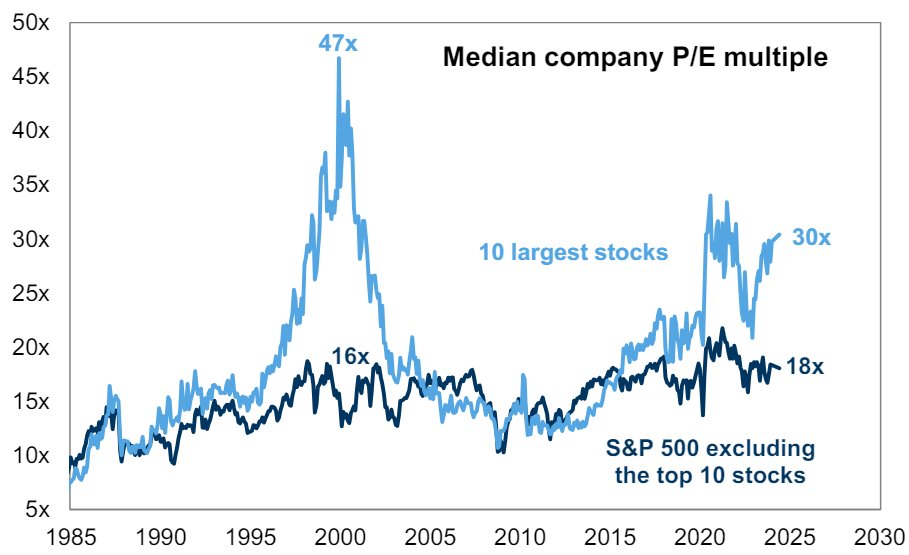

This data given below shows the performance of the top ten stocks in the S&P 500 compared to the rest of the market over nearly 40 years, from 1985 until now. During this period, the top ten stocks have consistently outperformed the rest of the market by a significant margin.

The Top Ten Stocks vs. The Rest

The top ten stocks in the S&P 500 have shown remarkable growth compared to the other 490 stocks in the index. The price-earnings (P/E) multiples of the top ten stocks have fluctuated widely, going from ten times to as high as 47 times during the dot-com boom, and then dropping back to ten times. Post-COVID, these multiples reached nearly 34-35 times and have now settled at around 30 times. In contrast, the P/E multiples for the remaining 490 stocks have stayed relatively stable, between twelve to 18 times.

Concentration of Market Action

The real market action is concentrated in these top ten stocks. Each market peak has seen significant contributions from these stocks, making it crucial for investors to identify and include these key performers in their portfolios. Examples of these high-performing stocks in the US market include Nvidia, Apple, Microsoft, and AVGO. These companies are currently driving the market upwards.

Similar Trends in the Indian Market

A similar trend can be observed in the Indian market. In the CNX 500 index, a small group of ten to 20 stocks are the main drivers of market growth. These can include public sector enterprise stocks, defense stocks, public sector banking stocks, and some auto stocks. Just like in the US, these top stocks show higher P/E multiples and faster growth compared to the majority of the market.

Identifying Key Stocks for Your Portfolio

For investors, it is very important to identify these top-performing stocks. While the bulk of the market, about 450 stocks, show only gradual growth, the real movers are a small group of stocks with higher growth potential. Including these key stocks in your investment strategy can make a significant difference in your portfolio’s performance.

Disclaimers and disclosures : https://tinyurl.com/2763eyaz

If you have any questions, please write to support@weekendinvesting.com