Stable Dynamics of FII and DII Trading

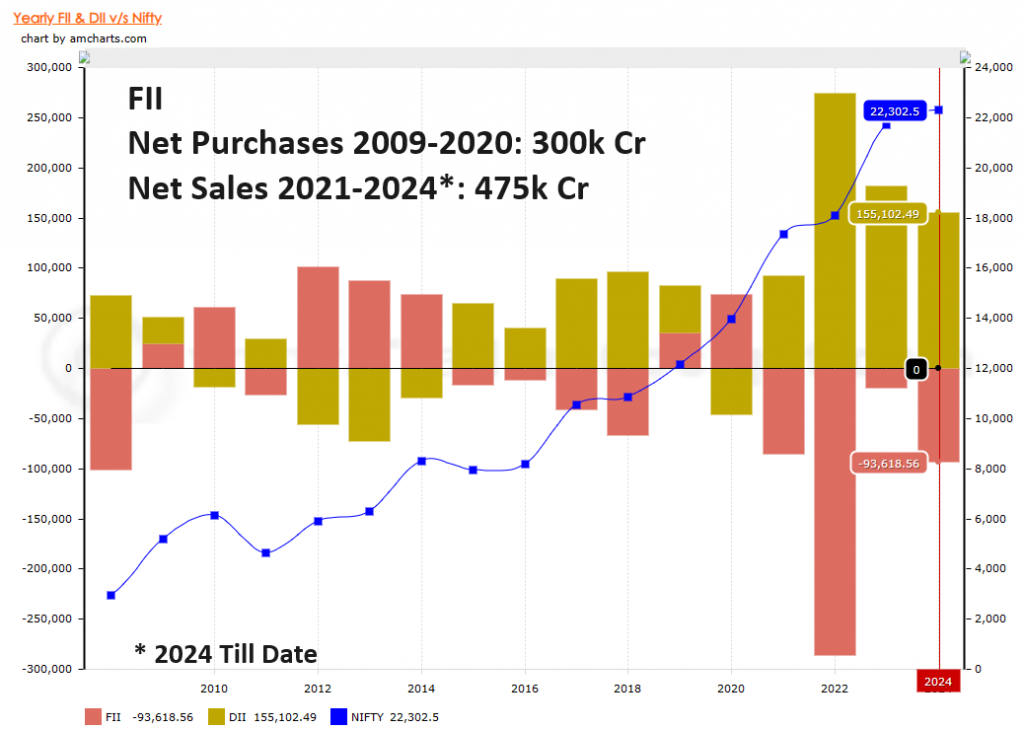

One fascinating trend observed in the financial markets, highlighted by amcharts and shared by Piyush Chaudhary, is the contrasting behaviors of Foreign Institutional Investors (FIIs) and Domestic Institutional Investors (DIIs). Over the years, their trading activities have consistently been in opposition, providing a crucial counterweight to market movements.

Counterbalancing Trades

Whether it’s a bullish or bearish market, FIIs and DIIs seem to be at odds with each other. For instance, in challenging years like 2018 and 2020, when one group was selling, the other was buying in significant amounts. This contra nature of their trades acts as a stabilizing force, ensuring that market movements don’t tilt excessively in one direction.

Changing Landscape of Market Control

A noteworthy shift in market dynamics is the decreasing average holding of FIIs, dropping from 19% to around 15% over the last half-decade. This decline signifies a growing influence of domestic players in driving market trends. As Indian institutions assert more control, the market becomes less dependent on foreign investment patterns.

Financial Inclusion and Market Participation

The increasing participation of domestic investors is a positive sign for market stability. With more Indians entering the market, there’s a sense of financial inclusion and empowerment. This trend emphasizes the importance of nurturing and preserving a conducive environment for retail investors.

Potential Challenges Ahead

While the current scenario appears balanced and favorable, there are potential challenges on the horizon. Any sudden taxation changes in the equity markets could disrupt the delicate balance between FIIs and DIIs. Maintaining stability and continuity in market policies is crucial to sustaining investor confidence and momentum.

Disclaimers and disclosures : https://tinyurl.com/2763eyaz

If you have any questions, please write to support@weekendinvesting.com