In this blog, we will be examining key indicators to gain insights into various countries’ financial landscapes. While we won’t delve into the nitty-gritty of PE ratios and such, we’ll explore a broader perspective on how different nations stack up against each other in terms of growth potential and valuation.

Comparing Growth and Valuation Across Countries

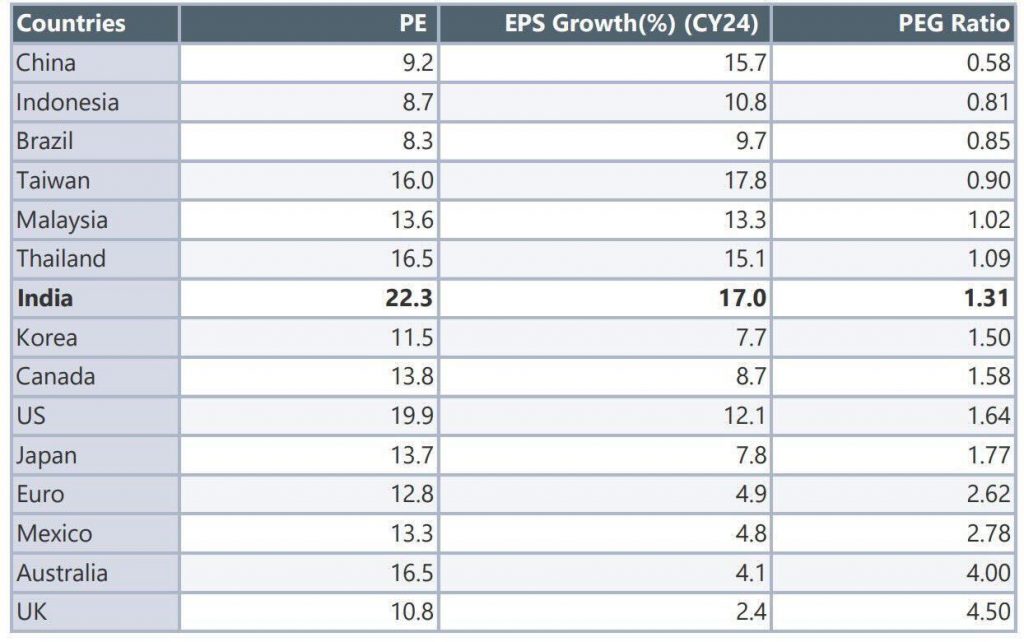

Taking a glance at the PE ratios of different countries, it’s evident that India leads the pack with a ratio of 22.3, sparking discussions about its valuation. On the other hand, China, with a PE ratio of nine and an EPS growth of 15%, emerges as an attractive option. Meanwhile, mature markets like the US, Japan, and European countries boast significantly higher PE ratios, signaling potentially overvalued markets.

Understanding the PEG Ratio: A Key Measure

To gauge a market’s attractiveness, we look at the PEG ratio, which factors in both the PE ratio and EPS growth. China’s PEG ratio stands at a mere 0.5, indicating a compelling investment opportunity with its high growth and low valuation. Conversely, mature markets exhibit significantly higher PEG ratios, suggesting relatively lower growth potential compared to their valuation.

India’s Position: A Balanced Perspective

Despite India’s relatively higher PE ratio, its PEG ratio remains reasonable at 1.3, indicating a balance between growth and valuation. With political stability and infrastructural improvements on the horizon, India presents an intriguing investment landscape, offering favorable growth prospects amidst a dynamic economic environment.

The Importance of Diversification and Strategy

In navigating the complexities of the market, it’s crucial to adopt a diversified investment strategy. By spreading investments across various asset classes outside of only equities, investors can mitigate risks and capitalize on opportunities while remaining resilient to market fluctuations. Having clear exit rules and a well-defined investment plan further strengthens one’s financial position.

If you have any questions, please write to support@weekendinvesting.com