The Namaste Pattern: A Cautionary Tale for Investors

The “Namaste Pattern” is a recurring phenomenon observed in the stock market, particularly after a bull run in a specific sector. This article explores this pattern using the example of Polyplex Corporation and highlights the importance of having an exit strategy.

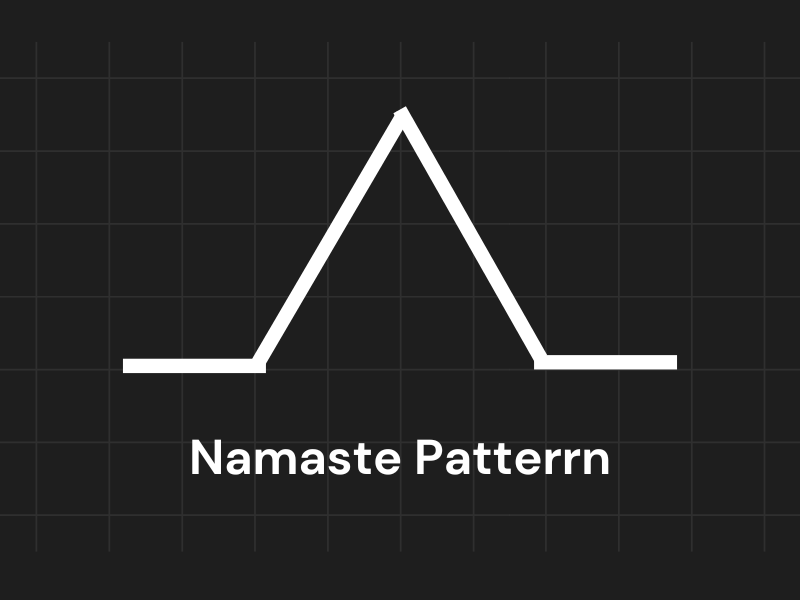

Understanding the Namaste Pattern

The Namaste pattern resembles the salutation gesture with folded hands. One side of the stock chart reflects a sharp rise in price, while the other side mirrors a complete reversal, bringing the price back to its starting point. This pattern signifies a period of significant price inflation followed by a correction that erases all the gains.

Polyplex Corporation: A Case Study:

Polyplex Corporation’s stock price surged from ₹200 during the COVID-19 market crash of 2020 to a peak of nearly ₹2700 by 2022. This dramatic rise was fueled by market optimism surrounding a potential strategic investment. However, when the details of the investment were revealed, the sale price fell short of expectations, leading to a significant drop in the stock price.

Market Signals and Investor Psychology

The “Bhav Bhagwan Che, BBC Principle” emphasizes that the market often anticipates future events. In the case of Polyplex, the market sensed that the actual sale price wouldn’t reach the high expectations, leading to a price drop before the official announcement. This highlights the importance of paying attention to market signals and avoiding getting caught up in excessive optimism.

The Importance of an Exit Strategy:

The Polyplex example underscores the crucial role of having a well-defined exit strategy in place. Whether based on technical indicators like moving averages, price drops, or personal risk tolerance, investors should establish clear rules for exiting a position to protect their capital.

Learning from the Pattern:

The Namaste pattern serves as a reminder that bull markets can be followed by sharp corrections. Investors should not get carried away by the euphoria of a rising market and instead, focus on implementing disciplined investment strategies that include clear entry and exit points. While hoping for a future recovery is natural, it’s essential to prioritize portfolio protection by managing risk effectively.

Kindly write to us on support@weekendinvesting.com if you have any queries