Understanding the Trends in US Government Bond Yields: A Century-Long Analysis

As an investor, it is crucial to understand the dynamics of the stock market and develop a clear-cut plan for your investments. In this video, we will be exploring the importance of opportunity cost & regret. We will also discuss how to effectively manage these two factors.

Case Study on Tata Elxsi

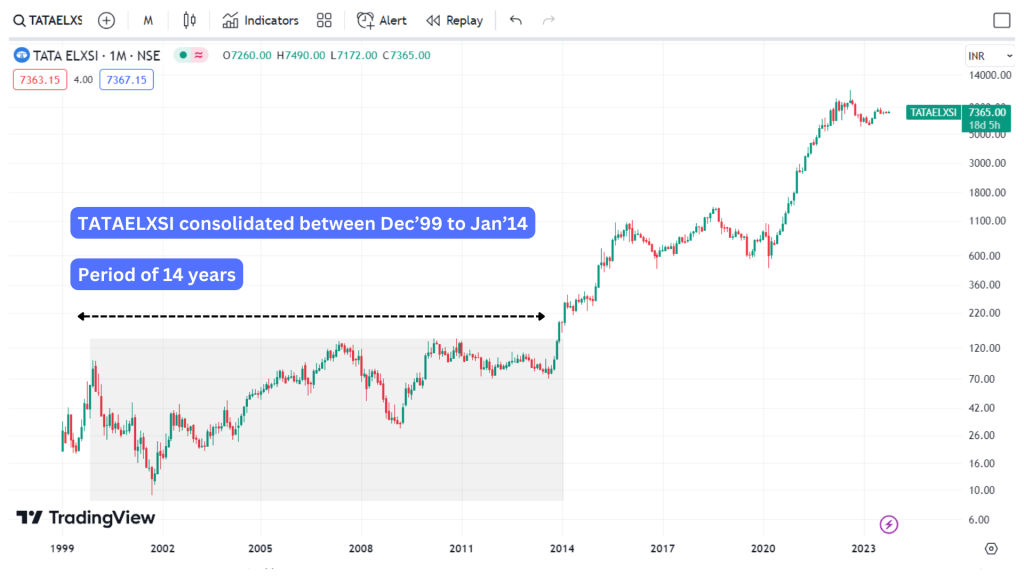

Let’s start by examining the 24-year chart of Tata Elxsi, a well-known company that has had its fair share of ups and downs. What stands out in this chart is that for the first decade, from the late 1999 to 2014, the stock did not make any significant progress.

It wasn’t until 2013 that a major rally occurred, followed by another rally in 2020.

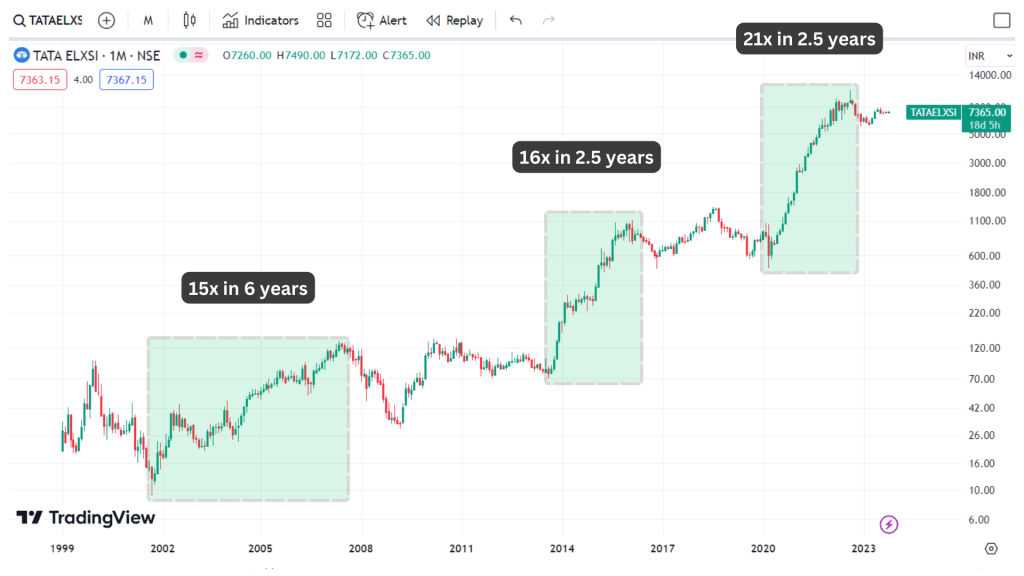

Ideally, TATA ELXSI saw three major uptrends. The first uptrend was between Sep 2001 to May 2007 clocking a remarkable 15x growth in a period of 6 years. The second leg of upward trend was seen between Aug 2013 to Dec 2015 clocking 16x under 2.5 years. The latest surge was witnessed between Mar 2020 till Aug 2022 putting up a mammoth 21x again under 2.5 years.

During these rallies, investors who made timely decisions and capitalised on the upward movement of the stock could have potentially eliminated years of waiting and frustration. By taking profits during these periods, they could have reinvested their capital elsewhere, leading to better overall returns.

The concept of opportunity cost plays a significant role in stock investing. By holding onto a stock with stagnant growth, you essentially tie up your capital, missing out on other potential investment opportunities. If, instead, you had utilised your capital during those slow years by investing in general index returns, you would have likely achieved better returns over the long term. But this is not exactly what we are trying to convey in this article. How could one have potentially predicted when a stock is about to enter into a rangebound phase or potentially a downward trend. This can only be solved with a systematic approach like we do at WeekendInvesting.

It is essential to latch onto moving stocks that show potential for gains. However, this approach requires a well-defined strategy. The fear and uncertainty associated with any stock can hinder decision-making, leading to missed opportunities or regrets.

Let’s consider a recent example. Suppose a stock has experienced a tremendous rally, going from Rs 500 to Rs 10,700 in just a few years. As an investor, you may feel that you missed the opportunity to buy in at lower prices. If you enter the stock at Rs 5,000 or Rs 6,000, you may still experience minor gains. However, your mind may anchor to the highest price of Rs 10,700, causing hesitation when it comes to selling at a lower price, such as Rs 7,300 or even Rs 5,600.

Having a plan is KEY !

These emotions and regrets can cloud judgement and hinder decision-making. To avoid such situations, it is crucial to have a clear-cut plan in place for your investments. This plan should encompass factors such as the amount to buy, the timing of buying, and most importantly, the exit strategy.

Having a predetermined exit plan allows you to eliminate emotional decision-making and make objective choices based on your strategy. It ensures that you are proactive and not at the mercy of the market’s whims. Keeping in mind that not all stocks experience significant movements, it is essential to develop an investment approach that considers the ever-changing dynamics of the market.

It is also essential to diversify your portfolio. Relying solely on one stock or a few stocks can expose you to unnecessary risks. Diversification spreads your investments across different sectors, reducing the impact of potential losses from a single stock or sector.It is worth noting that successful companies today may not necessarily hold onto their market domination forever. Competitors are constantly vying to grab market share, and there are no guarantees that a company’s unique selling proposition (USP) will endure indefinitely.

If you have any questions, please write to support@weekendinvesting.com

One thought on “Opportunity Cost and Regret : Case study on Tata Elxsi”