An Analysis of Nominal GDP and Public Debt in Global Economies

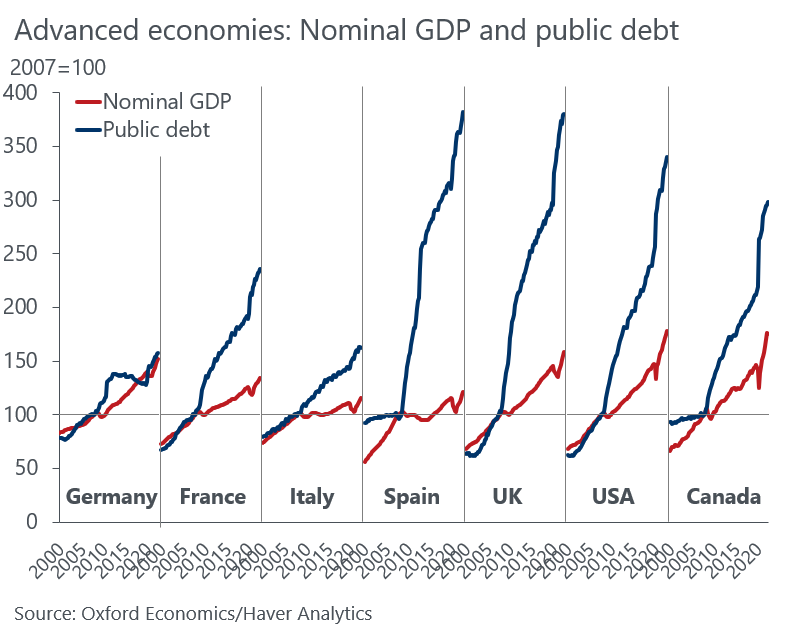

In this article, we would like to highlight the relationship between nominal GDP and public debt in several countries, namely Germany, France, Italy, Spain, UK, USA, and Canada & throw light on the alarming levels of public debt in these countries, which range from 250% to 350% of GDP. Sustaining such high levels of debt is unsustainable for developed economies whereas India has been managing its debt more effectively.

Nominal GDP, represented by the red line in the chart provided, serves as a measure of a country’s economic output without accounting for inflation. Public debt, represented by the blue line, refers to the total amount of money owed by a government due to borrowed funds. The alarming aspect of the chart is the significant disparity between GDP and public debt in the mentioned countries.

While India’s debt-to-GDP ratio stands at 85%, which some might consider high for an emerging market, it pales in comparison to the levels seen in Germany, France, Italy, Spain, UK, USA, and Canada.

India is actually performing exceptionally well when compared to these supposedly more developed economies. The key factor that allows these countries to sustain their high debt levels is their ability to secure near-zero interest rates.

However, the questionable fact is the long-term sustainability of this approach. In a scenario where interest rates rise to three, four, or even 5%, economies like the US, UK, and Spain would struggle to cope. These economies already face slow or stagnant growth rates, with the UK, Spain, and Germany experiencing particularly limited growth prospects. Canada, too, is facing a lack of growth. Without sustainable growth, it becomes increasingly challenging to manage high levels of debt given the rising interest expense.

Imagine a person with an annual income of Rs100 and a debt of Rs300. After covering their expenses, they are left with only Rs10 to repay their debt. At a 3% interest rate, they can manage their debt payments. However, if the interest rate increases to 4%, 5%, or 6%, the person would be burdened with reduced funds for other expenses.

Extrapolating this analogy to countries, we wanted to highlight that the mentioned economies are struggling to find a balance between economic growth and the burden of high interest rate levels.

On the other hand, India stands out as a growing economy. Currently, it holds the title of the fastest-growing economy. Indian interest rates remain at comfortable levels, providing stability in an otherwise uncertain global market scenario. As a result, India is attracting a significant influx of capital and investment opportunities due to its favourable market conditions.

If you have any questions, please write to support@weekendinvesting.com