In the world of investing, Asset Under Management (AUM) is a critical metric that measures the total market value of assets that a fund or asset management company (AMC) manages on behalf of its investors. AUM growth is a positive sign for any fund or AMC, as it indicates increased trust and capital inflow from investors. However, there are several implications and challenges associated with the expansion of AUM, which can affect the performance and strategies of these entities.

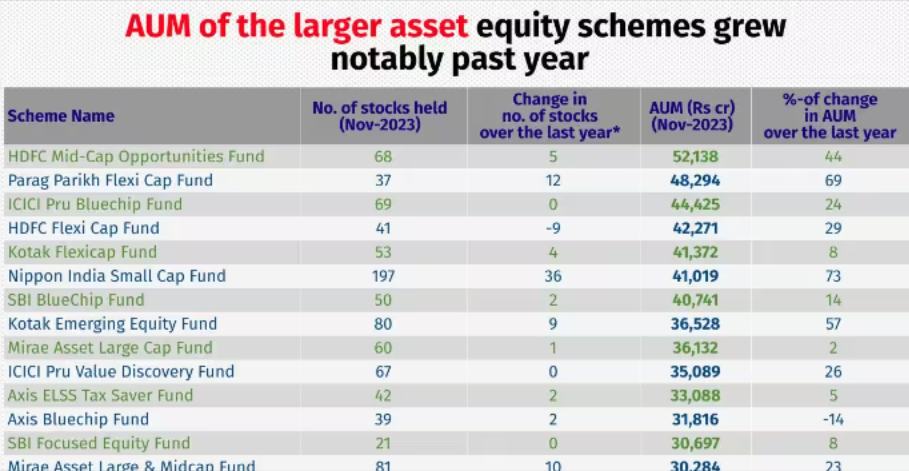

In a recent article from Money Control, an interesting table was presented that showcased the AUM growth of the largest asset equity schemes over the last year.The number of stocks held by these funds varies, ranging from around 50 to 90 on average. Some funds are highly focused, such as SBI focused, holding just 21 stocks, while others, like Nippon India Small Cap, have a more diversified portfolio with 197 stocks.

For large-cap funds, even a single-digit or negative AUM growth, despite a positive market trend, indicates underperformance. On the other hand, small-cap funds experiencing a 73% growth in AUM align with the outperformance of the small-cap index, indicating a net gain for investors.

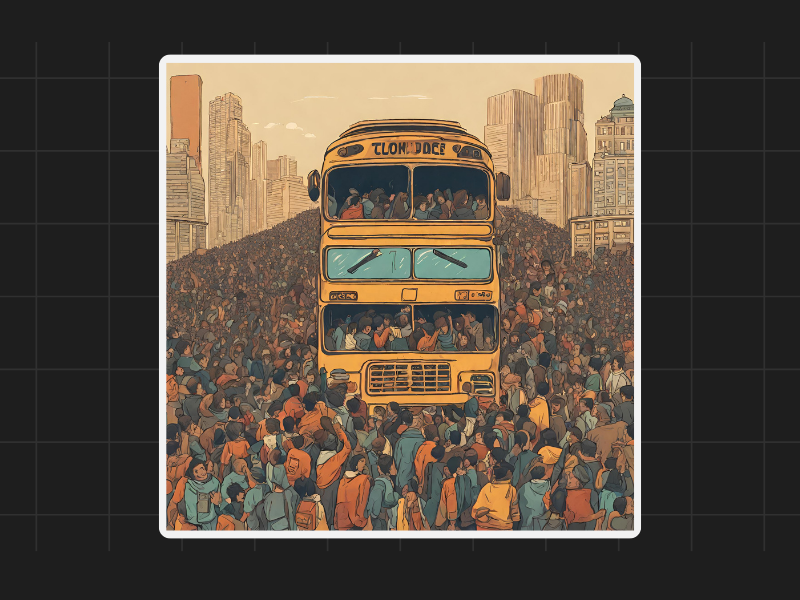

One crucial factor to consider is how additional AUM is managed by these AMCs. In a discussion held during a WeekendInvestors’ hangout, it was emphasised that retail investors have a unique advantage over institutional investors when it comes to flexibility and liquidity requirements. The transactions executed by funds and AMCs require significant buyer and seller participation. However, as the size of AUM grows, executing these transactions becomes increasingly challenging due to limited liquidity in the market for certain stocks.

To illustrate this point, let’s consider the scenario of SBI focused equity fund, which holds 20 stocks and has an AUM of 30,000 crores. If they wish to rebalance their portfolio, they would need to sell 1,500 crores worth of a single stock. The market may not be deep enough to absorb such a massive transaction easily. Therefore, they would have to negotiate with other institutions or execute the deal off-market while displaying the execution on the stock exchange screen. This limitation hampers the fund’s ability to be nimble and agile in buying or selling stocks.

Individual investors, including retail investors, have an advantage over institutional investors in terms of their ability to maneuver through the market. They can take advantage of their smaller holdings and execute transactions without significantly impacting the market. Meanwhile, AMCs and funds with larger AUMs must navigate the challenges associated with executing transactions in the open market.

As AUM continues to grow for many AMCs, there is a concern that their ability to generate alpha or outperform the market will diminish. Typically, as the size of AUM grows, the number of stocks in which these funds can invest becomes limited. For example, the top mid-cap funds may only be able to invest in a restricted pool of 20 to 40 mid-cap stocks, which limits their ability to diversify and capture potential opportunities.

A manager’s sensitivity to the liquidity of the stocks they invest in is crucial. Failure to consider this liquidity factor can have severe consequences. An infamous case involved a popular small-cap manager running a Portfolio Management Service (PMS). As the AUM of the PMS reached 1,000-2,000 crores, he had to buy significant stakes in small-cap stocks, sometimes reaching 6-8% equity ownership. With such a significant position, it became challenging for the manager to exit the stock without attracting attention from the market. The market, aware of the manager’s position, could manipulate the stock price to make the exit as challenging as possible.

This example highlights the advantage that individual investors have over funds and AMCs. Individual investors can remain relatively invisible in the market, particularly if they hold less than the disclosure limit (typically around 5% of a stock’s equity). Institutional investors with larger AUMs can attract unwanted attention and may face challenges when executing their investment strategies. This dynamic creates an interesting dichotomy between individual investors and institutions in terms of market impact and flexibility.

If you have any questions, please write to support@weekendinvesting.com