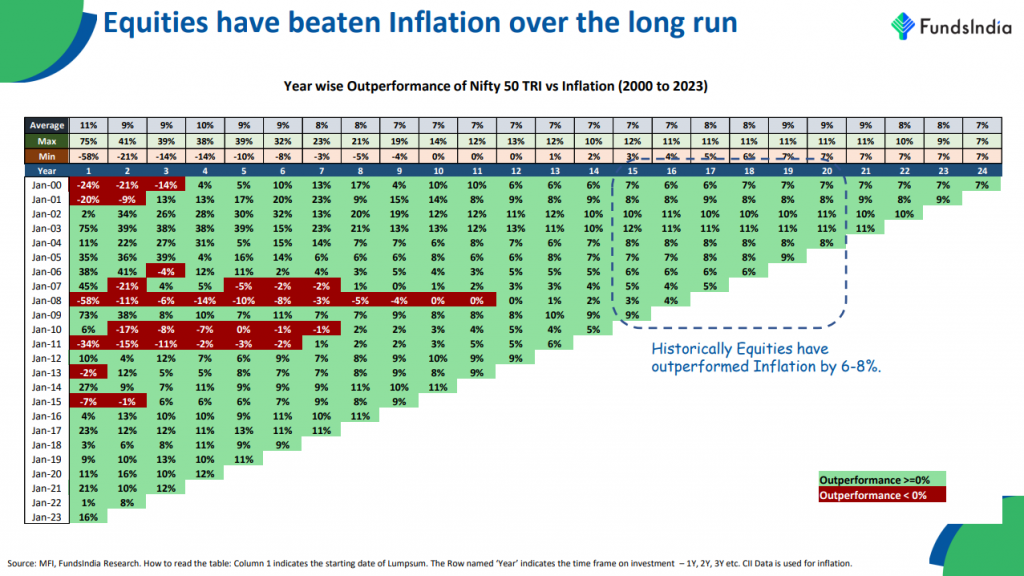

When it comes to investing in the stock market, many investors worry about timing their entry, fearing that starting during a downturn may lead to losses. However, data from Funds India Research reveals an interesting trend: regardless of when you start investing, staying in the market over the long term can beat inflation by a significant margin.

The analysis compares Nifty total returns with inflation rates over different starting periods. It illustrates that staying invested in the Nifty index for extended periods can yield returns well above inflation rates. For instance, investing for 15 to 20 years could potentially result in beating inflation by 6-7% annually, showcasing the power of long-term market participation.

Lump Sum Investments Over Time

Even if you started investing during challenging times, such as the market downturns in January 2000 or January 2008, the data shows that over a period of 10 years, you would have matched or even outperformed inflation. This means that despite temporary setbacks, the market tends to recover and deliver positive returns over the long haul.

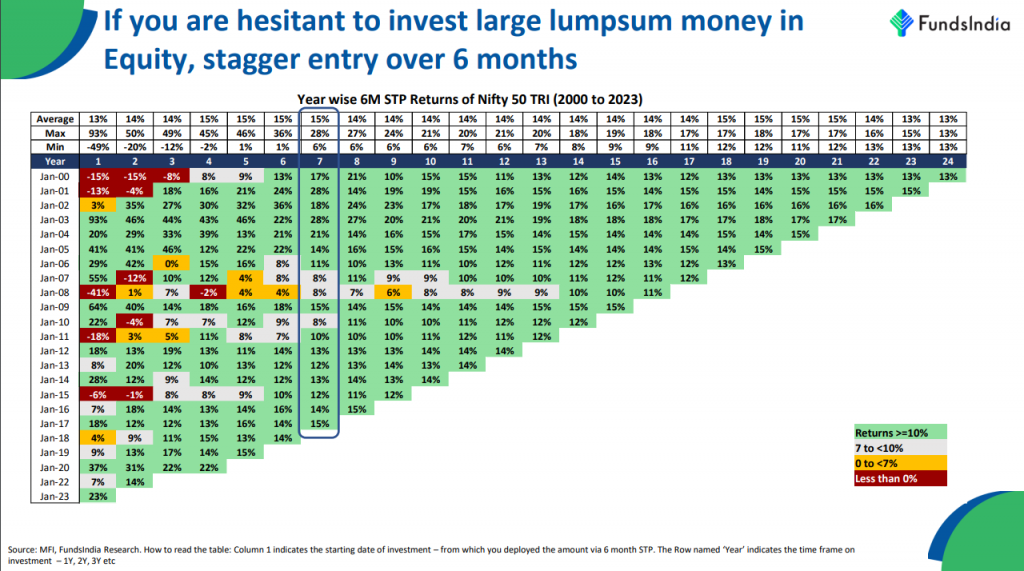

Even staggered investments, spread over six months, can significantly mitigate the impact of market volatility. By gradually entering the market, investors can smooth out the effects of lump sum investments, potentially achieving consistent returns over time.

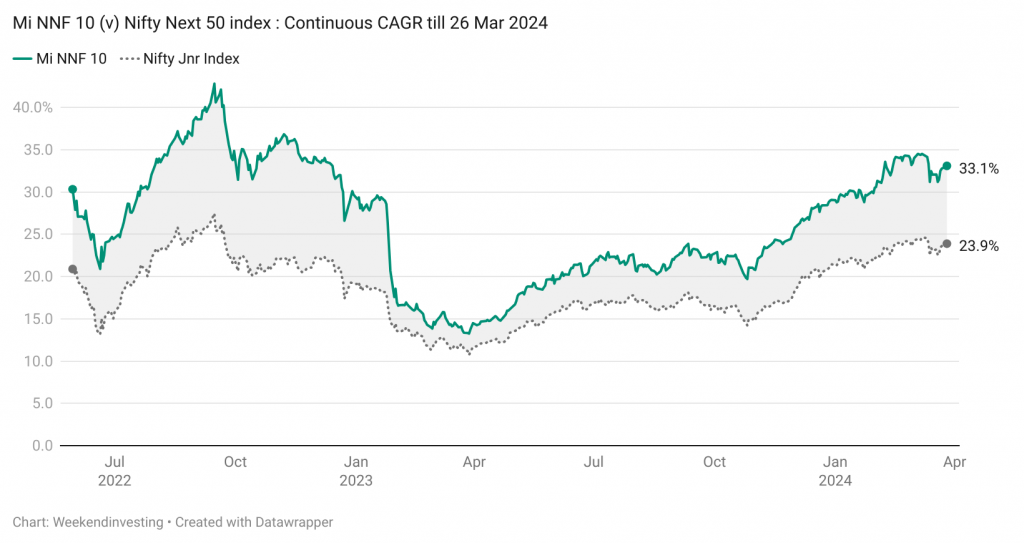

While the stock market inherently offers opportunities for long-term wealth accumulation, structured investing strategies, like those offered by WeekendInvesting, can further enhance returns. These strategies aim to optimize investment decisions based on data-driven analyses, improving the likelihood of achieving favorable outcomes over time.

WeekendInvesting Strategy Spotlight

This chart denotes the CAGR of both Mi NNF 10 and its benchmark, the Nifty Jnr Index on which the strategy is based. The strategy has recorded a CAGR of 33% compared to 24% on the Nifty Jnr (Period : 12 Nov 2020 to 26 Mar 2024 – 3 years and 4 months)

The sheer consistency in outperformance of the strategy is essentially an outcome of ;

– Picking and riding the strongest stocks within its universe in a non discretionary – rule based manner.

– Allocating a standard 10% weightage to all stocks without any bias towards market capitalization

– Riding winners as long as momentum exists and dumping losers as soon as momentum fades away

The subscription fee for Mi NNF 10 shall be increased to Rs 9,999 from current fee of Rs 7,499 effective – 0

99 effective – 01 Apr 2024 onward. Go ahead and make use of this opportunity to subscribe to to Mi NNF 10 before the price increase.

If you have any questions, please write to support@weekendinvesting.com