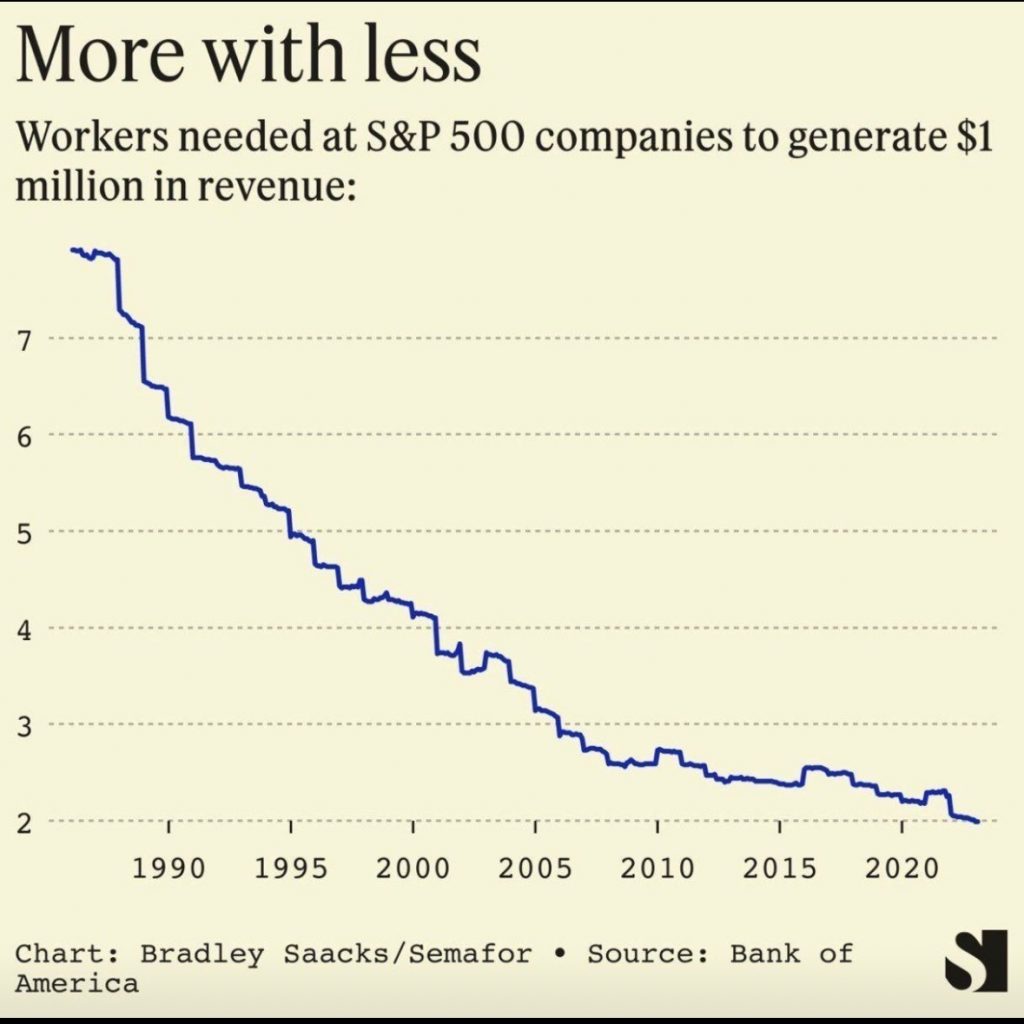

In a recent report by Bradley Saacks of Bank of America, an intriguing revelation surfaced: the number of workers needed at S&P 500 companies to generate a million dollars in revenue has significantly decreased over the last three decades, from seven to two. This data sheds light on the evolving landscape of corporate efficiency and productivity, hinting at the pervasive influence of technological advancements and operational optimization.

Navigating the Age of Disruption

As we delve deeper into the implications of this data, it becomes apparent that we’re amidst an era of relentless disruption. The narrative of innovation and efficiency isn’t a recent phenomenon but rather a consistent trend over the past few decades. While some may attribute this trend solely to technological advancements, it’s essential to recognize the multifaceted nature of disruption, encompassing factors such as market dynamics, consumer preferences, and strategic partnerships.

Momentum Investing: Going with the Flow

In essence, momentum investing embodies the principle of going with the flow, rather than against it. By aligning investment decisions with the prevailing market trends and sentiments, investors can mitigate resistance and capitalize on emerging opportunities. This approach has proven effective across various market conditions, from bull markets to flat markets and even during periods of disruption like the COVID-19 pandemic.

Check out our Momentum Strategies to successfully navigate through this fast evolving landscape

As we chart our course in an increasingly dynamic market environment, it’s essential to remain agile, adaptive, and open to change. While past performance may offer insights, it’s no guarantee of future success in a landscape where disruption is the new normal. By embracing change, leveraging collective intelligence, and aligning with market momentum, investors can navigate through uncertainty and seize opportunities for long-term growth and prosperity.

If you have any questions, please write to support@weekendinvesting.com