The Importance of Gold in Diversifying Your Portfolio

Gold has long been considered a safe-haven asset and a store of value, especially during times of economic uncertainty. In this insightful video, Tavi Costa of Crascat Capital provides valuable insights into the historical cycles of gold and highlights the current factors that make it an attractive investment. As an analyst with a deep understanding of commodity cycles and precious metals, Costa emphasises the significance of gold in diversifying your portfolio. In this blog post, we will delve into the three gold cycles since 1970, discuss the factors that have influenced gold’s performance, and explore why gold remains an essential asset in today’s market.

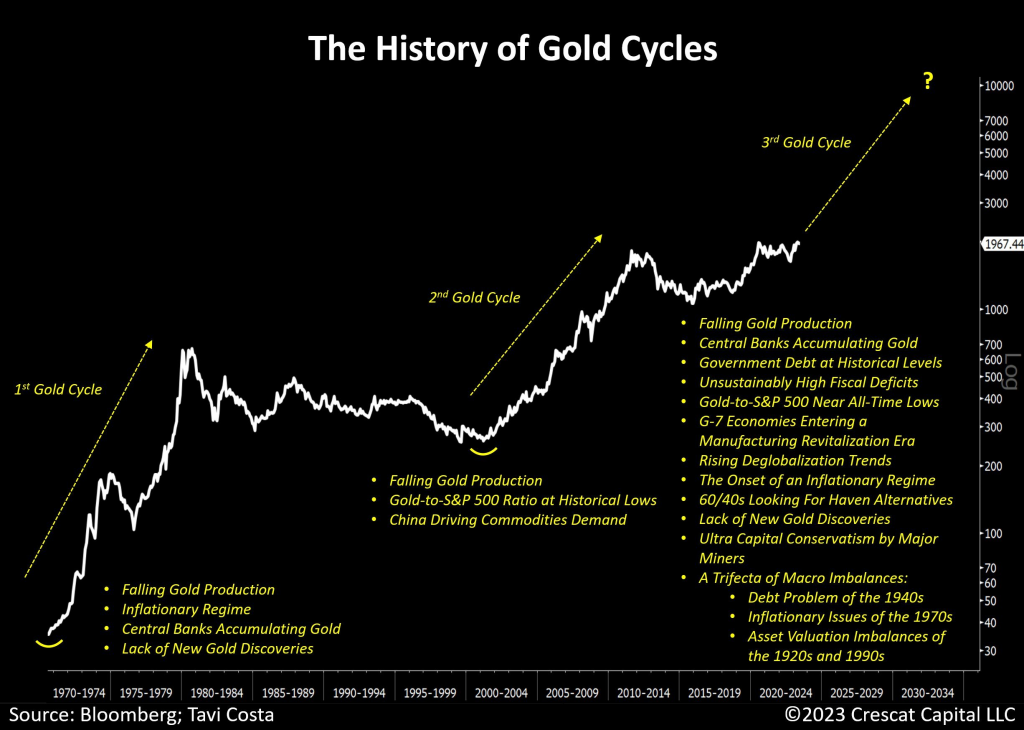

Source : Bloomberg; Tavi Costa

The Three Gold Cycles

Since 1970, there have been three distinct gold cycles, each characterised by unique factors impacting the precious metal’s price and demand. The first gold cycle started in 1971 when President Nixon removed the gold standard, allowing the price of gold to rise significantly. This cycle witnessed falling gold production, an inflationary regime, central banks accumulating gold reserves, and a lack of new gold discoveries. Interestingly, these factors mirror the current situation in the gold market, where we are observing declining gold production, inflationary pressures, and central banks actively adding to their gold reserves.

The second gold cycle began around the year 2000, following a long period of central banks, like the UK and Canada, selling off their gold reserves. Once these selling activities ceased, gold experienced a resurgence. Similar to the first cycle, this phase also witnessed falling gold production, historically low gold to S&P 500 ratio, and increased demand from China, which was driving the demand for commodities. The global financial crisis of 2008 further fueled the cycle, as governments printed massive amounts of money, increasing gold’s value.

The current phase, which Costa refers to as the third gold cycle, started around 2016. While we have already seen a 25% increase from the bottom, Costa believes there is much more potential for gold to rise. The key features of this cycle include falling gold production, rapidly accumulating gold reserves by central banks, expanding government debt and fiscal deficits, and the presence of various macroeconomic factors such as inflation and lack of control over interest rates.

Factors Influencing Gold’s Performance

Throughout history, gold has been influenced by a range of factors, and understanding these dynamics is crucial in assessing its investment potential. Falling gold production is one such factor driving the upward trajectory of gold prices. As the supply decreases, the scarcity of gold increases, which often results in higher demand from both central banks and individual investors.

Central banks play a crucial role in gold accumulation as a means of diversifying their foreign reserves. Notably, in recent years, central banks, particularly those of emerging economies, have been actively adding gold to their reserves. This trend further solidifies the importance of gold as a store of value and a hedge against economic uncertainties.

Another significant factor is the expansion of government debt and fiscal deficits. Countries worldwide are grappling with rising debt levels, and this issue is further exacerbated by inflationary pressures and the lack of control over interest rates. In times of economic instability, gold provides a reliable hedge against currency devaluation and acts as a safeguard for investors’ wealth.

The Future of Gold

Considering the current economic landscape, Tavi Costa believes that gold has substantial potential for future growth. Based on his analysis, he predicts that gold prices in US dollar terms could reach $5000 to $10,000 in the coming years. This projection is supported by the ongoing trends of falling gold production, central bank accumulation, increasing government debt, and the various macroeconomic challenges faced by governments worldwide.

As an investor, it is imperative to consider the benefits of allocating a portion of your portfolio to gold. A diversified portfolio is crucial in mitigating risks and reducing the impact of market volatility. Gold has historically demonstrated its ability to retain value and serve as a safe haven during economic downturns. By including gold in your investment strategy, you can safeguard your wealth and potentially benefit from future price appreciation.

If you have any questions, please write to support@weekendinvesting.com