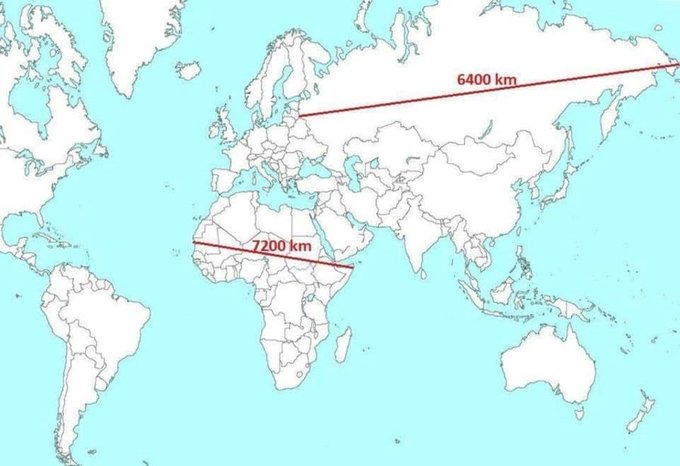

The world map, a familiar sight, yet often misunderstood in its true dimensions. Just as Asia spans 6400 kilometers and Africa stretches 7200 kilometers, reality can differ greatly from what’s portrayed on the surface. Similarly, corporate results often present an idealized version of reality, designed to showcase companies in the best light possible. Promoters strive to maintain investor confidence, often concealing challenges to buy time for resolution.

The Myth of Pristine Corporate Transparency

Despite the expectation of transparency, corporate results are often anything but. Investors are lured by the allure of promising narratives, failing to delve into the underlying data. IPOs, touted as once-in-a-lifetime opportunities, are frequently oversold, masking the true intentions of sellers. Promoters and private equity firms capitalize on investor enthusiasm, maximizing sale prices while purporting to leave value on the table.

The Buyer Beware Mentality

In financial markets, buyers are often portrayed as unwitting victims, swayed by persuasive narratives and glossy presentations. Yet, discerning investors understand the importance of scrutinizing data and constructing their investment models. Rather than succumbing to external narratives, investors should rely on data-driven analyses to inform their decisions, avoiding the pitfalls of misleading stories.

The allure of a compelling story can cloud judgment, leading investors astray. Whether it’s stocks, ULIPs, or hybrid funds, the facade of success often conceals underlying realities. By adopting a skeptical mindset and scrutinizing data impartially, investors can navigate the complexities of financial markets with greater confidence and clarity.

Ultimately, the key to successful investing lies in letting data speak for itself. Rather than relying on external narratives, investors should conduct thorough analyses and make informed decisions based on tangible evidence.

Disclaimers and disclosures : https://tinyurl.com/2763eyaz

If you have any questions, please write to support@weekendinvesting.com