Debate on Fed Rate Cuts

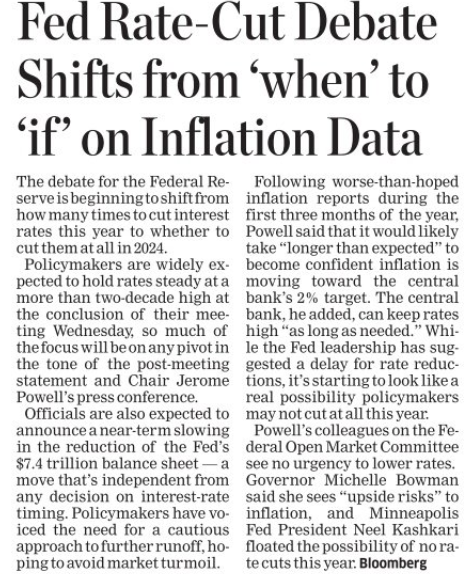

One topic that’s been garnering attention is the debate surrounding Federal Reserve rate cuts. Initially, there were talks of multiple cuts in the calendar year, but now the forecast has dwindled to only about two cuts. Some speculate that there might not be any cuts at all, attributing this shift to the challenges posed by inflation, leading to a situation akin to stagflation.

Impact on Markets and Bond Yields

This shift in the debate from when the Fed rate cuts will happen to if they will happen has significant implications for bond yields and market dynamics. Despite numerous forecasts and predictions, the outcomes often deviate from expectations, adding to the uncertainty surrounding economic policy.

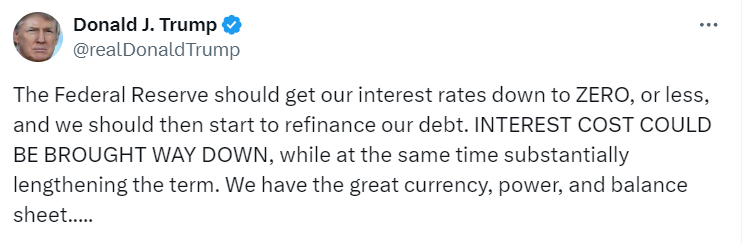

Trump’s Influence on Interest Rates

Adding fuel to the fire, Presidential candidate Trump has been vocal about his desire for the Federal Reserve to slash interest rates to zero. Should he secure another term in office, this scenario could become a reality, drastically altering the economic landscape. However, such a move could unleash uncontrollable inflation and drive up commodity and stock prices.

Historical Precedents

The power wielded by a single individual, particularly the President of the United States, can reshape economic history. Similar to Nixon’s decision in 1971 to detach the US dollar from the gold standard, which led to unprecedented economic shifts, the decisions made by current leaders have far-reaching consequences for future generations.

Implications for Future Generations

While short-term political gains may drive certain policy decisions, the long-term ramifications are often borne by future generations. The trend of governments resorting to extensive bailouts and stimulus packages to maintain political power comes at a cost, with mounting debts and economic instability looming over the horizon.

Disclaimers and disclosures : https://tinyurl.com/2763eyaz

If you have any questions, please write to support@weekendinvesting.com