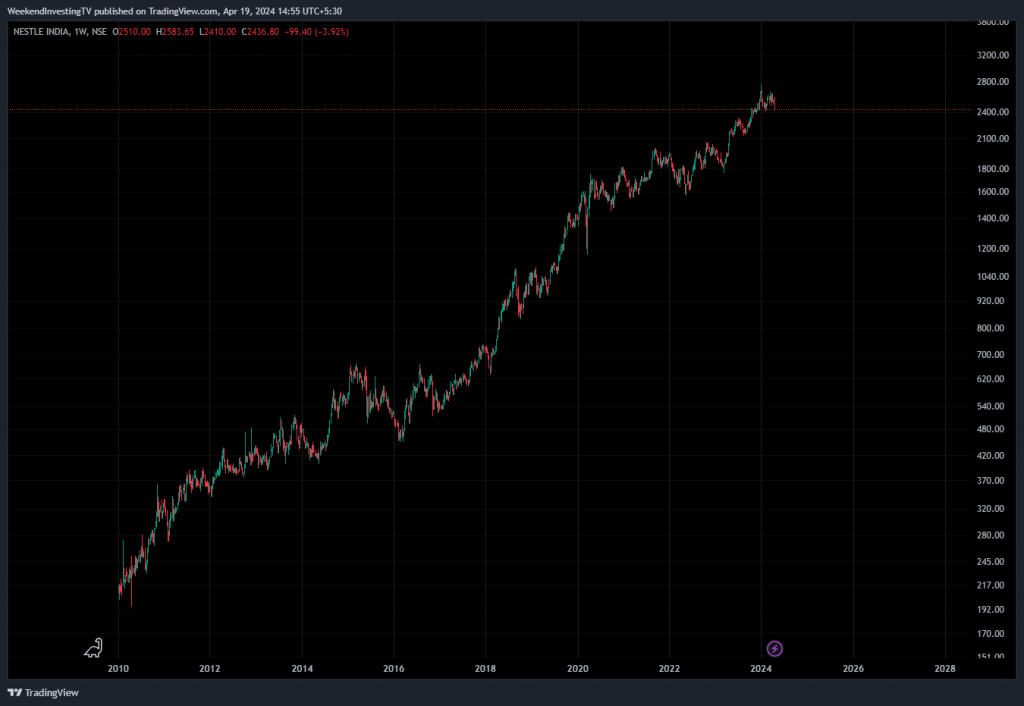

Let’s dive into the fascinating journey of Nestle India as depicted in this 14-year chart analysis. From its humble beginnings around Rs200 in 2010 to its current impressive price of approximately Rs2500 in 2024, Nestle India has emerged as one of India’s biggest success stories. Despite encountering challenges like the COVID crash and occasional market hiccups, Nestle India’s trajectory has been overwhelmingly positive.

The Perils of High Valuations

At present, Nestle India trades at around 75 times earnings, signifying its status as a high-growth company. However, even if its stock price were to halve overnight, resulting in a hypothetical valuation of Rs1200, it would still be trading at 40 times earnings, which is still a significant indicator of growth potential. But what if the market decides to de-rate its price-earnings ratio over the next decade? This raises concerns about the sustainability of high valuations and the need for a proactive plan of action.

Mitigating Risks Through Rule-Based Systems

Investing in expensive stocks entails inherent risks, particularly if market sentiments shift or valuations undergo a correction. Implementing a rule-based system can serve as a safeguard against unforeseen downturns. By setting clear exit criteria based on technical indicators like the 200-day moving average or the relative strength index (RSI), investors can minimize potential losses and navigate market uncertainties more effectively.

Embracing Quantitative Methods

For investors less inclined towards traditional value investing, adopting quantitative methods for stock screening and exit strategies can offer a prudent approach. By leveraging quantitative metrics and algorithms, investors can identify and exit stocks before they pose significant risks to their portfolios. While minor losses may still occur, the overarching goal is to avoid catastrophic downturns and preserve capital.

Navigating Uncertainty

In essence, the case study of Nestle India underscores the importance of balancing risk and reward in investment decisions. While past performance may be promising, the future remains uncertain. By embracing strategies that provide assurance and mitigate potential risks, investors can navigate market volatility with greater confidence. Ultimately, the goal is not just to maximize returns but to safeguard against unforeseen challenges and uncertainties.

WeekendInvesting Strategy Spotlight – It isn’t always about the multibaggers !

There has always been a frenzy in the stock market around multibaggers.

You will often come across stories that go like this – “Oh I bought this stock when it was trading around Rs 25 and today it is trading at Rs 250”. “I made a handsome 10x on this stock”

But, people seldom discuss negative outcomes or stories of their failure. Aspects like risk mitigation, position sizing & opportunity cost often take a back seat paving way for cooler discussions around multibagger stocks.

Consider the case of “VEDL”. After making a high of Rs 484, the stock has virtually remained flat for 14 long years. One may wonder whether it is even possible to successfully navigate through the troubled waters of a choppy stock like this one but that is where the beauty of momentum lies.

VEDL entered Mi NNF 10 back in Apr 2021 at a time when most might wonder “Why now”. The stock may not have gone on to become a multibagger for the portfolio but just the fact that a rule based approach could successfully maneuver through a stock like this without having to face a loss & instead to come out with a reasonable gain of 50% speaks volumes about the ability of momentum investing to keep you calm and composed at all times without having to worry about the outcomes too much.

So multibagger is not the only thing that sounds cool,

Identifying and extracting momentum in a stock that has remained stagnant for 14 years is also a story worthy of a discussion.

Disclaimers and disclosures : https://tinyurl.com/2763eyaz

If you have any questions, please write to support@weekendinvesting.com