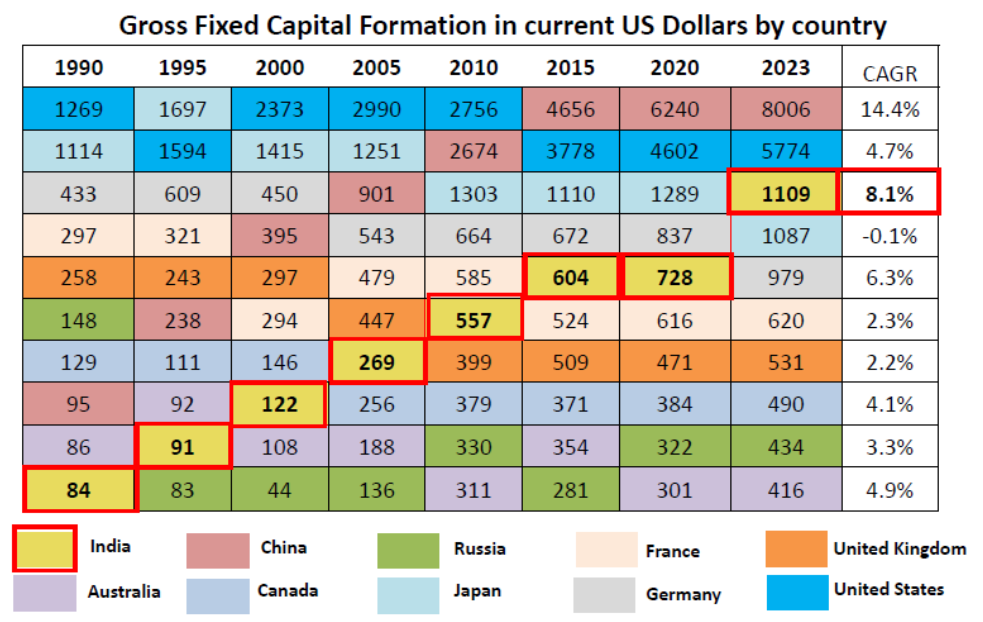

A recent infographic from DSP highlights the impressive rise of India in terms of gross fixed capital formation. Using data from World Development Indicators and Bloomberg, this chart shows how India, China, and the US have progressed over the last three decades. The most striking detail is India’s remarkable growth rate of 8.1% CAGR. In recent years, India has made significant strides in capital formation, which could bring many strategic advantages on the global stage.

Comparing India, China, and the US

The infographic shows the trajectories of gross fixed capital formation in India, China, and the US. China’s growth has been exceptional, moving from $95 billion in the mid-90s to $900 billion by 2005. They hit the $1 trillion mark around 2005-06 and continued to grow exponentially. India has followed a slower trajectory but has seen consistent growth. As of 2023, India reached $1,100 billion, trailing China by about 18 years. However, if India continues on this path, it can expect substantial growth in the coming decades.

The Potential for Exponential Growth

China’s rapid growth in capital formation from $100 billion to nearly $1 trillion in about 15 years serves as an inspiring benchmark. While India has taken longer to reach similar milestones, the rate of change is picking up. With the right policies and environment, India could see an exponential curve of growth. This could significantly increase the per capita income and overall prosperity in the country, mirroring China’s economic boom from 2005 to 2023.

The US: A Steady Leader

The US has maintained its position as a leader in gross fixed capital formation. From a trillion dollars in the 1990s, it grew to $3 trillion by 2005 and reached $5.7 trillion more recently. Although the growth has been steady rather than exponential, the US remains a top player. This steady growth provides a stark contrast to the rapid, exponential growth seen in China and the potential for such growth in India.

Optimism for India’s Economic Future

The data suggests that India is on the cusp of a significant economic leap. If India can emulate even 80% of China’s growth trajectory, the economic landscape could transform dramatically by 2040. The exponential increase in capital formation would likely lead to a surge in prosperity, elevating the per capita income and overall economic health of the nation.

Stock Market Implications

This economic growth has positive implications for India’s stock market. Historically, the Nifty has grown at about 12% annually. However, with the current trajectory of economic growth, there is potential for even higher returns. It’s possible that in the next five years, the Nifty could grow at 15% or more annually. This would align with periods of rapid economic growth seen in other economies, where stock markets have outperformed historical averages.

Disclaimers and disclosures : https://tinyurl.com/2763eyaz

If you have any questions, please write to support@weekendinvesting.com