Understanding Taxation on Gold

In this blog post, we will delve into the various formats of gold and explore how each one is taxed in India.

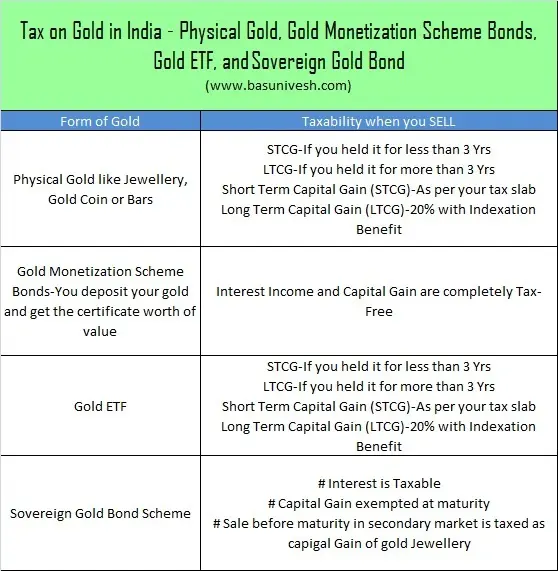

Physical Gold: Jewellery, Coins, and Bars

If you own physical gold in the form of jewellery, coins, or bars, the tax implications vary depending on the duration of your ownership. If you hold the physical metal for less than three years, you will be subject to short-term capital gain tax, which is calculated based on your existing income tax slab. Unlike equity investments where the short-term capital gains tax is fixed at 15%, gold follows the income tax slab rates.

On the other hand, if you hold physical gold for more than three years, you will be liable for long-term capital gain tax of 20%. However, it’s important to note that you can avail the indexation benefit, which allows you to adjust the cost of acquisition for inflation. The indexation benefit is significant because it helps reduce the tax burden by factoring in the impact of inflation over time. It’s worth noting that the indexation benefit is calculated at around 5% to 6% per year, offering substantial savings.

In case of a loss on your gold investment, you can carry forward the loss for up to eight years, allowing you to offset it against future gains.

Gold Monetization Scheme: A Lesser-Known Option

The Gold Monetization Scheme is a government initiative overseen by the Reserve Bank of India (RBI) that enables individuals to deposit their gold and earn interest on it. Under this scheme, you can deposit your gold jewellery or bars at specified branches of State Bank of India (SBI) and receive a certificate indicating the amount of gold deposited. The certificate entitles you to earn interest on your gold deposit, and what’s more, the capital gains from the scheme are entirely tax-free.

Suppose you decide to participate in the Gold Monetization Scheme for a period of five years. At the end of the five-year tenure, you have two options: you can either reclaim the physical gold in the form of bars (not jewellery), entirely tax-free, or choose to receive the equivalent cash value.

The Gold Monetization Scheme is an excellent opportunity for gold owners to earn interest on their investment while enjoying tax-free capital gains.

Gold ETFs

Gold Exchange Traded Funds (ETFs) have gained popularity as an investment avenue, offering investors the opportunity to invest in gold without physically owning it. When it comes to tax implications, gold ETFs follow a similar pattern to physical gold investments.

If you hold gold ETFs for less than three years, any gains will be considered short-term capital gains and taxed according to your income tax slab. On the other hand, if you hold gold ETFs for more than three years, the gains will be subject to long-term capital gains tax at a rate of 20%, along with the benefit of indexation.

It’s important to note that gold ETFs are treated in the same manner as physical gold when it comes to taxation.

Sovereign Gold Bond Scheme: A Tax-Efficient Choice

The Sovereign Gold Bond Scheme offers individuals an opportunity to invest in government-issued gold bonds that are backed by the Reserve Bank of India. This scheme provides an attractive option for those looking to reap the benefits of gold investment with tax-efficiency in mind.

If you hold sovereign gold bonds until maturity, the long-term capital gains on redemption are entirely tax-free. However, if you decide to sell before maturity, holding the bonds for more than three years will qualify them for long-term capital gains tax of 20% with indexation. Selling the bonds before the three-year threshold will result in short-term capital gains taxed according to your income tax slab.

To optimise the tax benefits of the Sovereign Gold Bond Scheme, it’s recommended to hold the bonds until maturity, ensuring that the capital appreciation is entirely tax-free. Nevertheless, it’s important to note that the interest earned on these bonds, paid half-yearly, is taxable as per your income tax slab.

If you have any questions, please write to support@weekendinvesting.com