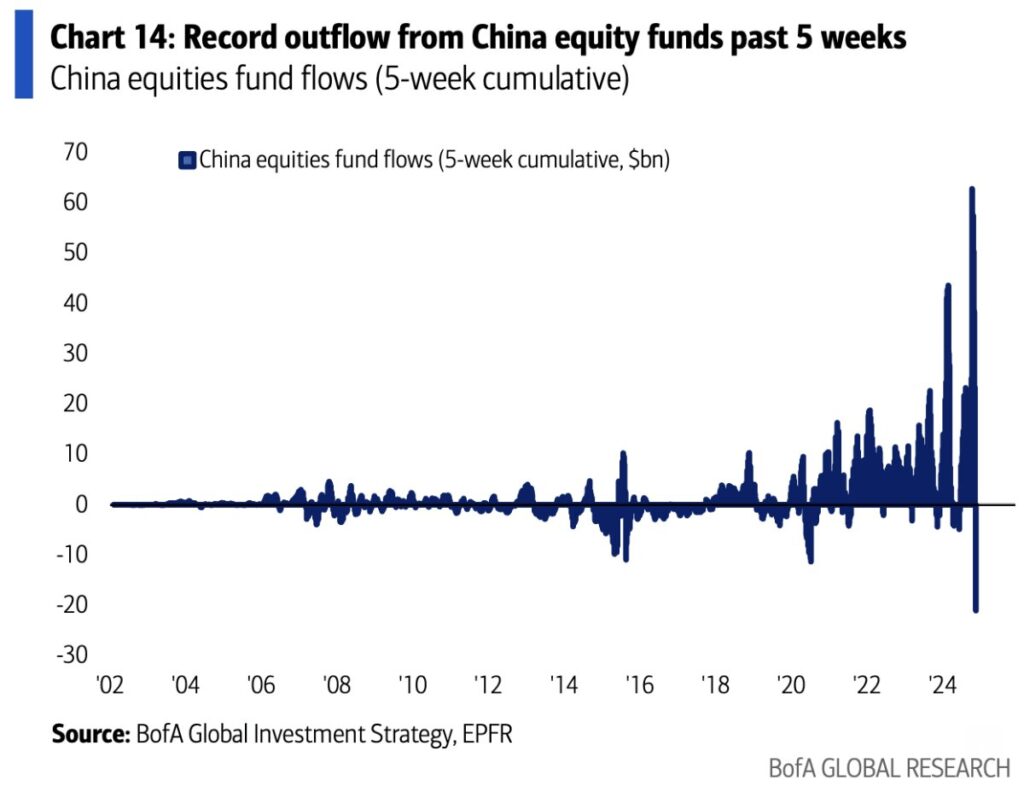

Volatility in China Equity Funds

Recently, there has been significant movement in China equity funds, as shown in a chart by a leading global research institution. Over the past five weeks, there has been extreme volatility, with large inflows of funds followed by sharp outflows. Such a drastic shift hasn’t been seen in a long time, leaving many investors wondering what to make of this situation.

Funds Flowing In and Out

During this period, there was a significant inflow of funds into Chinese equities, but almost immediately afterward, a wave of outflows followed. This kind of rapid change raises questions about the stability and confidence of investors in China’s market. The volatility is so intense that it becomes difficult to draw any solid conclusions from it. The uncertainty in these markets reflects the unpredictable nature of fund movements.

Impact on India and Fund Positioning

The volatility in China has had an impact on other markets, particularly India. Some funds, seeing an opportunity in China, began selling off their positions in Indian equities. However, as things turned around in China, institutions like CLSA have begun re-evaluating their strategies. CLSA recently moved India from an “underweight” to “overweight” position, meaning they are now more optimistic about Indian markets than before.

Are Big Funds Always Right?

There’s often a belief that large funds and institutions have the best understanding of where the market is heading. These funds are seen as highly knowledgeable investors, almost like financial experts who know all the right moves. However, they are just as human as any other investor, and their decisions aren’t always correct. In fact, many large funds fail to outperform the market over long periods of time.

Investment Committees and Decision-Making

Most large funds have investment committees made up of several individuals, each with their own opinions on how to invest. These committees vote on where to allocate money, which means their decisions are a result of group thinking, not some sort of perfect insight into the markets. Often, their investment strategies don’t provide better returns than what a regular investor could achieve.

Avoid Following Big Fund Narratives Blindly

One common mistake is to believe that just because big funds are moving money into or out of a market, it means everyone else should follow. Large fund movements often receive a lot of attention and can create narratives that influence other investors. However, these funds don’t always have better judgment or results, and it’s important not to blindly follow their moves. Each investor should focus on their own strategy and goals rather than being swayed by what large institutions are doing.

WeekendInvesting launches – PortfolioMomentum Report

Momentum Score: See what percentage of your portfolio is in high vs. low momentum stocks, giving you a snapshot of its performance and health.

Weightage Skew: Discover if certain stocks are dominating your portfolio, affecting its performance and risk balance.

Why it matters

Weak momentum stocks can limit your gains, while high momentum stocks improve capital allocation, enhancing your chances of superior performance.

Disclaimers and disclosures : https://tinyurl.com/2763eyaz

If you have any questions, please write to support@weekendinvesting.com