Interest rates, particularly the US ten-year yield, have become a critical factor in the global financial landscape. As the interest rate on US government bonds, it serves as the basis for pricing everything else in the world. The recent rally in interest rates is a cause for concern, as it indicates a potential shift towards higher rates in the near future. In this article, we will explore the implications of rising interest rates and the potential impacts it may have on various aspects of the economy.

Let’s delve into the recent trend of rising US interest rates. Since the COVID-19 bottom in March 2020, the interest rate on US ten-year yields has steadily increased from half a percent to 1.7%, 3.4%, and 4.3%. While there was a temporary retreat from these highs, the rates have broken out again on the upper side. This upward trend is alarming, as it suggests a trajectory towards even higher rates, possibly reaching 5%.

The implications of a 5% interest rate on the US economy are far-reaching. It can affect various aspects, including demand, the strength of the dollar, and foreign flows from other markets. If domestic markets yield 5%, investors may choose to prioritise US investments, leading to capital outflows from other markets. In addition, highly leveraged businesses may face challenges, especially those heavily reliant on low interest rates. Home mortgages, credit card debt, car loans, and other consumer-driven sectors may also experience substantial pressure if interest rates continue to rise.

The impact of rising interest rates in the US extends beyond its borders. Given that the US is a major consumption source for the world, any disruptions in its functioning can reverberate throughout global markets. China, as one of the largest economies, is likely to feel the effects to a greater extent, while other markets, including India, may also experience repercussions to some degree.

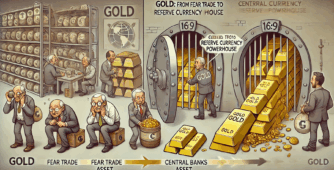

To gain a deeper understanding, let’s explore the long-term implications of rising interest rates. Examining a monthly chart of US yields over the past century reveals interesting patterns. Following World War I, yields spiked between 1917 and 1922, reaching a maximum of approximately 5.6%. Subsequently, yields gradually decreased to a maximum of 2% until World War II. After the war, yields began rising, ultimately reaching highs of 5%, 8%, and even close to 16% by 1981. The advent of the 1980s marked a major rally in yields, primarily prompted by the United States’ decision to unpeg the dollar from gold, leading to an era of expansive spending.

The generations that reached adulthood in the 1980s and beyond have lived through a period of declining interest rates. This prolonged trend is now being challenged, as some experts suggest that inflation may persist for an extended period, resulting in upward pressure on interest rates. This paradigm shift could have significant consequences since many structures and systems have been built around the assumption of declining rates. Individuals and businesses that rely on low interest rates for financial stability may find it increasingly difficult to adapt to a higher rate environment.

One crucial aspect to safeguard against the impact of rising interest rates is asset allocation. Diversifying investments across various assets like equity, real estate, and gold can offer protection against the potential vulnerabilities associated with interest rate hikes. While other investment alternatives may also be viable, equity investments remain an attractive option due to limited opportunities elsewhere.

To better understand the impact of interest rate cycles on equity returns, let’s examine the performance of the S&P 500 during previous periods of rising interest rates. From 1947 to 1980, when interest rates soared from 2% to 16%, the compounded annual growth rate (CAGR) of the S&P 500 was approximately 5-5.5%. In contrast, from 1980 to 2020, a period spanning over 50 years, the CAGR was nearly 9%. This analysis indicates that interest rate fluctuations can significantly affect equity returns.

The rising trend of interest rates in the US raises concerns about its potential implications and impacts on the global economy. It is essential that individuals, businesses, and investors remain aware of these trends and their potential consequences. While there is no definitive answer to how this will unfold, developing a plan to protect against potential risks and adopting proactive strategies within equity investments can be vital for navigating an increasingly different world in the coming decades.

Download the WeekendInvesting App

If you have any questions for us. please write to us!