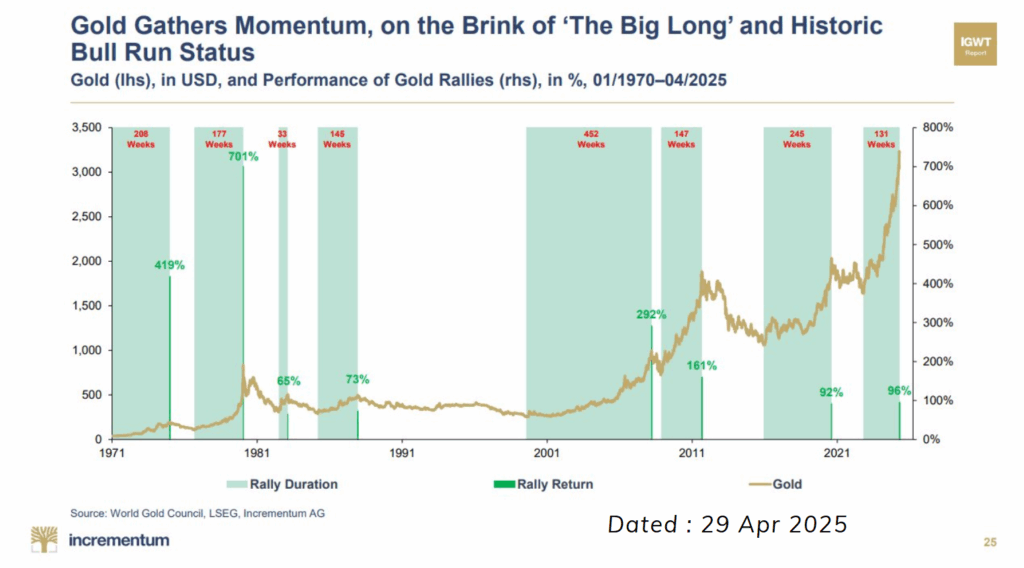

A Look at Past Gold Rallies

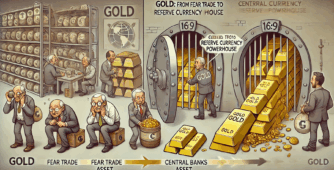

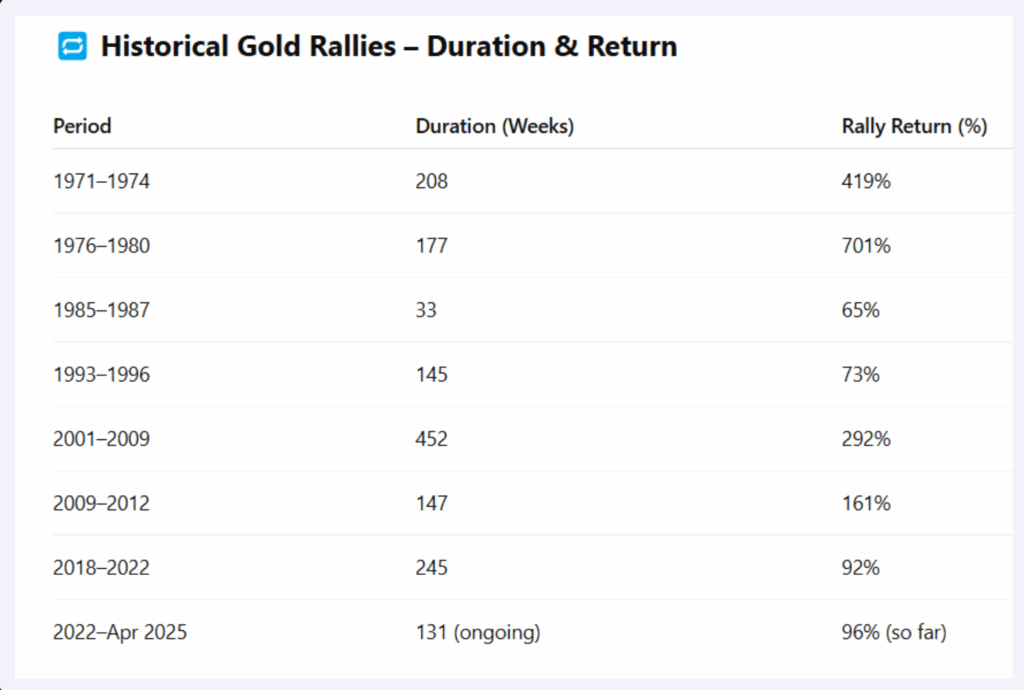

Over the last 55 years, gold has experienced significant rallies on multiple occasions. Each rally lasted several weeks and yielded substantial returns. For example, in 1971, gold prices surged by 419% over 208 weeks. Later, there was an increase of 701% over 177 weeks. In 1987, gold prices jumped 65% in just 33 weeks. Between 1993 and 1996, gold provided a 73% return over 145 weeks. These figures demonstrate that gold has consistently been a strong investment during certain periods.

Performance of major gold rallies (in duration and returns) from 1970 to April 2025

Gold rally durations and returns across key historical periods (1971–2025).

Performance of Gold in the 2000s

From 2001 to 2009, gold experienced a steady rise over 452 weeks, resulting in a return of approximately 300%. Then, from 2009 to 2012, the return was 161%. This trend indicates that even in the modern era, gold rallies can last for extended periods and offer good returns. These prolonged rallies highlight the importance of gold in an investor’s portfolio.

Recent Rally from 2018 to 2022

The gold rally from 2018 to 2022 lasted for 245 weeks and generated a 92% return. Although this return is lower than some past rallies, it was still strong compared to other investments during that time. The average duration and return of previous gold rallies suggest that the recent rally may have more potential for growth.

The Current Gold Rally

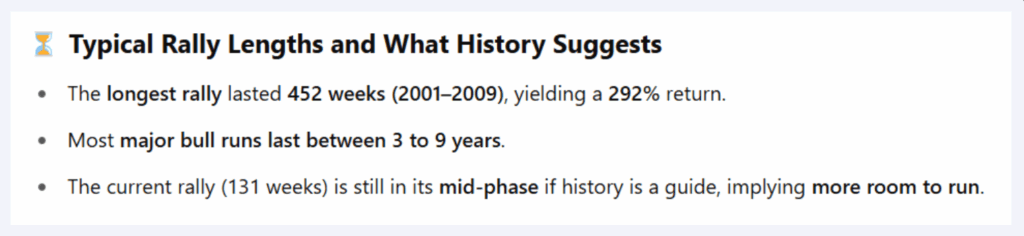

Currently, the ongoing rally has reached 131 weeks and has already provided a return of 96%. This situation could either signify the conclusion of the rally or merely the beginning of something more significant. When compared to earlier rallies, many of which lasted longer and yielded higher returns, it appears that there might still be considerable upside in this current rally.

What Makes This Rally Special

One major differentiating factor this time is the global economic environment. Central banks worldwide are actively purchasing gold. Rather than holding their reserves in U.S. Treasury bonds, many countries and large institutions are turning to gold, viewing it as a safer asset in today’s uncertain world. This shift is a key reason why this rally could continue for an extended period.

What’s Next for Gold Investors?

It is challenging to predict how far this rally will extend, but based on past data and current global trends, there is a possibility it could last for several more years. The important question is how high gold prices can rise before the rally begins to decelerate. Investors should remain vigilant and closely monitor how this trend develops.

How long do you think this gold rally will last? Will it beat the past records? Share your views in the comments below!

Thank you so much for taking the time to read. We truly appreciate your support and hope you found it helpful. If you did, please consider sharing it with your friends. Looking forward to seeing you in the next one!

WeekendInvesting launches – The Momentum Podcast

In this episode of the Momentum Podcast by Weekend Investing, we sit down with Sudheer , a software engineer from Infosys who shares his honest and inspiring investing journey—from early losses in derivatives and scams to his turnaround using Weekend Investing’s smallcases.

💡 Hear how Sudheer allocates ₹30,000/month, balances risk with gold, navigates market dips confidently, and the crucial mindset shift he learned through momentum investing.

👉 Don’t miss Sudheer’s powerful advice for new investors and the importance of discipline and long-term thinking.

Fill in the form below to be part of this exciting series : https://forms.gle/HDbEk9xrTjVecW2c9