The Nikkei’s Tale: A Cautionary Lesson for Index Investors

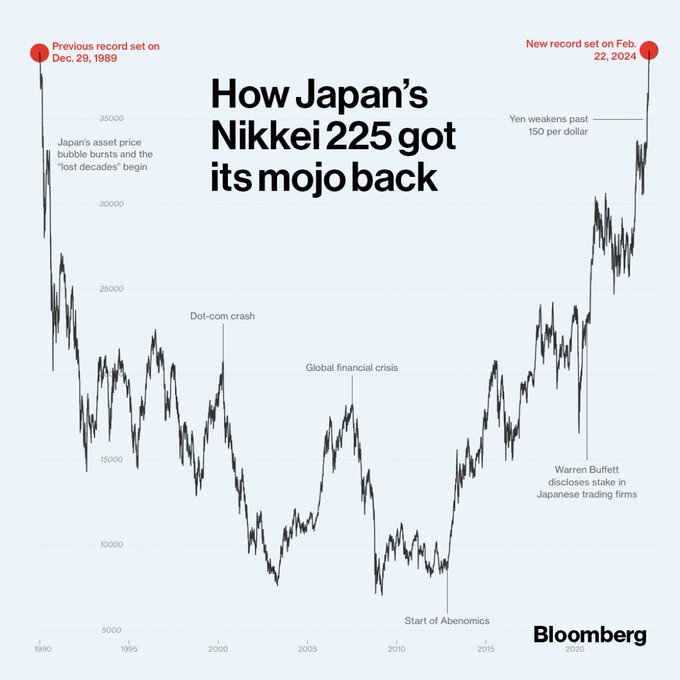

The recent surge of the Nikkei 225, reaching a new high after 35 years, offers valuable insights for investors. While it’s tempting to view passive index investing as a guaranteed path to growth, the Japanese market serves as a stark reminder of potential pitfalls.

A 35-Year Journey: The Nikkei’s climb back to its peak exemplifies how an index can stagnate for extended periods. This challenges the common perception that passive investing in broad market indexes inherently leads to consistent growth.

The Mania Factor: The Japanese bubble highlights how excessive liquidity can inflate asset prices beyond reasonable valuations. This “mania,” can occur in individual stocks, entire asset classes, and even broad-based indexes like the Nikkei.

Passive Investing and the Risk of Missing Out: The “buy and hold” mentality prevalent in passive investing can lead to underperformance when markets encounter significant corrections like the Nikkei’s post-bubble slump. This reinforces the importance of acknowledging potential downside risks even in diversified strategies.

Market Cycles and the Illusion of Perpetual Growth: Younger generations who have not experienced major market downturns may harbor the misconception that markets only go up. I’d like to emphasize the cyclical nature of markets & remind one and all that periods of strong growth can be followed by significant corrections.

The “Modi 3.0” Scenario: The hypothetical scenario of a sudden influx of capital highlights how liquidity surges can drastically alter market behavior. This underscores the potential for short-term, sentiment-driven price movements not necessarily justified by underlying fundamentals.

The Takeaway: While passive investing can offer a convenient and low-cost way to participate in the market, it’s crucial to remember its limitations. Investors should be aware of potential for stagnation and corrections, acknowledge market cycles, and consider the benefits of active management strategies that may offer greater flexibility and potential for outperformance.

Kindly write to us on support@weekendinvesting.com if you have any queries