Surging Equity Options Trading: A Cause for Concern?

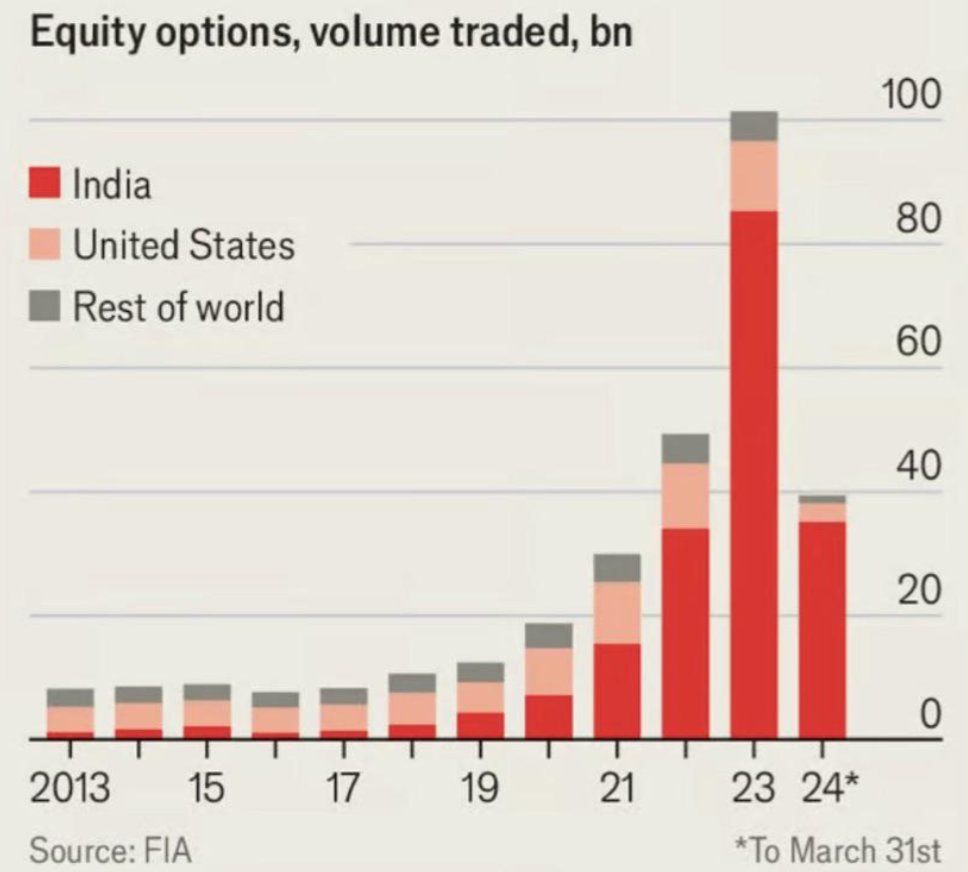

In recent times, there’s been a surge in equity options trading, as highlighted by data from FIA. The volume of options traded in India has seen a remarkable uptick, surpassing that of the US and the rest of the world. This trend is particularly noteworthy because it reflects a continuously increasing pattern over the years.

India’s Exponential Growth

From 2013 to 2024, India’s equity options volume has witnessed exponential growth, reaching an unprecedented level. While the absolute volume of options traded in the US has remained relatively stagnant, India’s market has experienced significant expansion. This growth trajectory suggests a burgeoning interest in options trading among Indian investors.

Positive and Negative Takeaways

The surge in options trading can be interpreted in both positive and negative lights. On one hand, it indicates a growing participation in the market, showcasing increased financial literacy and engagement. However, there’s also a concern that this surge may be driven by speculative fervor rather than informed investment decisions.

A Speculative Frenzy

Options trading, with its potential for high returns and relatively low capital requirements, has become a popular avenue for speculation. With various trading vehicles and instruments available, it’s akin to a replacement for other forms of gambling, such as sports betting and casinos. However, the speculative nature of options trading can lead to significant losses, as highlighted by SEBI’s report stating that 89% of participants lose money.

Sustainability and Regulation

The sustainability of this trend is questionable, given the high percentage of participants losing money. There’s a possibility that regulatory measures may be introduced to curb excessive speculation and protect retail investors. While liquidity is vital for market functioning, promoting speculative trading without adequate safeguards can have detrimental effects on the majority of participants.

Finding Balance

While options trading offers opportunities for learning and engagement with the market, there’s a need for balance. Educators play a crucial role in imparting financial literacy and promoting responsible investing practices. Ultimately, achieving a balance between market participation, speculation, and investor protection is essential for the long-term health of the financial ecosystem.

Disclaimers and disclosures : https://tinyurl.com/2763eyaz

If you have any questions, please write to support@weekendinvesting.com