Many people often hear that a stock is attractive because it’s cheap, or that it should not be bought because it is expensive. This is often about high-quality stocks. But there are other options. A stock might not be of the best quality but still have a good price. Similarly, a good stock might be overpriced, or a bad stock might be undervalued. It’s essential to remember that we aim to buy low and sell high, or buy high and sell higher. The stock’s quality matters only if there are severe issues like fraud. But if it’s a mediocre quality stock versus an excellent quality stock, we should focus on which one has a better price.

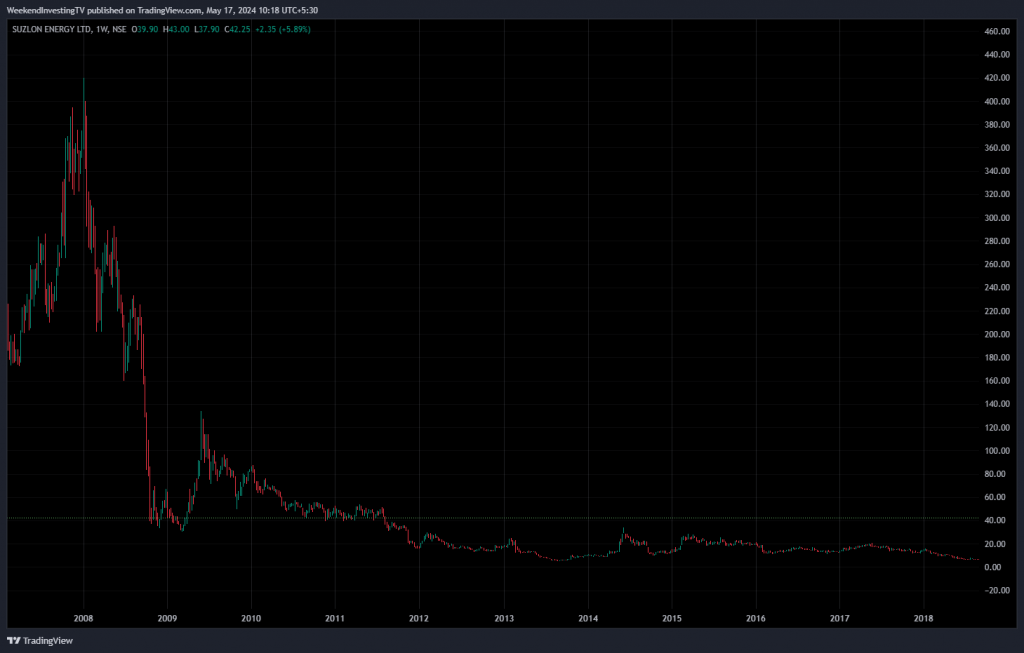

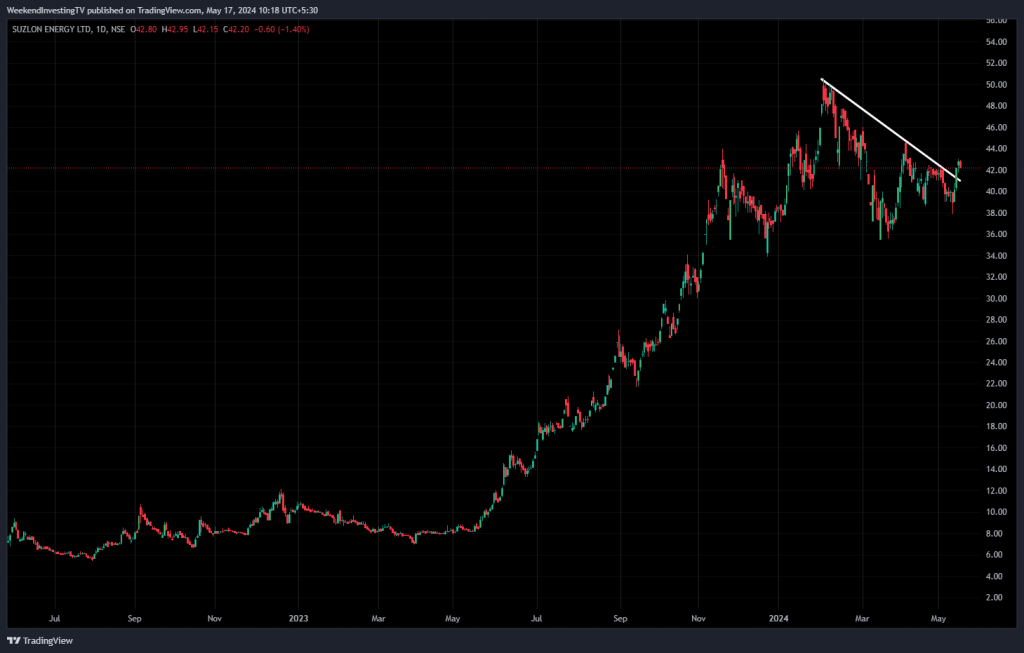

The Suzlon Example

Let’s take Suzlon as an example. At one point, Suzlon was a good stock but at a very high price, around Rs. 400. Over time, its value dropped to Rs. 2 due to business problems, making it a bad stock at a bad price. Eventually, Suzlon restructured and started improving, turning it into a bad stock at a good price. With more restructuring and improvements, Suzlon transformed into a good stock at a good price, climbing from Rs. 2-4 to nearly Rs. 50 recently. This shows how a stock’s status can change over time and why it’s crucial to consider both quality and price.

Good Stocks vs. Good Prices

It’s important to combine the narrative of a good or bad stock with its price. A high-quality stock at an overpriced rate might not be a wise investment. Conversely, a lower-quality stock at a good price might offer great returns. The company’s quality, management, and sector are significant, but the price relative to these factors is crucial. This understanding helps determine whether you will gain from your investment.

Momentum Investing

Momentum investing doesn’t focus on whether a stock is good or bad. It buys stocks at good prices and sells them when prices are not favorable. For instance, buying Suzlon at Rs. 10-12 might have been a good price regardless of its quality. As prices went up, strategies might sell the stock at relatively higher prices. This approach shows that getting out of the usual narrative and looking deeper into data and price movements can lead to better investment decisions.

Price and Quality Analysis

When investing, it’s essential to analyze both price and quality. A high-quality stock at a very high price might not be the best buy. Similarly, a lower-quality stock at a very low price could offer significant returns if the price improves. By focusing on these factors, you can make better investment choices.

Disclaimers and disclosures : https://tinyurl.com/2763eyaz

If you have any questions, please write to support@weekendinvesting.com