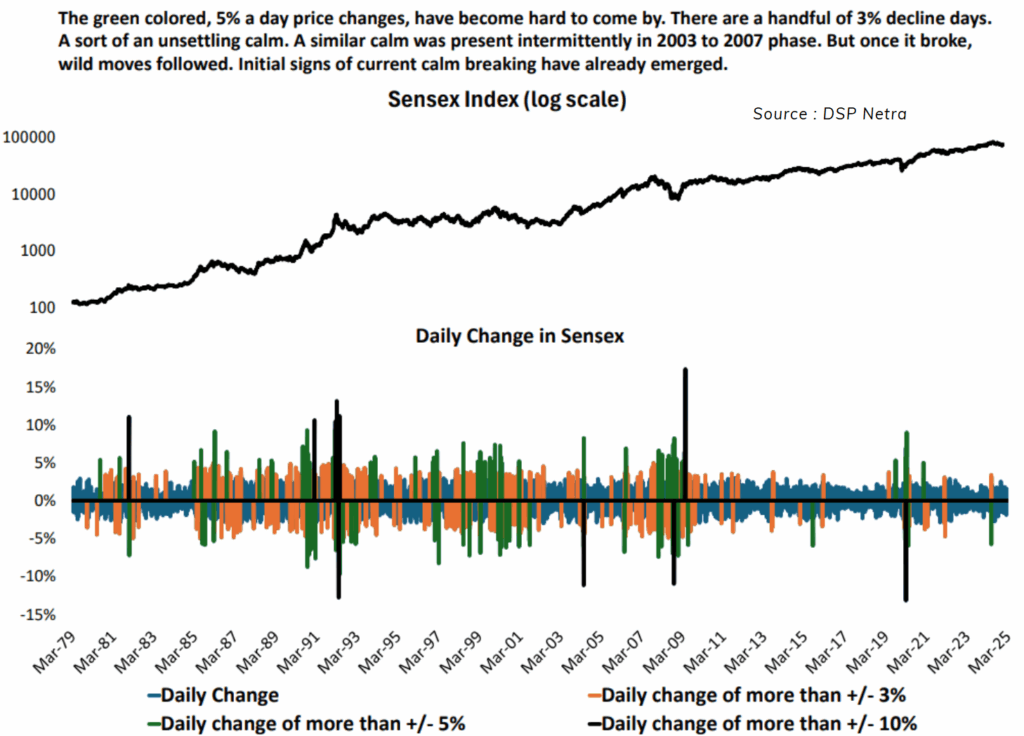

Understanding Daily Sensex Changes

The Sensex, which is a stock market index, does not fluctuate in the same manner every day. Most of the time, the daily change is less than 3%. However, there are occasions when it can rise or fall by more than 5% or even 10%. These larger fluctuations are rare and typically occur during significant global events. For instance, during the COVID crash in March 2020, there was a decline of over 10%. Before that, we also witnessed sharp movements during the 2008 financial crisis.

Sensex Index (log scale) (Source: DSP Netra)

What the Chart Indicates

A chart visually represents these changes using different colors: black lines indicate movements greater than 10%, orange shows changes over 3%, green is for changes over 5%, and blue represents normal daily fluctuations. From analyzing this chart, we can see that very high movements (depicted by black and green lines) were common in earlier years. However, in recent times, these occurrences have become quite rare.

Calmer Markets in Recent Years

Since 2008, the stock market has exhibited much more stability. Large fluctuations of 3%, 5%, or 10% are not as frequent as they once were. This trend suggests that markets are becoming more stable and mature. Even in the face of significant global news or crises, the market tends to maintain its composure and avoids panic, reflecting growing confidence among investors.

What This Means for Investors

This gradual and stable movement is a positive sign for investors. It allows individuals to enter and exit the stock market with greater confidence, reducing the need for panic-driven decisions. Even when faced with negative news, the market does not react as erratically as it has in the past. Support and resistance levels are functioning effectively. Overall, the market environment is becoming healthier and more stable.

Looking Ahead

These calm trends are beneficial for long-term investing. As the stock market continues to grow and mature, investors can feel more secure. Fewer sharp fluctuations mean less anxiety and improved planning.

What are your thoughts on these market moves? Feel free to share in the comments below! If you found this information helpful, please share it with your friends!

WeekendInvesting launches – The Momentum Podcast

In this episode of the Momentum Podcast by Weekend Investing, we sit down with Sudheer , a software engineer from Infosys who shares his honest and inspiring investing journey—from early losses in derivatives and scams to his turnaround using Weekend Investing’s smallcases.

💡 Hear how Sudheer allocates ₹30,000/month, balances risk with gold, navigates market dips confidently, and the crucial mindset shift he learned through momentum investing.

👉 Don’t miss Sudheer’s powerful advice for new investors and the importance of discipline and long-term thinking.

Fill in the form below to be part of this exciting series : https://forms.gle/HDbEk9xrTjVecW2c9