A Strange Trend in Gold ETF Holdings

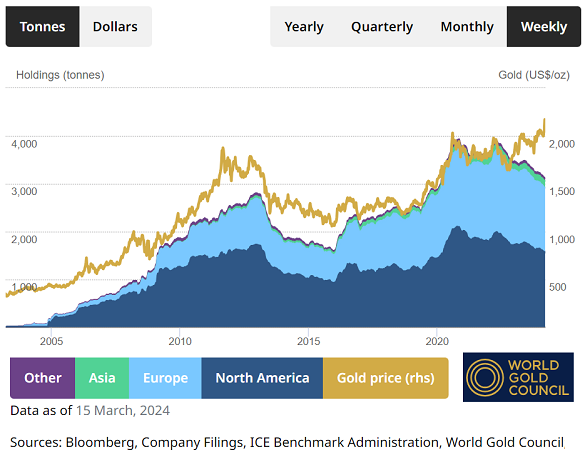

Recently, something unusual has been happening with Gold ETF holdings, and it’s worth exploring further. The chart of Gold ETF holdings shows an interesting trend. The orange line represents the price of gold in US dollars, currently around $2300. The other lines represent the total holdings of various Gold ETFs. Traditionally, these holdings have followed the price of gold. When gold prices went up, ETF holdings increased, and when gold prices fell, ETF holdings decreased. However, since 2022, this pattern has changed.

Gold Prices Up, ETF Holdings Down

Since 2022, gold prices have been rising, yet ETF holdings have been falling. This is contrary to the trend observed for decades. Normally, when gold prices rise, people buy more gold ETFs. This change suggests that something different is happening in the market. The question is, who is buying gold ETFs, and who is not?

Shift in Gold Ownership

Gold ETFs are usually bought by retail investors, high-net-worth individuals (HNIs), small family offices, and not by large institutions or central banks. Large institutions and central banks prefer to buy physical gold. It seems that physical gold is shifting from individuals to central banks. Despite rising gold prices, ETF holdings are decreasing because central banks are buying more physical gold.

Central Banks Increasing Gold Holdings

Central banks in countries like China, Russia, India, Turkey, Poland, Uzbekistan, and Singapore are continuously increasing their gold holdings. There are around 3000 tons of gold produced each year. Central banks used to consume about 200-250 tons per year. Now, they are consuming over 1000 tons per year. This means an additional 780-800 tons of gold are needed by central banks each year. This additional demand is likely causing the decrease in gold ETF holdings despite rising gold prices.

Gold Moving to Stronger Hands

This shift in gold ownership indicates that gold is moving from weaker hands (retail investors) to stronger hands (central banks and institutions). Central banks are likely buying gold for long-term asset allocation, not for trading. This suggests that letting go of gold holdings, whether in ETFs or otherwise, may not be a good strategy. Gold should be seen as an asset for long-term allocation, not for short-term trading.

Disclaimers and disclosures : https://tinyurl.com/2763eyaz

If you have any questions, please write to support@weekendinvesting.com