Understanding the Japanese Investment Experience: A Different Perspective

Investing in the Japanese equity market has often been seen as a challenging endeavour, with many referring to the “lost decades” experienced by investors. However, let’s take a closer look at the Japanese investment experience from a different perspective. Contrary to popular belief, investors in Japan may not have necessarily lost money if they were well asset allocated across various asset classes such as equity, gold, real estate, and bonds.

To illustrate this, let’s consider two asset classes: gold and the Japanese index, Nikkei 225. Looking at the past 40 years of data, we can see that gold has experienced a 176% increase, while equity has shown a 297% increase. Considering the near-zero interest rate environment that Japan has witnessed over the past four decades, any return should be considered a good return.

However, it is crucial to dive deeper into specific periods to gain a better understanding of the Japanese investment landscape. Between 1983 and 1990, the Japanese index experienced an astounding four-fold increase in just seven years. To put this into perspective, a similar move in the Indian stock market benchmark, Nifty, in the coming decade would lead to a level of 80,000 in 2030. Unfortunately, this rapid growth was followed by a significant collapse, with the index plummeting by over 90% in the next twenty-five years. Finally, in 2008, the market hit its lowest point and has since recovered by approximately 300%.

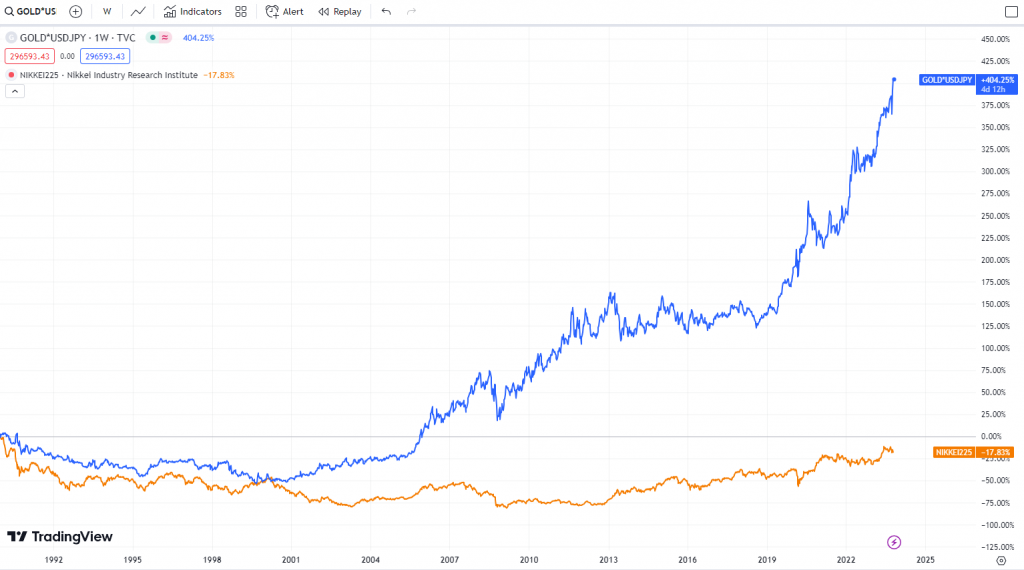

If we focus on the period from the equity market peak in 1990, a different picture emerges. From that peak until now, the Japanese index has experienced a 17% decline. However, it is crucial to note that it has been over three decades since the peak, and investors who diversified their holdings into gold have enjoyed substantial gains. Gold initially declined by around 50% by the year 2000 but has since recovered and shows an impressive increase of 404%.

To better understand the potential benefits of strategic asset allocation during volatile periods, let’s consider an example. Assume an investor allocated their funds equally between equity and gold, and regularly rebalance their portfolio. As the equity market rose, they would have moved some gains into the gold asset class. Conversely, during market downturns, gains from gold would have been reallocated into equities. While the overall returns would likely fall in between the extremes of the individual asset class returns, the beauty of this approach lies in avoiding significant drawdowns, especially after market peaks.

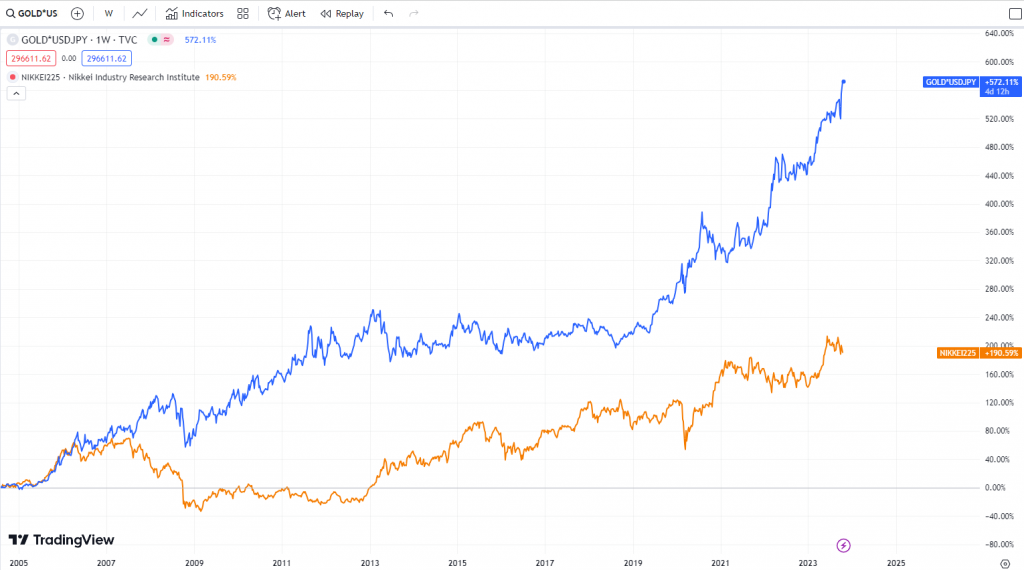

For the first decade after the equity peak, investors would have experienced a drawdown following the substantial forex move. However, once they absorbed this initial shock, a “golden period” would have commenced, particularly considering the substantial growth in gold since 2005. From 2005 until now, equity has increased by approximately 190%, while gold has seen an impressive 572% increase.

This study showcases the benefits of incorporating assets like gold to hedge against currency fluctuations and protect wealth. While equity is generally known to generate better long-term returns, it’s important to acknowledge that there will be periods of poor performance or volatile market conditions that can erode confidence and potentially diminish one’s net worth. To safeguard both wealth and confidence, it is essential to diversify across asset classes that can serve as a hedge. Gold, as demonstrated in this study, can be one such example.

If you have any questions, please write to support@weekendinvesting.com