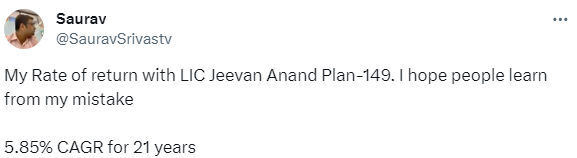

In today’s ever-evolving financial landscape, the quest for sound investment strategies often leads individuals down diverse paths. Recently, a compelling narrative emerged, shedding light on the experiences of an investor, Mr. Saurav Srivastav, and his 21-year journey with a LIC Jeevan Anand plan. With an initial investment of Rs 15,000 per year, Mr. Srivastav’s journey presents a fascinating case study, raising pertinent questions about the intersection of insurance and investment, and the implications thereof.

The allure of structured products often lies in their promise of steady returns and financial security. However, beneath the surface, complexities lurk, as highlighted by Mr. Srivastav’s journey. Despite the apparent gains, the nuances of such investments warrant closer examination. This prompts a critical discussion on the efficacy of structured products and their alignment with long-term financial goals.

The issue of mis-selling looms large in the financial realm, casting a shadow of doubt on the integrity of investment offerings. Mr. Srivastav’s experience underscores the importance of transparency and informed decision-making. When consumers are inadequately informed about the risks and potential returns of their investments, trust is compromised, and financial well-being may suffer as a result.

A fundamental principle in financial planning is the segregation of insurance and investments. By delineating these two aspects, individuals can tailor their financial strategies to meet their unique needs and objectives. This approach not only enhances risk management but also fosters greater clarity and control over one’s financial future.

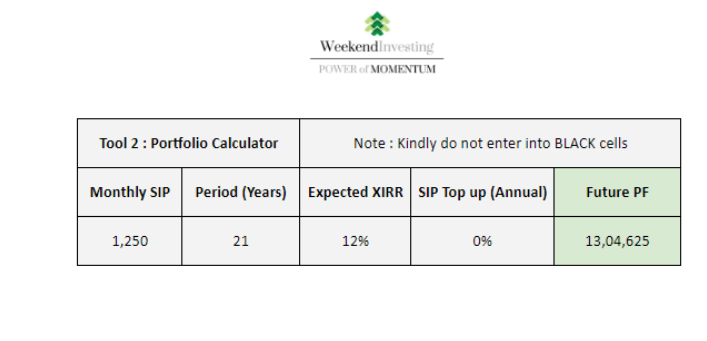

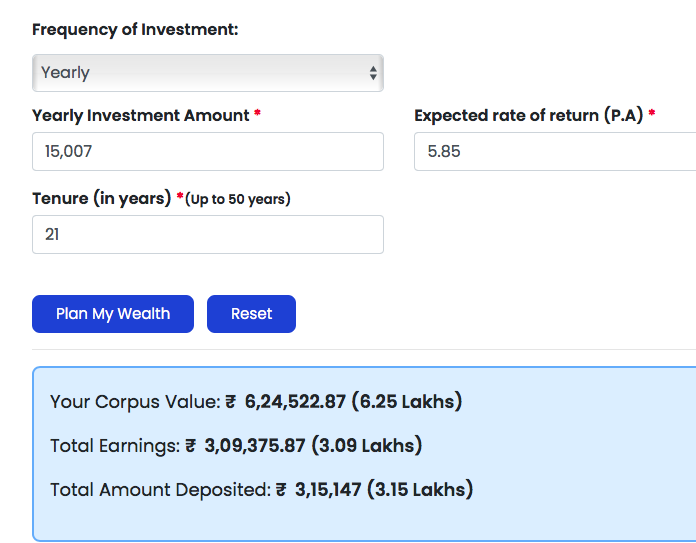

Central to the discourse is a comparative analysis of investment outcomes. By juxtaposing the returns from insurance-linked investments with those from alternative avenues such as equities (at 12% XIRR), valuable insights emerge.

A simple 12% XIRR yielding instrument would have taken the overall corpus to a significantly higher 13 lac compared to mere 6.2 lacs on the policy.

This exercise underscores the importance of exploring diverse investment options and understanding their respective implications for wealth accumulation and protection.

At its core, the narrative advocates for financial literacy and empowerment. Educating individuals about the intricacies of personal finance equips them with the tools to navigate the complexities of the financial landscape. Armed with knowledge, individuals can make informed decisions, mitigate risks, and pursue their long-term financial goals with confidence.

If you have any questions, please write to support@weekendinvesting.com