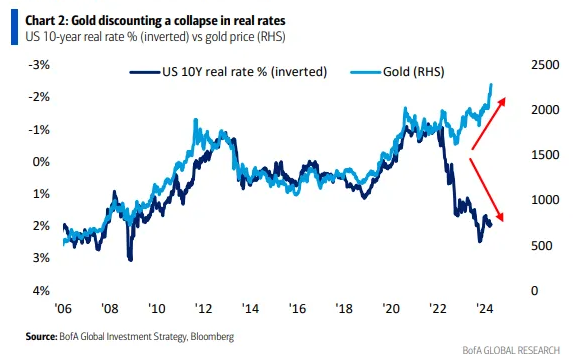

In this intriguing analysis, we’re presented with a comparative chart showcasing the dynamics between gold prices in dollar terms and the US ten-year real rate. Traditionally, these two metrics have exhibited a strong inverse correlation: as real rates rise, gold prices tend to fall, and vice versa. However, recent data reveals a departure from this pattern, sparking curiosity and prompting deeper analysis.

Breaking the Correlation

Over the past fifteen years, the relationship between real rates and gold prices has been remarkably synchronized. Yet, in the last year or so, this correlation appears to be unraveling. Despite real rates strengthening, gold prices continue to climb, defying conventional expectations. This anomaly begs the question: what factors are driving this deviation from the norm?

One plausible explanation is a potential impending disruption in the global landscape. While traditional market indicators suggest a downturn in gold prices, external factors such as increased central bank purchases and anticipated inflationary pressures challenge this narrative. The prospect of rising inflation rates looms large, threatening to upend existing market dynamics and reshape investment strategies.

Should inflation surge in the coming months without a corresponding decrease in interest rates, real rates could plummet. This scenario, while speculative, could trigger a significant uptick in asset prices across various sectors, including real estate, stocks, and commodities like gold and oil. The specter of inflation casts a shadow of uncertainty over the economic horizon, prompting investors to consider hedging their portfolios against potential risks.

Navigating Uncertainty

Despite the perplexing nature of the current situation, adhering to the BBC principle—Bhav Bhagwan Che—offers a guiding light amid the uncertainty. Gold’s upward trajectory serves as a subtle yet potent signal of looming trouble, whether in the form of inflation, geopolitical tensions, or monetary disruptions. As such, prudent investors may find value in diversifying their portfolios to mitigate potential risks.

Spotlight : The art of dealing with (no) emotions !

Navigating the decision to invest in a stock that has remained range-bound for over a decade poses a significant challenge, particularly for those engaged in discretionary styles of investing.

We take the example of COAL INDIA which finally broke out of its long-standing range towards the end of 2023 and try to draw some learnings from two scenarios.

Existing investors, having weathered the stock’s historical cycles, may view the breakout as an opportunity to sell, anticipating a return to familiar correction levels around Rs 200. Conversely, newer investors might hesitate to enter the market at Rs 200, fearing a repetition of the 2015 correction pattern.

Momentum investing offers a refreshing departure from such biases, empowering a predefined system to dictate stock entry and exit points. The Mi India Top 10, for instance, picked up this stock around Rs 295 in October 2023 and has been a beneficiary of its impressive performance ever since.

Of course, we cannot exactly say how long this trend may last. But we are quite sure about the fact that the strategy will be quick to get rid of any stock that starts to observe a fade in its momentum.

Disclaimers and disclosures : https://tinyurl.com/2763eyaz

If you have any questions, please write to support@weekendinvesting.com