In a recent interaction with one of our viewers, an intriguing question was posed to me: What would have happened if one had invested in the Japanese market and followed a momentum investing approach? Furthermore, the viewer wondered how Indian investors would fare if faced with a similar situation in the future. This query prompted me to delve into the historical performance of the Japanese market and draw lessons that can be applied to the Indian context.

To begin, it is worth noting that the Japanese market experienced a remarkable period of growth from 1970 to 1989. The Nikkei 225 Index surged significantly during this time. In just 20 years, from 1975 to 1995, this index jumped a staggering 17 times. When we consider the current Indian market scenario and project it 20 years into the future, it is not inconceivable to imagine Nifty growing 17 times larger, reaching an unimaginable level of 3,40,000. Such meteoric rises are within the realm of possibility in the stock market.

However, it is crucial to note that digesting such monumental market moves takes time. The Japanese market itself has only recently recovered and returned to its pre-crash levels after a gap of 33 years.

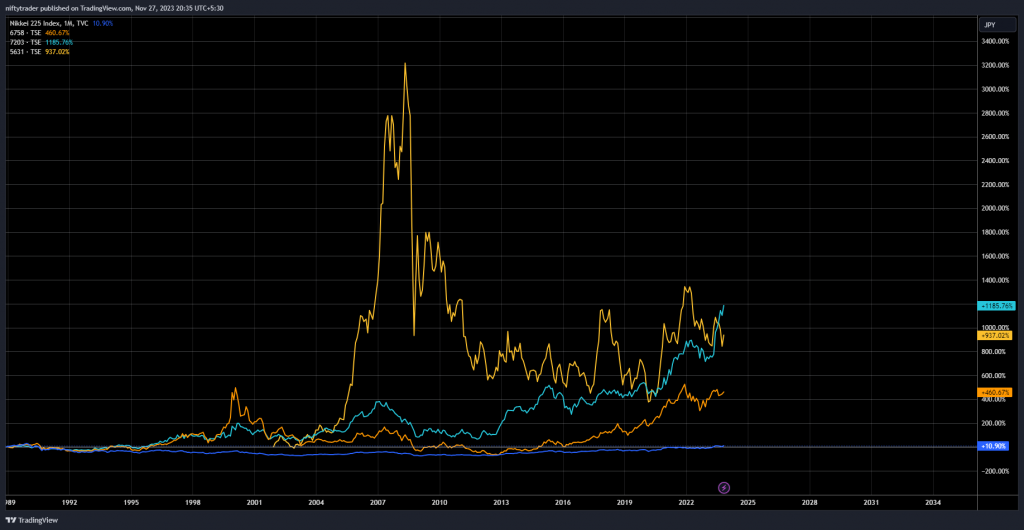

If we assume a ten-fold increase in the index, investors can easily fathom the substantial wealth that could be generated. When the index rises by ten times, investors’ wealth can increase by an astonishing 20x to 50x. Nonetheless, it is necessary to consider the entire timeline and not just focus on the crash period. Even before the crash, investors who followed a proper investment strategy would have witnessed immense gains. Furthermore, those who expertly maneuvered their investments after the crash would have continued to accumulate significant profits.

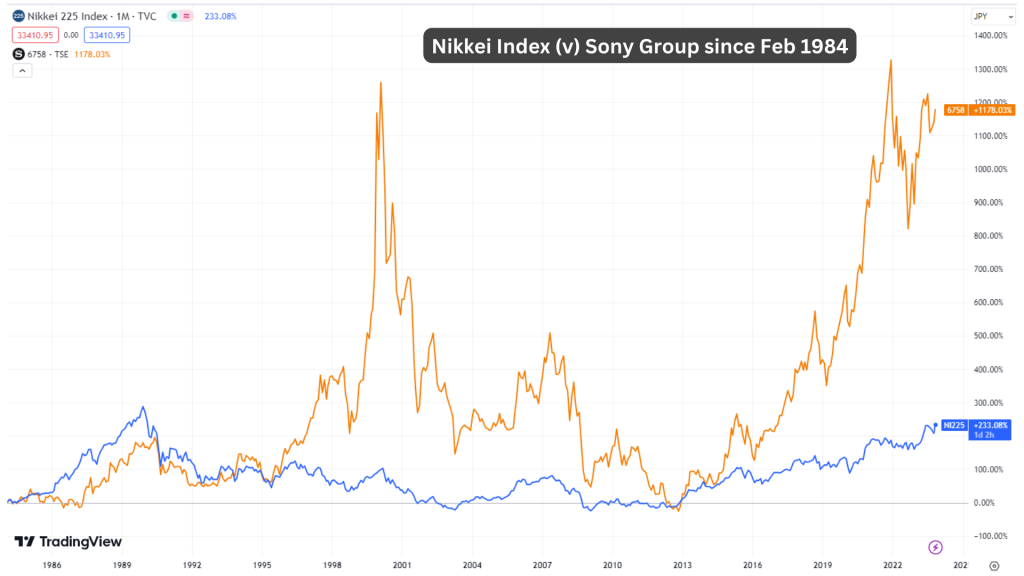

For example, let’s examine the performance of Sony Corporation, one of the most renowned Japanese companies. Despite the overall market downtrend, Sony initially dropped by 50% along with the market. However, the company witnessed a phenomenal recovery, soaring to new heights. From its base value of 100, it reached an impressive 700, representing a seven-fold increase. Even after a subsequent decline , it surged once again by 20 times, offering investors ample opportunities to ride this wave of success.

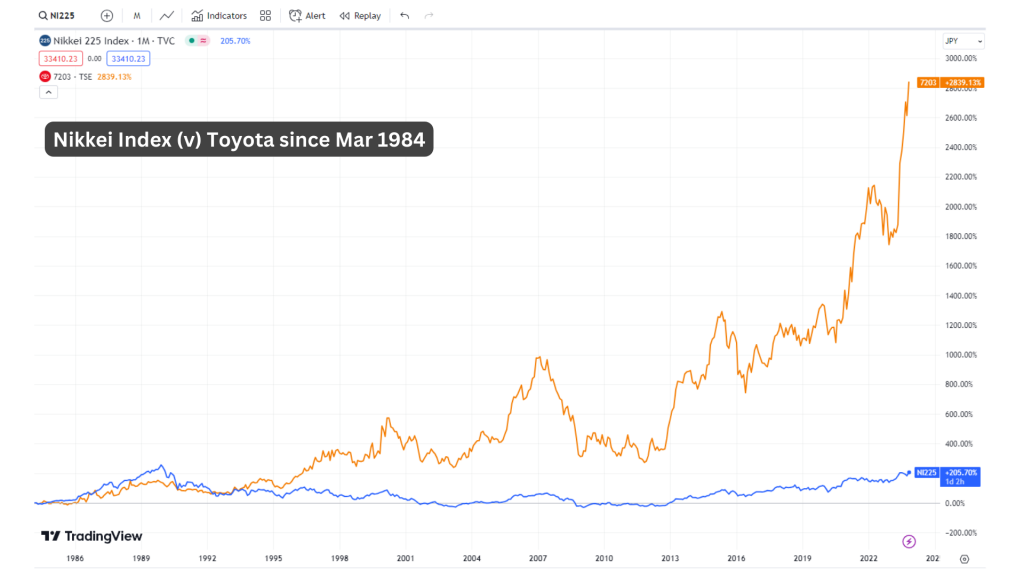

Similarly, Toyota Corporation, another beloved Japanese company, exemplifies the potential gains that can be achieved despite a market downturn. While the Japanese market is currently at 3x gains since Mar 1984, Toyota defied the trend, surging an astonishing 27x. This remarkable performance demonstrates that even if the overall market is slumbering, individual stocks within specific sectors can still fly high.

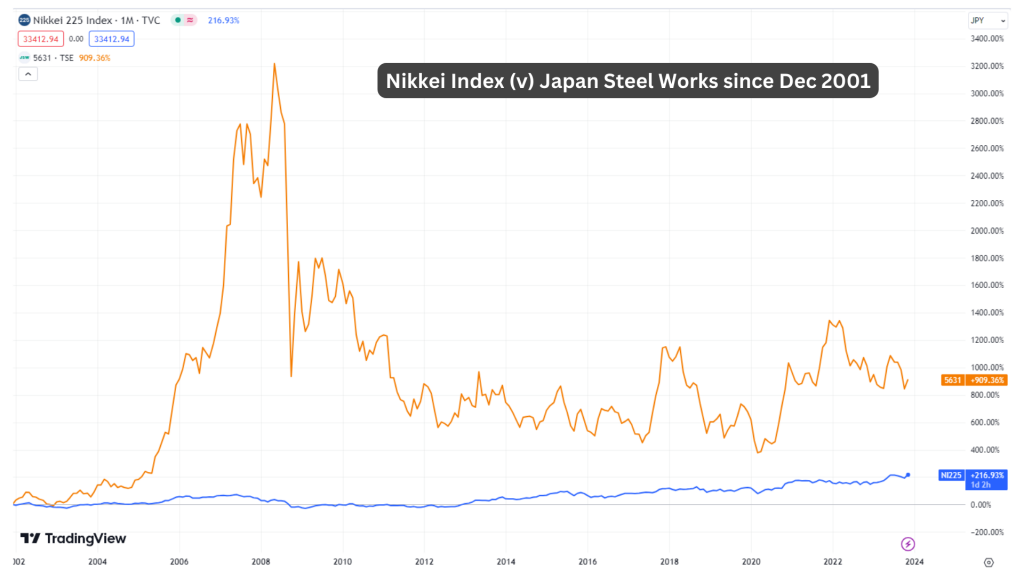

In another example, Japan Steel Works experienced substantial growth from 2002 onwards. Although I lack the data from 1990, the chart reveals that Japanese steel multiplied by an astounding 32 times before giving back some of those gains. An investor adhering to a proper investment strategy, particularly one aligned with momentum investing, would have undoubtedly reaped significant profits from the stocks initial movement between 2004 and 2008.

The key takeaway from analysing the Japanese market is that, despite the overall index performance, individual stocks can still deliver exceptional growth. By employing a momentum strategy, investors can successfully navigate volatile market conditions. This strategy maintains the potential for considerable gains when the market is ascending and protects against substantial losses during downturns.

If you have any questions, please write to support@weekendinvesting.com

V good article

Thank you