Twice a year, major stock market indices go through significant changes. These changes occur at the end of March and September when the index committee refreshes the list of companies in different indices. The methodology for selecting these companies is primarily based on market capitalization, liquidity, and the impact cost of each stock. Stocks that perform well and see a rise in market capitalization move up to higher indices, while those that fall in value drop to lower indices. This regular reshuffling is a key feature of how indices are maintained.

Changes in Different Indices

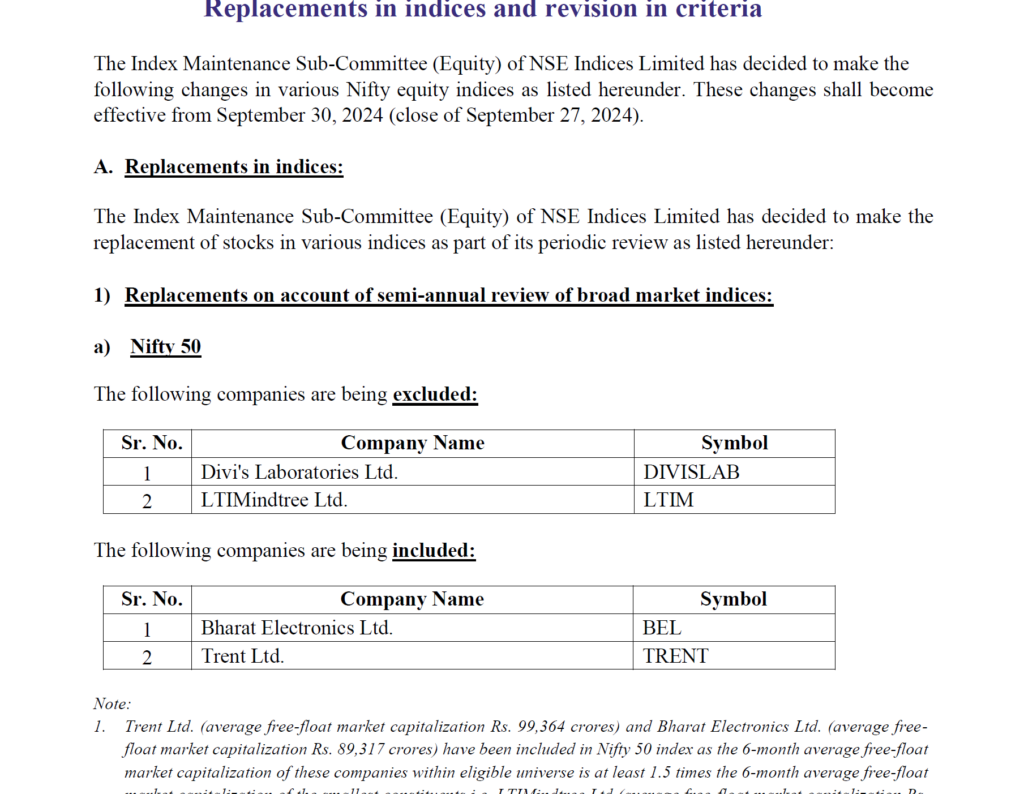

Recent changes to indices have shown varying levels of adjustment. For instance, in the Nifty 50 index, only two companies were replaced. This is a relatively small change, representing just 4% of the index.

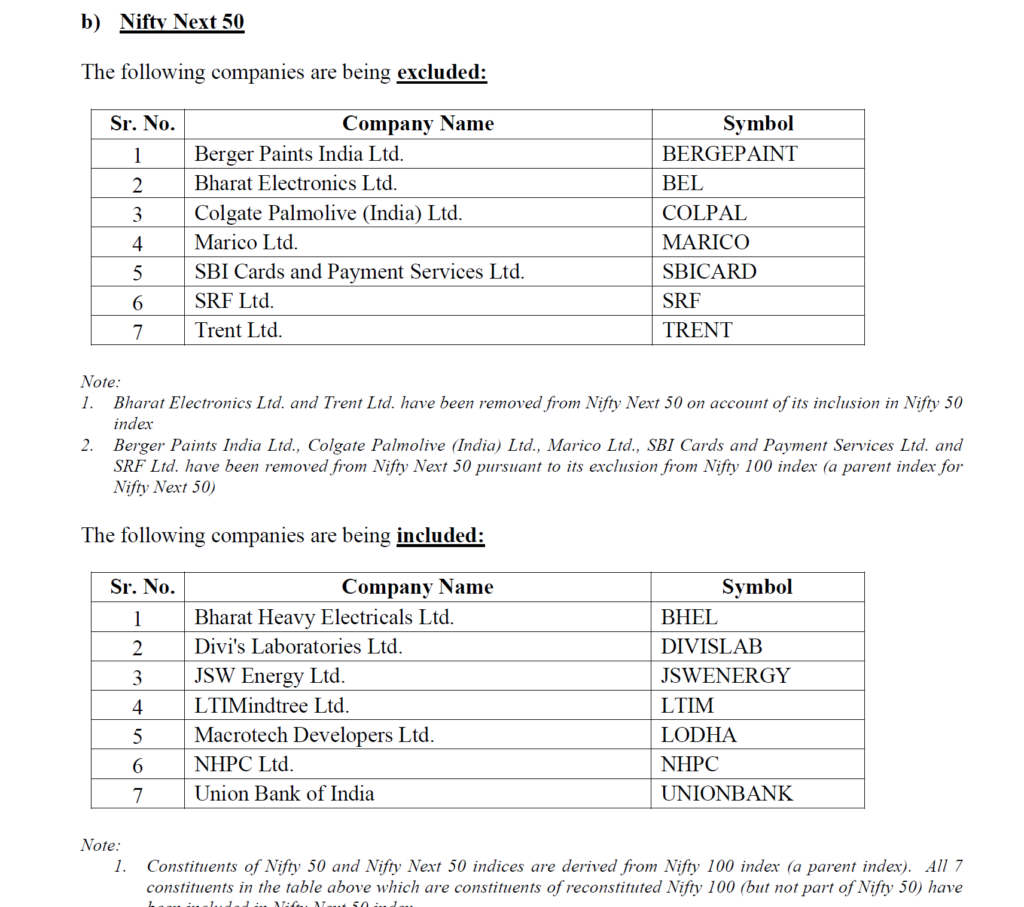

However, in the Nifty Next 50 index, seven companies were swapped out, accounting for 14% of the index. When you look at indices like the Nifty 500, which tracks a larger number of companies, the changes become more significant, with 27 companies being removed.

The changes are even more dramatic in smaller indices. For example, the Nifty Small Cap 250 index saw 38 stocks removed from the list, which is quite a large shift for a 250-stock portfolio. Similarly, in the Small Cap 100 index, 25 out of 100 stocks were replaced. This is a 25% change in just six months. These frequent changes reflect how quickly the market can evolve, with stocks moving between indices based on performance.

Impact on Strategies

The regular rebalancing of indices can have a considerable impact on investment strategies. For investors holding stocks that are moving up from small-cap to mid-cap categories, this can sometimes disrupt their portfolios. For instance, companies like HSCL, Cochin Shipyard, and Tata Invest have performed well, but since they are moving out of the small-cap category, investors with a small-cap focus may need to adjust their portfolios.

In some cases, stocks that are performing well, like Trent, are promoted to higher indices. Trent, for example, moved from Nifty Next 50 to Nifty, requiring investors with a Nifty Next 50 strategy to let go of it and the Nifty strategy to acquire it. These changes can be disruptive, but they are a part of the nature of investing in an evolving market.

Momentum Investing and Index Rebalancing

A closer look at these index changes reveals an underlying momentum strategy at play. Momentum investing is when stocks that have been performing well are retained or added to higher indices, while those that haven’t performed as well are dropped. This is evident in the latest changes where companies like BEL and Trent, which have done well, have been promoted to the Nifty 50, while companies like Divis and LTI, which have underperformed, have been moved to the Nifty Next 50.

This pattern shows that index investing, often viewed as a passive strategy, is actually driven by momentum. The better-performing stocks are given more weight in the indices, while the weaker ones are downgraded. This rebalancing happens automatically, following the market’s natural momentum.

Momentum in Index Investing

What many people don’t realize is that index investing, which is one of the most popular passive investment strategies globally, is inherently based on momentum. As stocks move up or down in performance, they are added or removed from indices accordingly. This makes a large portion of the market essentially follow a momentum-based strategy, even though it may not be labeled as such.

Disclaimers and disclosures : https://tinyurl.com/2763eyaz

If you have any questions, please write to support@weekendinvesting.com