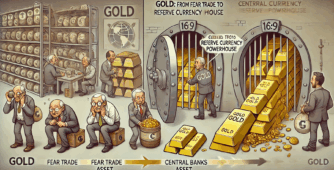

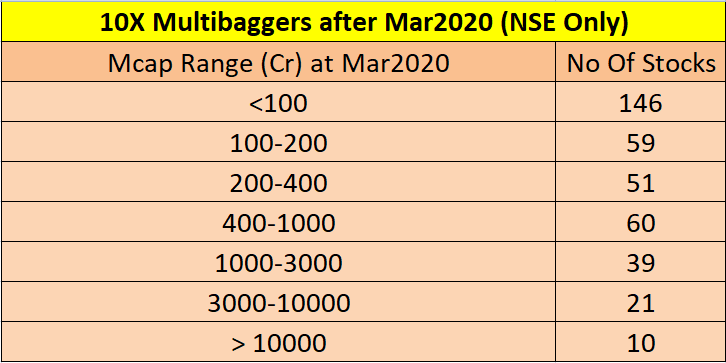

Since the COVID-19 market crash, many small-cap stocks have shown remarkable growth. According to a recent analysis, a large number of companies have seen their stock prices increase by ten times since the market bottom in March 2020. A “ten-bagger” refers to a stock that has multiplied tenfold, and it’s clear that smaller companies, particularly those with a market cap of less than ₹1,000 crore at the time, made up the bulk of these success stories.

The Power of Small Companies

Out of approximately 370 companies that became ten-baggers, around 300 were smaller companies, valued under ₹1,000 crore during the market lows of March 2020. These companies were in a tough spot before the rebound, with many of them suffering steep declines, losing up to 80% of their market value. However, as the market recovered, these small-cap stocks rose sharply, proving the potential for significant returns in smaller, less visible companies.

Bigger Companies Also Saw Growth

While most of the ten-baggers were small-cap stocks, there were also a few mid-cap and larger companies that experienced significant gains. Ten companies from the ₹10,000 crore market cap range, 21 from the ₹3,000-₹10,000 crore range, and 39 companies from the ₹1,000-₹3,000 crore range became part of this growth story. These companies likely attracted the attention of various investment strategies, particularly those focused on momentum investing as their prices climbed.

Momentum Investing and Stock Selection

Momentum investing plays a key role in identifying these high-performing stocks. Momentum strategies focus on stocks that are already trending upwards, often hitting new highs and showing strong growth potential. Instead of analyzing non price related factors, momentum investors look at factors like price movement and volume. This allows them to catch stocks on the rise without getting bogged down by traditional metrics.

Understanding the Pareto Principle in Investing

In momentum investing, the Pareto Principle often applies, where 20% of stocks contribute to 80% of the profits. This means that not all stocks in a portfolio will be winners, and some may even result in losses. However, the gains from the top-performing stocks tend to outweigh the losses from the underperforming ones. Around 40% of the stocks picked in these strategies may result in losses, but the remaining 60% often generate significant profits, making the overall strategy successful in the long term.

The Benefits of Rule-Based Investing

The key to this investment approach lies in a rule-based, mechanical process that removes emotion from the decision-making process. By focusing purely on the price and volume trends of stocks and applying filters like market cap and risk assessment, investors can enter stocks that have strong growth potential without needing to justify every move based on traditional analysis. Over time, this structured method has proven to generate good returns.

Disclaimers and disclosures : https://tinyurl.com/2763eyaz

If you have any questions, please write to support@weekendinvesting.com