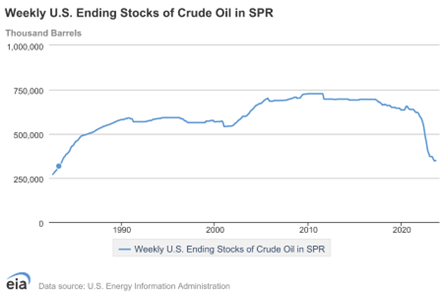

A recent tweet by macro analyst Luke Gromen saw him highlighting a concerning trend in the US Strategic Petroleum Reserve. This graph showed the decline of the reserve, reaching levels not seen since the mid-1980s. This reduction carries significant implications for the US economy and its ability to control inflation. In this article, we will explore the reasons behind this decline, the role of OPEC and Saudi Arabia, and the potential consequences for the United States.

Historically, when oil prices rose, the Strategic Petroleum Reserve would intervene by selectively supplying more oil to the market. This action helped cool off prices and maintain control over inflation. However, the situation has changed with OPEC and Saudi Arabia withholding supply to drive prices up. As a supplier, their intention is to benefit from higher prices, effectively throttling supply to force the market to bid up prices.

This new dynamic puts the US in a difficult position. If they want to cool off inflation, they would need to sell off part of their already diminished Strategic Petroleum Reserve. On the other hand, if they decide to buy back oil to replenish the reserve, it will cause prices to skyrocket and lead to inflationary issues within the country. This catch-22 situation leaves the US trapped within the current oil market dynamics.

However, in recent years, China and Russia have been distancing themselves from this Petrodollar system. They aim to eliminate the dependence on the US dollar and price oil in other currencies. The implications of this shift could be significant. For example, when China buys oil from Saudi Arabia, it can pay in yuan instead of dollars. This enables Saudi Arabia to invest that yuan outside of the US, effectively reducing the influence of the US dollar in global markets.

Returning to Luke Gromen’s tweet, he draws parallels between the decline of China’s forex reserves and the reduction in the US Strategic Petroleum Reserve. China has been actively reducing its dollar reserves due to its desire to move away from reliance on the dollar. However, they still require forex reserves for various imports. Consequently, the market will bid up the US dollar against the yuan, forcing China to devalue its currency to maintain transactions and international trade.

If we apply the analogy from Luke Gromen’s tweet, we can see that once the US petroleum reserves reach a critically low level, the market will need to devalue the US dollar against oil. Over the past 50 years, oil has been the constant denominator, while the US dollar’s inherent value has diminished. Therefore, it is likely that the US dollar will need to be marked down against oil, potentially leading to a significant oil shock in dollar terms.

The implications of such a scenario would be far-reaching, impacting not only the US economy but also countries around the world. India, for instance, would be particularly vulnerable to the consequences of a depreciated US dollar and skyrocketing oil prices.

This situation raises broader questions about the future of the US dollar’s dominance as the global reserve currency. It is increasingly evident that the current system may need to undergo significant changes. These changes could range from a shift to a basket of currencies or even a complete reorganisation of the global economic order.

It is important to note that we are not macro analysts, and our analysis should not be taken as gospel. We, like you, are constantly learning and exploring different perspectives. If you find any flaws or have further insights on this topic, please feel free to share them. Open dialogue and continuous learning are crucial in understanding the complex dynamics of the global economy.

Download the WeekendInvesting App

If you have any questions for us. please write t