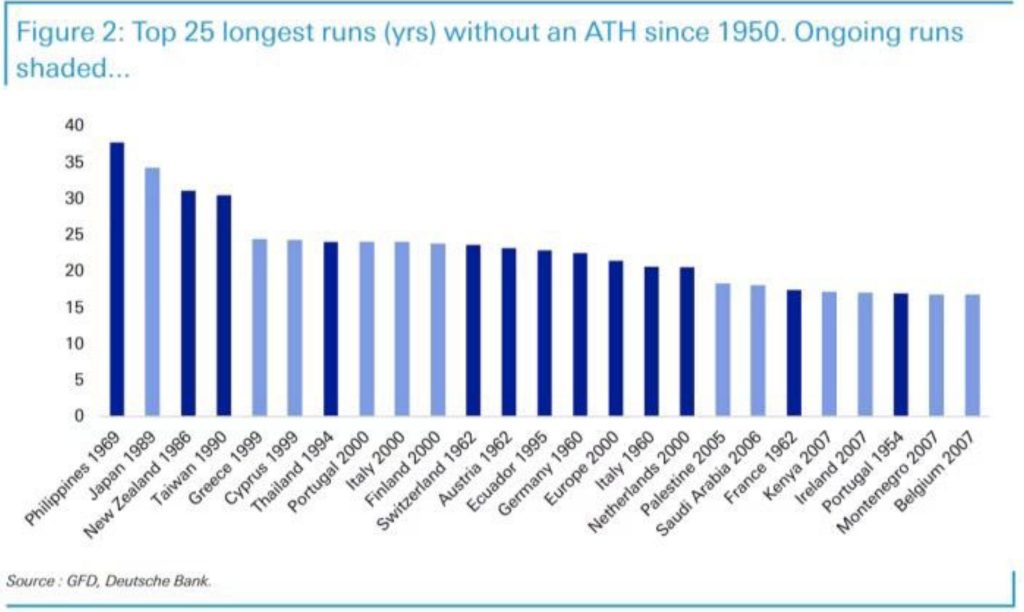

Exploring the historical trends of various indices over the past 70 to 80 years reveals fascinating insights into market dynamics and the duration between all-time highs (ATH). While investors in India may be accustomed to frequent ATHs, this is not the case for all markets globally.

Extended Waiting Periods for ATHs

In several countries like the Philippines, New Zealand, Taiwan, and Thailand, there have been prolonged periods, spanning decades, where the market failed to reach new ATHs. For instance, Portugal experienced a staggering 20-year gap between ATHs in 1954. Similarly, Japan endured a lengthy bear run from 1989, lasting over 30 to 35 years before witnessing a resurgence.

Lessons for Indian Investors

While India has been experiencing consistent ATHs in recent decades, it’s essential to recognize the possibility of such extended bear runs in the future. The rapid growth witnessed in certain asset classes, like real estate between 2005 and 2010, highlights how markets can experience exponential surges followed by prolonged periods of stagnation.

The Importance of Adaptive Strategies

In the event of a market downturn or extended period without ATHs, traditional index investing strategies may prove ineffective. Investors need to adopt dynamic approaches that account for market fluctuations and identify opportunities within the index. Simply relying on passive index investing may not suffice during such challenging market conditions.

Preparing for Market Volatility

Having exit plans and rotational strategies in place becomes crucial during times of market uncertainty. Rather than solely focusing on the overall index performance, investors should delve deeper into individual stock strengths and weaknesses to navigate through volatile market phases effectively.

WeekendInvesting Strategy Spotlight

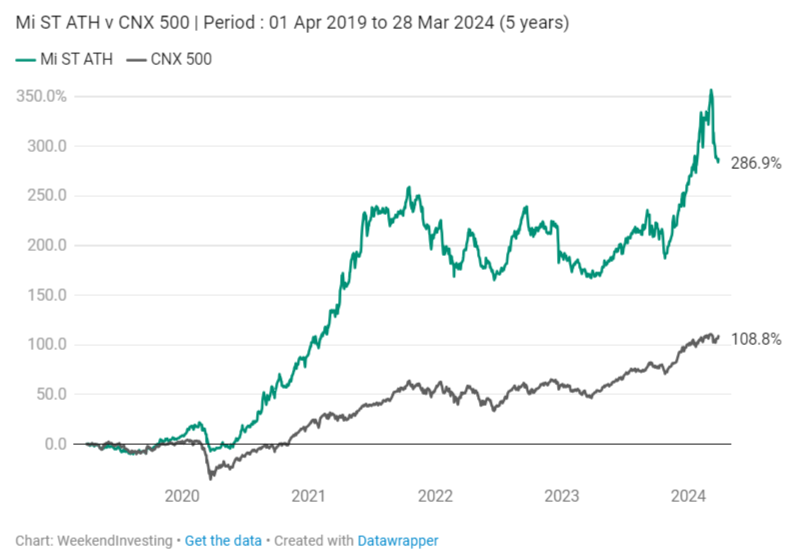

Mi ST ATH has completed 5 glorious years in the markets. The strategy, since it’s launch on 01 Apr 2019, has recorded a solid performance clocking 286% compared to 108% on the CNX 500 (the strategy’s benchmark)

Mi ST ATH’s CAGR at the end of 5 years since launch stands at a very healthy 31% compared to 16% on the CNX 500 index.

We would like to thank all subscribers of the strategy for their continued support and also convey our wishes for a rewarding journey in the future too.

If you have any questions, please write to support@weekendinvesting.com