Investing in the stock market is a complex task that involves various strategies and approaches. Among these, the debate between momentum and value investing has been a topic of interest and discussion for a long time. Both momentum and value investing have their own set of proponents who argue for the superiority of their chosen strategy. In this article, we will delve into the performance of momentum and value investing over a seven-year period and analyse the results.

First, let’s understand the basic principles behind momentum and value investing. Momentum investing focuses on identifying stocks that have shown consistent upward price movements over a certain period. This strategy assumes that past performance is indicative of future success. On the other hand, value investing involves identifying undervalued stocks that are trading below their intrinsic value. Investors following this strategy believe that these undervalued stocks will eventually rise to their true worth.

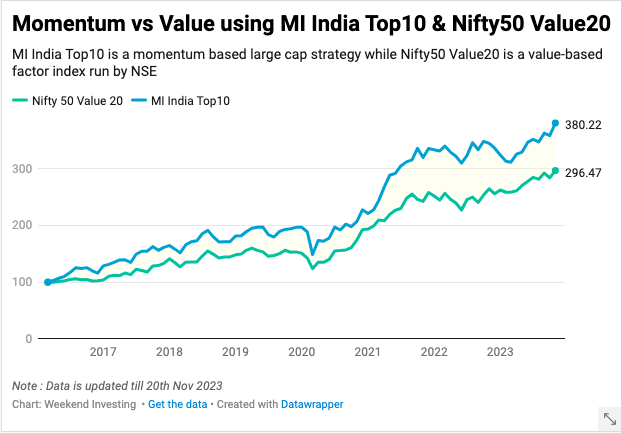

To evaluate the performance of these two investment styles, we will examine the Nifty 50 Value 20 index. This benchmark index comprises 20 stocks out of the 50 constituents of the Nifty 50 index, selected based on their valuation. The green line on the graph represents the performance of Nifty 50 Value 20, while the blue line indicates the performance of our 10 stock – Nifty 50 based – rotational momentum strategy known as Mi India Top 10, over a period of seven and a half years.

Over this period, the Nifty 50 Value 20 index registered a gain of approximately 200%, starting from 100 and reaching nearly 300. However, the Mi India Top 10 momentum strategy outperformed with a return of 280%, starting from 100 and reaching 380. This clearly illustrates the superiority of the momentum strategy over the value strategy in terms of returns.

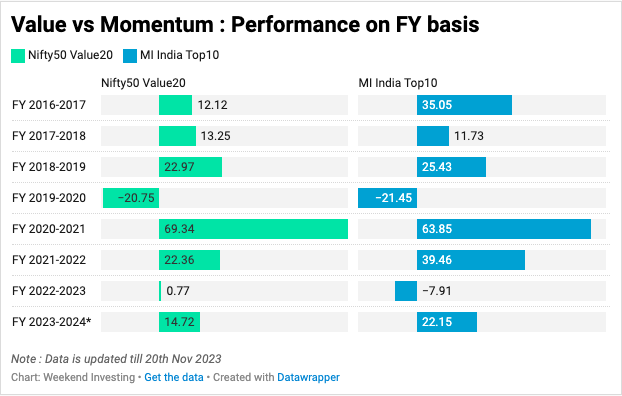

To gain further insights, let’s take a closer look at the year-on-year performance of both strategies.

In the financial year 2016-2017, Nifty 50 Value 20 gained 12%, while Mi India Top 10 achieved a higher return of 35%. In 2017-2018, the value strategy gained 13%, slightly outperforming the momentum strategy, which gained 11.7%. In the following year, 2018-2019, the value strategy achieved a return of 22.9%, while the momentum strategy attained a higher return of 25%. In 2019-2020, both strategies experienced a similar decline of approximately 21%. However, in 2020-2021, the value strategy regained momentum and gained 69%, surpassing the momentum strategy’s return of 64%. In 2021-2022, the value strategy gained 22%, while the momentum strategy exhibited a significant jump and gained 39%. In the current fiscal year, up until November 20th, 2023, the value strategy returned 14.7%, whereas the momentum strategy outperformed with a return of 22%.

Analyzing these year-on-year results, we observe that both strategies have shown similar performance in some years, with value marginally outperforming momentum in a few instances. However, in other years, momentum has exhibited significant outperformance compared to value. When we aggregate the returns of both strategies over the seven-year period, the momentum strategy outshines the value strategy by a substantial margin of approximately 30 percentage points.

The results of this study highlight the significant benefits of incorporating momentum investing into one’s portfolio. While some may argue in favour of value investing based on financial balance sheet analysis, the numbers speak for themselves. The momentum strategy has consistently yielded higher returns and proven its superiority over the value strategy over the long term.

Therefore, it is advisable to consider momentum investing as the core strategy for one’s portfolio. However, for those with a desire to explore value opportunities, including a small portion of value investments alongside the momentum portfolio may be a reasonable choice. Nonetheless, the data emphasizes the stark difference in performance between the two styles, reinforcing the argument in favor of momentum investing.

If you have any questions, please write to support@weekendinvesting.com