In an unexpected turn of events, Dell, represented by the blue line in the chart, has outperformed Apple, depicted by the white line, over the past five years.

While Apple has seen a modest 71% increase, Dell has surged by a staggering 327%. This scenario challenges the conventional belief that past success guarantees future performance, highlighting the importance of tracking momentum and being open to lesser-known stocks.

Quantitative methodologies that evaluate momentum scores or compare stock performances within specific indices offer valuable insights. Such approaches enable investors to identify hidden gems early on, before they gain widespread attention. While established brands may provide a sense of security, the ultimate goal of investing is to generate returns, making it crucial to remain open-minded and adaptable.

Lessons from Indian Markets

Similar trends have been observed in Indian markets, where renowned stocks like Hindustan Lever, Reliance, and ITC remained stagnant for years. Even prominent names like HDFC Bank and Bajaj Finance have experienced prolonged periods of limited movement. The past performance of these stocks does not guarantee future success, emphasizing the need for forward-looking investment strategies.

Instead of relying on rear-view mirror driving, where past achievements dictate future expectations, investors must adopt a forward-looking approach. This proactive stance allows investors to adapt to evolving market dynamics and adjust their strategies accordingly. With markets being inherently dynamic, embracing change and staying nimble is key to long-term success.

The continuous rise of indices reflects the principle of survival of the fittest in action. Index committees periodically adjust index components, favoring stocks that demonstrate upward momentum while removing underperformers. This cyclical process underscores the importance of allowing winning stocks to flourish while cutting losses to fuel portfolio growth.

WeekendInvesting Strategy Spotlight

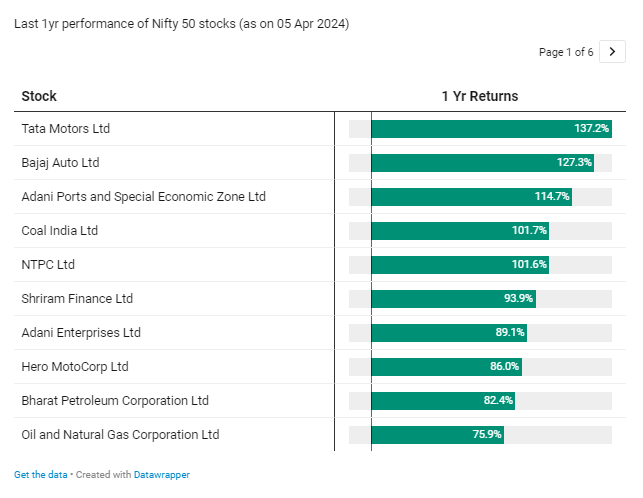

In the past 1 year, several stocks from Nifty 50 have performed well.

– 5 stocks clocked more than 100% gains

– 14 stocks returned between 50% and 99%

– 35 out of 50 stocks outperformed Nifty 50 in last 12 months

Nifty 50’s performance of 28% in FY 24 despite having so many outperforming stocks is primarily a result of the skew in weightage.

The top 5 performers of Nifty 50 in FY 24 hold a very small weightage varying between 1% to 1.8% each (collectively 6.7%).

This means that 10% of the stocks in Nifty 50 together hold 39% of the weights while the remaining 90% of the stocks hold only 61% weights collectively.

Chart link for top performers of Nifty 50 in FY 24 – https://www.datawrapper.de/_/bLoIj/

Navigating this skew

Mi India Top 10 rides only the top 10 performers of Nifty 50 and also allocates an equal 10% weightage to them thus providing all stocks with equal opportunity to contribute to the overall performance of the strategy.

Today is the last day to avail 25% discount on Mi India Top 10. Go use code FY2025 and subscribe soon before the offer ends.

Disclaimers and disclosures : https://tinyurl.com/2763eyaz

If you have any questions, please write to support@weekendinvesting.com