Why Trying to Predict the Market is a Losing Game

As investors, we are constantly bombarded with predictions and forecasts about the stock market. We look to experts, like Mike Wilson, the Chief Investment Officer at Morgan Stanley, to come up with accurate forecasts. After all, they have access to extensive knowledge, teams of experts, and sophisticated modelling techniques. However, the truth is that even the best minds in the industry, with all their resources, often make incorrect predictions.

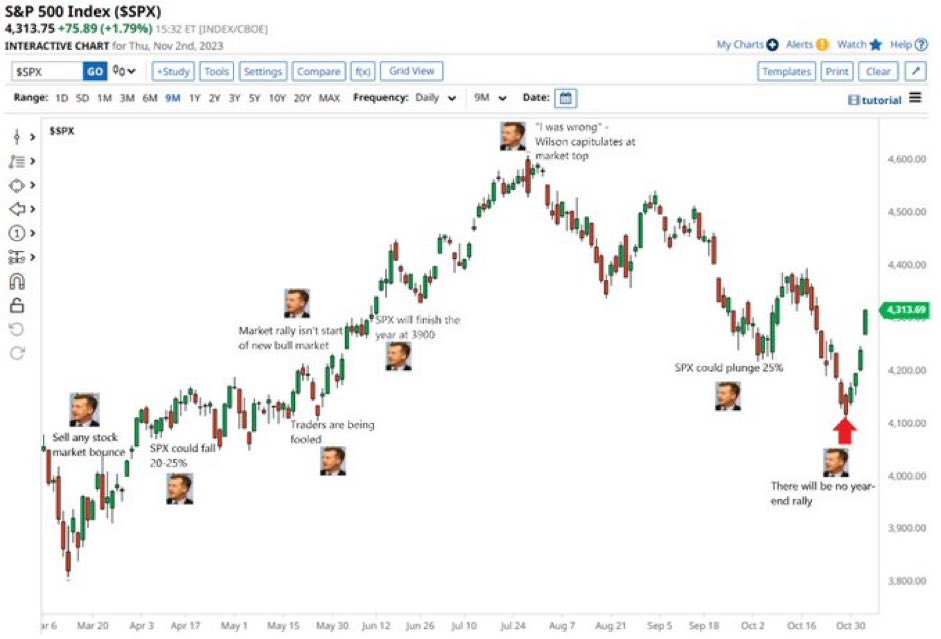

In a fascinating analysis published by @Barchart, we can see the S&P 500 plotted alongside the statements made by Mike Wilson. What this analysis reveals is that Mr. Wilson, despite his esteemed position, has made several incorrect predictions about the market. Time and time again, his forecasts have proven to be off the mark.

For example, after the 2020 market rally and the COVID bottom, Wilson stated that the S&P 500 could fall by 5%. However, the market never experienced such a decline. In another instance, he claimed that the rally would not sustain, yet the market continued its upward trajectory. Similarly, he doubted that the rally was the start of a new bull market, but it defied his expectations and continued to climb. Throughout the year, his predictions consistently failed to materialise.

What this analysis illustrates is that even the best investment managers, with their access to vast resources and teams of experts, cannot accurately predict the market. Their theses are often nullified, and the market behaves contrary to their expectations. This highlights a crucial message for all investors: trying to predict the market is a futile exercise. No one can consistently forecast what will happen in the market with precision.

Instead of attempting to predict the unpredictable, investors should focus on identifying patterns and trends. By recognizing these trends, one can make more informed investment decisions and achieve better outcomes. It is crucial to develop strategies that rely less on predicting the market’s future direction and more on capitalising on existing trends.

Transitioning from discretionary investing to non discretionary investing is a turning point for many investors. It involves removing personal biases and emotions from the decision-making process and adopting a more systematic approach. By doing so, investors can enhance their performance and achieve better results.

This shift requires investors to be dispassionate and objective in their strategies. They must analyse their investment approaches and consider how being nondiscretionary could impact the outcomes of their portfolios. By eliminating subjective judgments and relying on data-driven strategies, investors can navigate the market in a more disciplined and effective manner.

It is important to emphasise that this approach does not guarantee success or eliminate the risk of market fluctuations. Investing will always involve uncertainty and potential losses. However, adopting a nondiscretionary strategy allows investors to make well-informed decisions based on objective observations, rather than unreliable predictions. This approach can help investors remain focused on long-term trends and reduce the urge to time the market, which is notoriously difficult.

If you have any questions, please write to support@weekendinvesting.com