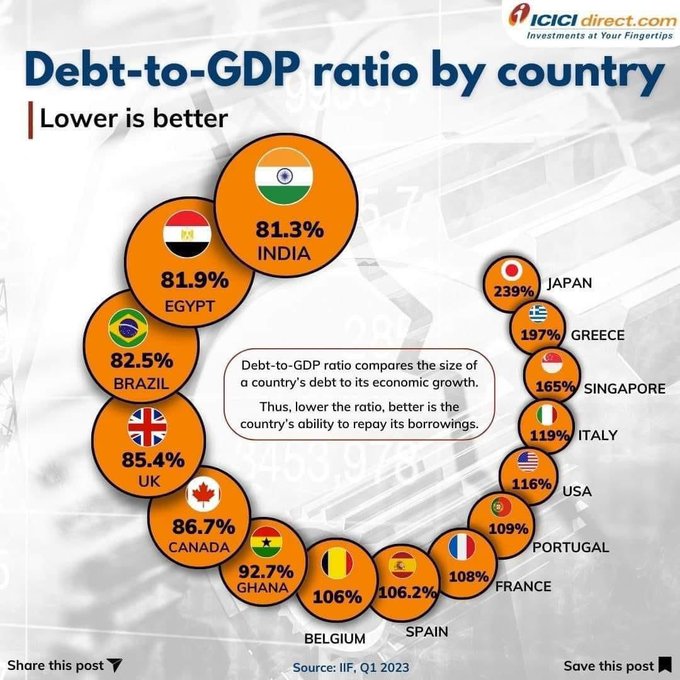

An infographic from ICICI Direct highlights the debt to GDP ratios of various countries. This ratio measures a country’s debt compared to its economic output or GDP. A high debt to GDP ratio indicates that a country has taken on a lot of debt, but its economic growth isn’t keeping up. This situation is seen in countries like Japan, Greece, Italy, and even the US, where debt levels continue to rise despite stagnant economic growth.

Debt Levels and Economic Growth

When a country’s economic growth is slow, but debt levels are high, it indicates that the country is borrowing to service its liabilities without sufficient GDP growth to offset this debt. It’s similar to an individual with a high credit rating but low income – they can take on debt, but repaying it becomes difficult. For countries, the GDP is like their income, and high debt to GDP ratios mean they might struggle to pay back what they owe, especially if interest rates rise.

India’s Strong Position

Compared to other countries, India has a relatively low debt to GDP ratio at 81%. This is better than many countries like Egypt, Brazil, the UK, Canada, Ghana, and Belgium. Countries with ratios above 100% include Belgium, Spain, France, Portugal, the USA (116%), Italy, Singapore, Greece, and Japan. While the US has some leeway because it issues the global currency, other countries with high ratios face significant challenges.

Potential for More Borrowing

India’s lower debt to GDP ratio means it has more room to borrow without being seen as over-indebted. This capacity to borrow more is beneficial for economic growth. It allows India to run more deficit years, implement more development programs, and invest in infrastructure. This potential for borrowing and investment is positive for India’s economic outlook on a macro level.

Stability and Future Prospects

India’s strong debt to GDP position suggests that its currency will remain relatively stable compared to others. As other countries struggle with high debt levels, India can maintain a more balanced financial situation. This stability is crucial because countries with high debt may eventually face severe measures to reduce their ratios, such as currency devaluation or selling assets. India, on the other hand, has a better starting point, which bodes well for its future economic stability.

Confidence for Investors

India’s favorable debt to GDP ratio should inspire confidence among investors. The country’s ability to borrow more without economic repercussions provides a long runway for growth. As an investor, knowing that India is in a strong financial position makes it an attractive market for long-term investments. This stability and growth potential are key reasons to consider investing in the Indian market.

Disclaimers and disclosures : https://tinyurl.com/2763eyaz

If you have any questions, please write to support@weekendinvesting.com