The wave against emerging markets continue and so far the feeling is that this is a healthy correction. It may be coincidental, but it is good that the Demonetization purge is happening alongside.

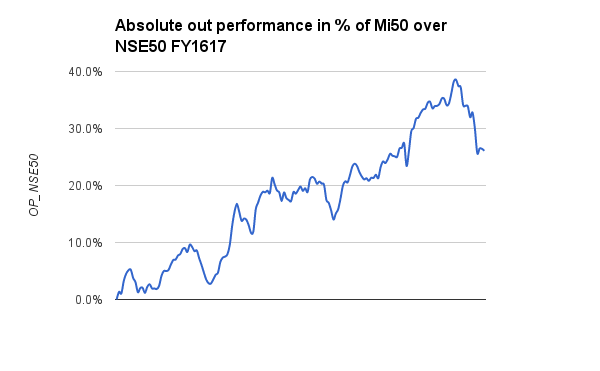

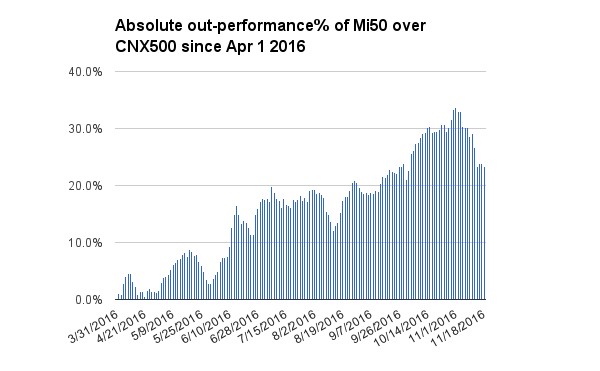

Mi50 has closed the week at 30.42% vs 4.3% and 7.1% for Nse50 and CNX500 for the FY respectively.

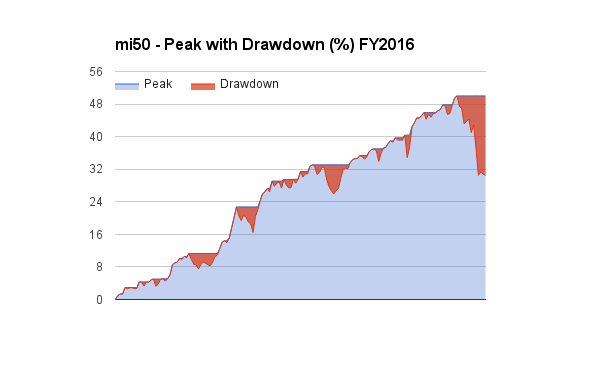

The draw-down reached 19.59% at the end of the week, the deepest since the inception.

The out performance of Mi50 vs the two indices this week continued to decline. The momentum in market continues to be under severe pressure.

The stocks that were exited today with their performance are:

| RAMCOCEM | 525.00 | 30.92% |

| GOCLCORP | 236.14 | -33.22% |

| KSL | 266.83 | 44.04% |

| BLUESTARCO | 463.00 | 16.77% |

| BODALCHEM | 108.95 | 48.43% |

| SUPPETRO | 190.00 | 44.38% |

| ORIENTPPR | 64.95 | 88.81% |

| CANFINHOME | 1491.05 | 25.83% |

| LLOYDELENG | 245.00 | -25.10% |

| ATUL | 2072.36 | 19.03% |

| BALAMINES | 292.77 | 64.48% |

The ones added are:

| 11/18/2016 | UJAAS | 38.55 |

The strategy now has 25 shares in play and about 46% capital in LiquidBees.

The distribution of sectors now :

The Win Loss statistics for the strategy are :

| All Trades | Wins | Avg | Losses | Avg |

| 53 | 33.81% | 29 | -9.04% | |

| Exits Only | Wins | Avg | Losses | Avg |

| 36 | 35.67% | 22 | -8.58% |

With more than 44% capital in cash, the volatility of the portfolio will be sober going forward. It may be the best time to take a long vacation.

Have a good one.

See that stocks related to property – Ramco, Blue Star, Canfin, Lloyd and

Crude Derivatives – Bodal, Sup Petro, Atul, Balaji going out. Brilliant.

High cash call – 46% also looks appropriate for next 3-4 months.

Want to see at what point it adds PSU Banks.