Q2 FY24 has continued the momentum from the first quarter but at a slower pace. The index rallied in two out of three months of this quarter and briefly stayed above 20000 mark to make an All Time High at 20222, nearly a 1000 points higher than the highest point of last quarter.

The global headwinds in the form of the troika, USD strengthening, US yields going up and FII sales have continued to remain strong rather worsening in this quarter. There continues to remain a spectre global recession, IT slowing down in CY24 and lack of overseas fund flow. However, India has incredibly sustained all these narratives and become a part of the very few countries that have seen an All Time High in 2023. An all-time high occurrence is an important parameter in the journey of a stock or an Index as the probability of continuation becomes very high for the ensuing period.

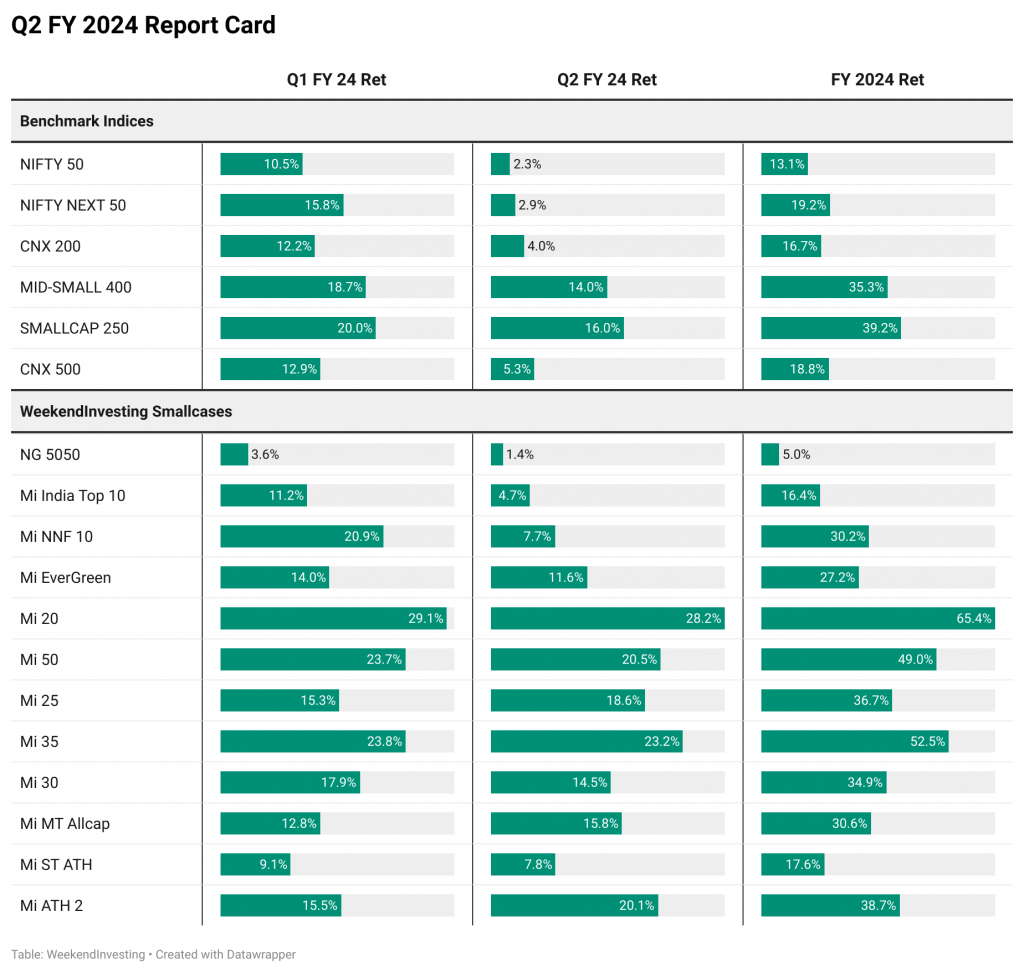

Nifty gained over 2.3% this quarter but the real action continued to be concentrated in the larger markets. Smallcap 250 and Midcap400 index gained 16% and 14.0% respectively.

For Q2FY24 within Weekendinvesting strategies notably, Mi20 was up 28.2%, Mi35 up 23.2%, Mi50 at 20.5% and Mi ATH 2 at 20.1%. All other strategies performed in line or beat the respective benchmarks.

Our belief in the concept of BBC (Bhav Bhagwan Che), a Gujarati saying which means that “Price is God” helps us follow the markets in a non-discretionary manner and we allow the markets to do the talking. This has been our sole mantra in the last 7+ years that we have been offering these services. Our non-discretionary approach at times can lag the markets when markets make trend changes but over time, we have seen this perform much better than many other styles of investing. The historical CAGR returns experienced by clients and the resulting thousands of testimonials are proof to this claim.

The forecast for next few quarters as it stands today is that of some consolidation in broader market and India will do well in maintaining its pole position amongst global markets given that all projections point to it emerging as the worlds’ fastest growing market.

At Weekendinvesting, we will continue to walk our established chosen path of following our strategies to the Tee. All our strategies have a self-healing and self-correcting approach and will come around strongly after any drawdown period that we may face. The whole setup is like a high probability winning machine provided you give the strategies adequate time to heal.

This last quarter we have taken many new initiatives at Weekendinvesting.

- We had the first Weekendinvesting Hangout meet in Delhi with was well received. We intend to meet in a new city every quarter.

- We started the WI App that more than 5000 people are using already for its super content and an educational US strategy available there. The online chat system on the app has reduced the already quick response time for all weekendinvestors and the clincher has been the online appointment system where you can have a one on one zoom call with our team to discuss anything.

- We have started a daily newsletter that goes out to a large audience as well. In this quarter we intend to focus more on further smoothening any processes that currently have any friction, refresh our product portfolio, and plan to upgraded our content delivery through YouTube and other channels to meet our target to educate youngsters on importance of saving, investing and having a planned approach.

We strongly believe in the long-term India story and we believe that momentum strategies will continue to do very well in this India scenario of too much capital chasing too less paper in the ensure that we are riding the winners when it is favorable to us and defending our position when it isn’t.

All the best.

Download the WeekendInvesting App

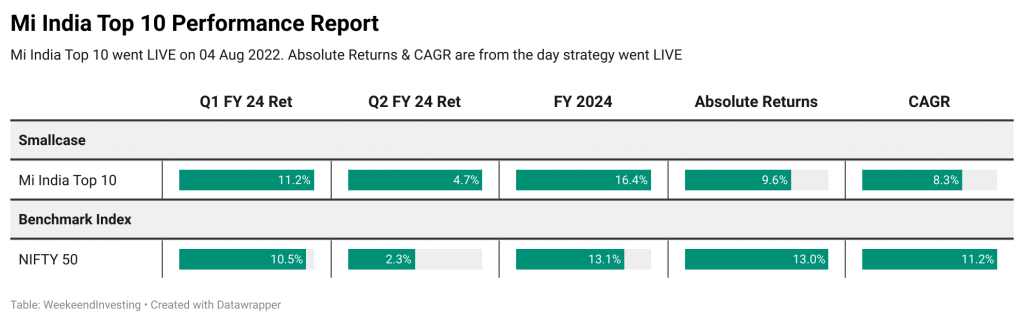

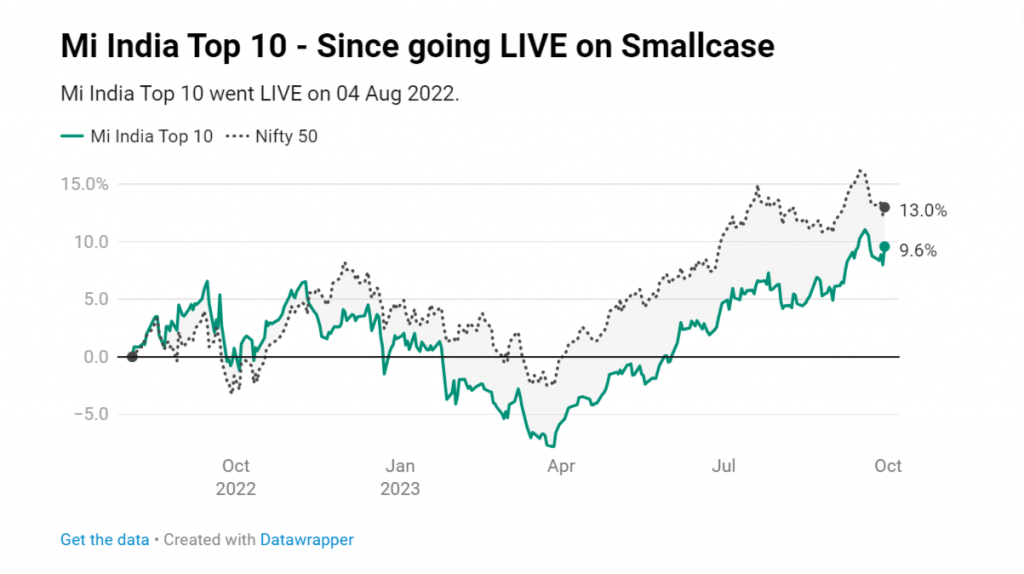

Mi India Top 10 Performance

Mi India Top 10 is a Low Churn – Monthly Rebalanced – Rotational Momentum strategy that invests in Top 10 trending stocks from the robust Nifty 50 Universe. Nifty 50 is India’s premier benchmark index for stocks that are ranked as Market Cap of 01st to 50th on the NSE and is rebalanced twice a year. This strategy does not go to cash like other strategies in a downturn but attempts to extract some more beta from this group by staying with the strength within this group. The strategy allocates 10% weight at the beginning of each month to its ten constituents and rebalances it each month. The strategy is available in the smallcase format.

- Mi India Top 10 had quite a good outing in Q2 FY 24 compared to Nifty 50 having returned 4.7% gains against 2.3% recorded by it’s benchmark. Overall, the strategy has outperformed the benchmark across both the quarters this FY 24 thus recording overall gains of 16.4% compared to 13.1% on the Nifty 50 in FY 24.

- Since its launch back in Aug 2022, Mi India Top 10 has been able to do well in terms of recovering from the early slump but has overall underperformed the Nifty 50 by 3%. In the 13 months since launch, Mi India Top 10 has recorded a CAGR of 8.3% as compared to 11.2% on Nifty 50

Mi India Top 10 Intro Video | Mi India Top 10 Blog Post | Mi India Top 10 Consolidated Document

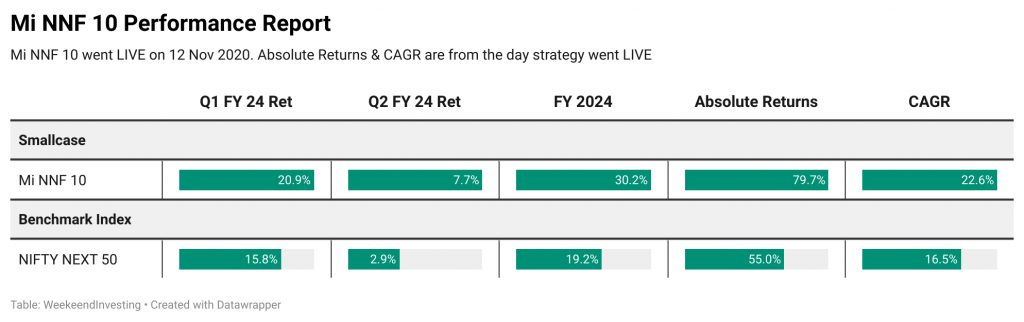

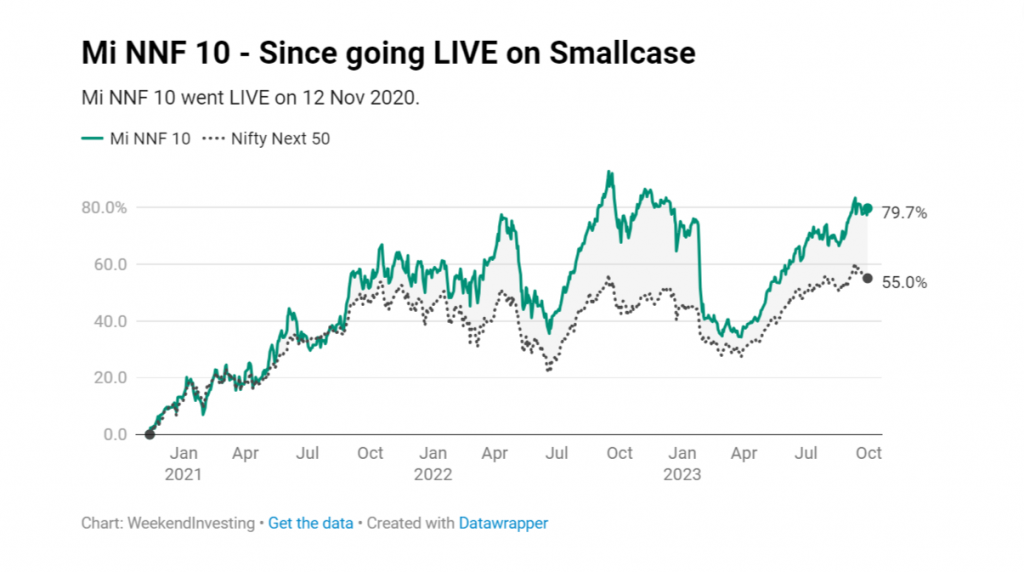

Mi NNF 10 Performance

Mi NNF10 is a rotational momentum strategy based on the Nifty Next 50 large cap index. It is a great substitute for capital that seeks investing in the indices. Nifty Next 50 is an index for stocks that are ranked as Market Cap of 51st to 100th on the NSE and is rebalanced twice a year. These large cap stocks have a higher volatility than the Nifty stocks. This strategy does not go to cash like other strategies in a downturn but this strategy is able to extract some more beta from this group by staying with the strength within this group. The strategy allocates 10% weight at the beginning of each month to its ten constituents and rebalances it each month. The strategy is available in the smallcase format.

- After going through a difficult period back in Jan 2023, the strategy has done exceptionally well to stage a remarkable comeback by outperforming its benchmark, the Nifty Next 50 in both Q1 (21% on Mi NNF 10 compared to 15.8% on Nifty Next 50) & Q2 FY 24 (7.7% on Mi NNF 10 compared to 2.9% on Nifty Next 50).

- Mi NNF 10 was launched back in Nov 2022 and has recorded a fantastic absolute returns of 79.7% compared to 55% on the Nifty Next 50 Index demonstrating a significant outperformance.

- The strategy has recorded a very strong CAGR of 22.6% compared to 16.5% on it’s benchmark (since launch)

Mi NNF 10 Intro Video | Mi NNF 10 Blog | Mi NNF 10 consolidated Document

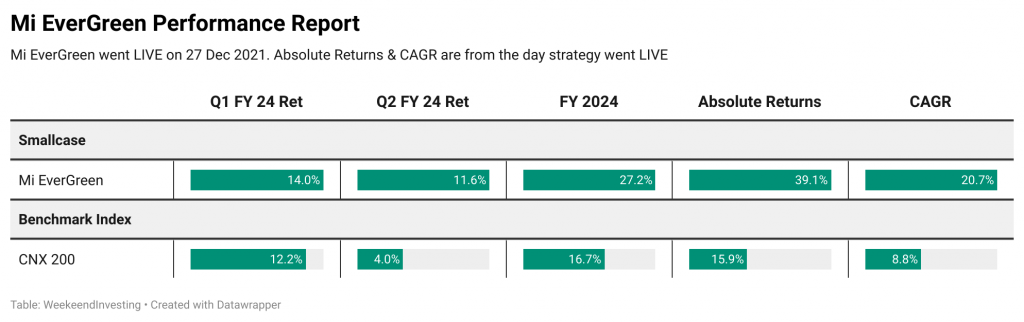

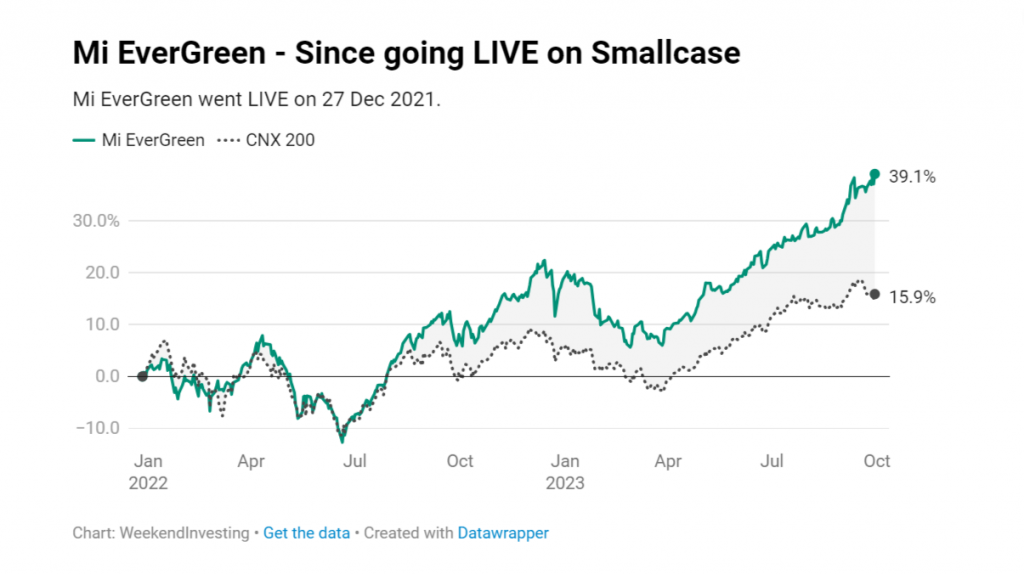

Mi EverGreen Performance

Mi Evergreen is a dynamic strategy which aims to outperform the underlying benchmark CNX200. This index comprises 200 large and mid-cap names which are the top-quality stocks in the markets. This product is suitable for use in all stages of the market cycles as it is designed to invest in the strongest stocks in the pack at any point. Additionally, there is a permanent hedge of Gold available here.

- The Gold hedged Mi EverGreen has continued to impress everyone with its continued incredible performance. Q2 FY 24 saw the strategy recording a phenomenal outperformance clocking 11.6% against 4% on it’s benchmark, the CNX 200 index. Overall, the strategy has clocked 27% against 16% on the CNX 200.

- Mi EverGreen , since launch on 27 Dec 2021 has clocked an absolute returns of 39.1% compared to 15.9% on the CNX 200 index.

- The CAGR of this strategy stands at a healthy 20% as against 8.8% clocked by the CNX 200 index.

Mi EverGreen Intro Video | Mi EverGreen Blog Post | Mi EverGreen Consolidated Document

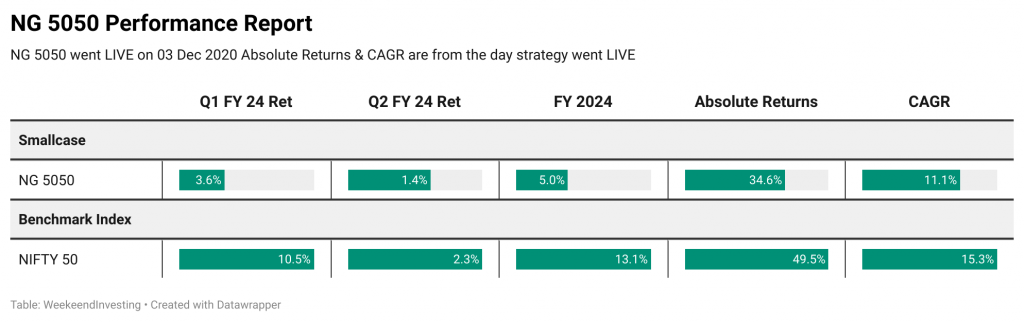

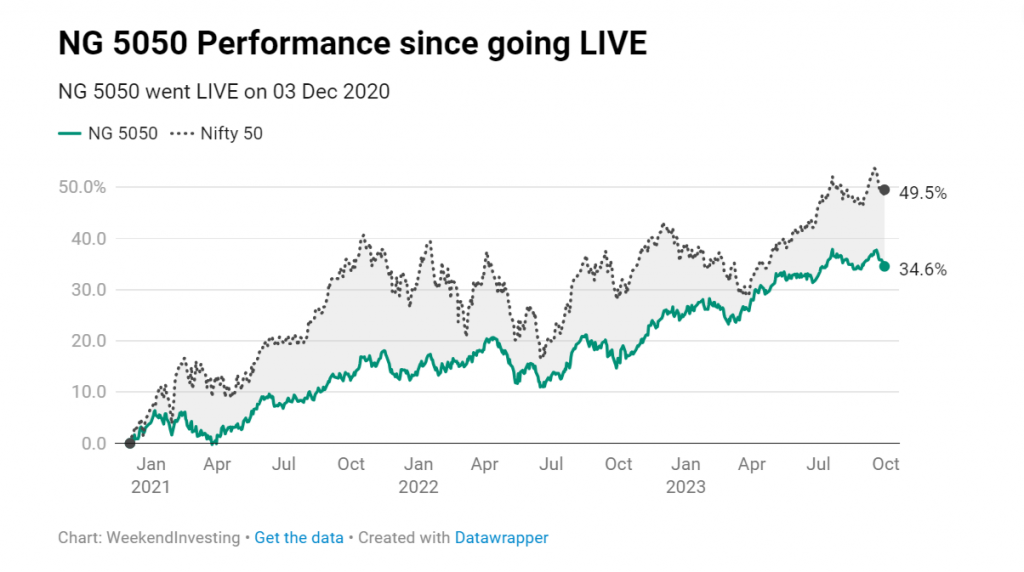

NG 5050 Performance

This portfolio invests in Nifty and Gold ETF in equal proportion and balances the weights every month. It is designed as a FREE alternative to market instruments that despite having higher risk are unable to deliver appropriate returns.

The strategy highlights the high inverse correlation between Nifty and Gold and how combining the two can result in a very low volatility outcome with superior returns than most low risk strategies. The strategy allocates equally to the two asset classes and rebalances it at the end of each month. The strategy is available only in the smallcase format.

- NG 5050 had a below average outing in both Q1 & Q2 FY 24. This strategy has proven to remain quite stable at all market scenarios owing to the 50% exposure to GOLD at all times.

- The highlight of this free strategy remains it’s brilliant CAGR at 11.9% at a much lower drawdown compared to Nifty 50. These credentials make this strategy a brilliant option if you are looking for a low turbulent option to provide stability to your equity portfolio.

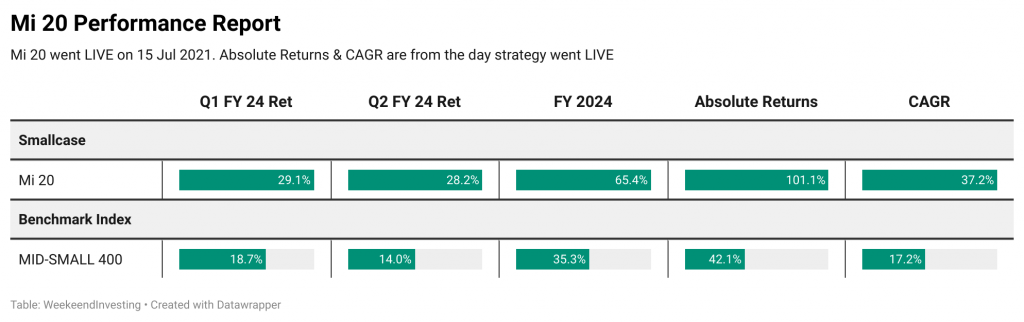

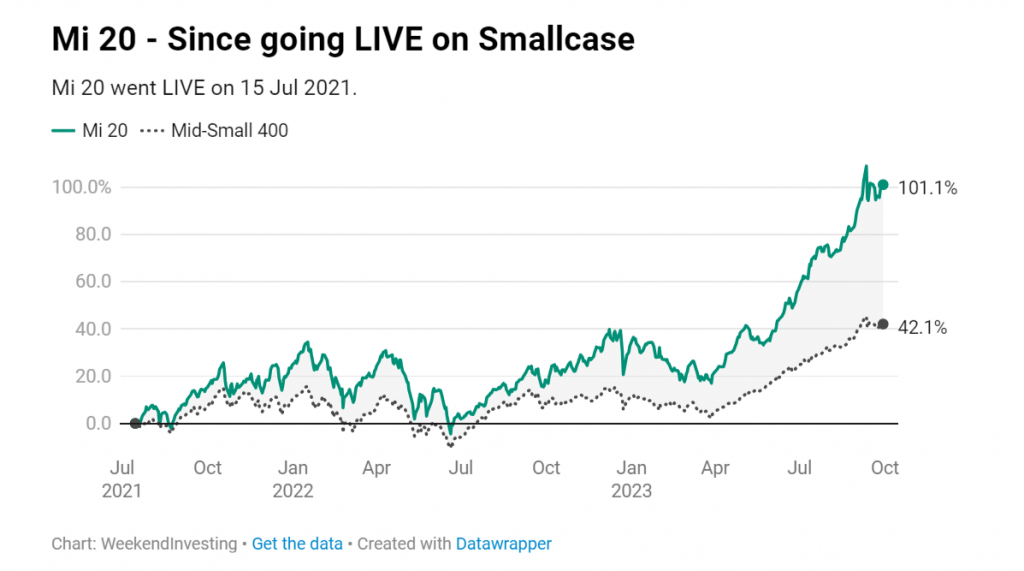

Mi 20 Performance

Mi 20 is a portfolio of up to 20 stocks that aims to create sizeable alpha with trending stocks from the Mid-Small Cap 400 Index using the principles of Rotational Momentum. The strategy is rebalanced weekly and allocates 5% to each new entrant. The strategy is only available in the smallcase format.

- Mi 20 continues on the glorious run topping our charts in the current FY 24. Q2 has also been extremely impressive with returns of 28.2% compared to 14% on the mid-small 400 index. Overall Mi 20 has clocked a superb 65% against 35% on its benchmark.

- Absolute Returns : Since it’s launch in July 2021 (2 years & 3 months), the strategy has achieved a phenomenal 2x (101%) compared to 42% on its benchmark.

- The strategy’s CAGR stands at a phenomenal 37% as against 17% on it’s benchmark.

Mi 20 Intro Video | Mi 20 Blog Post | Mi 20 Consolidated Document

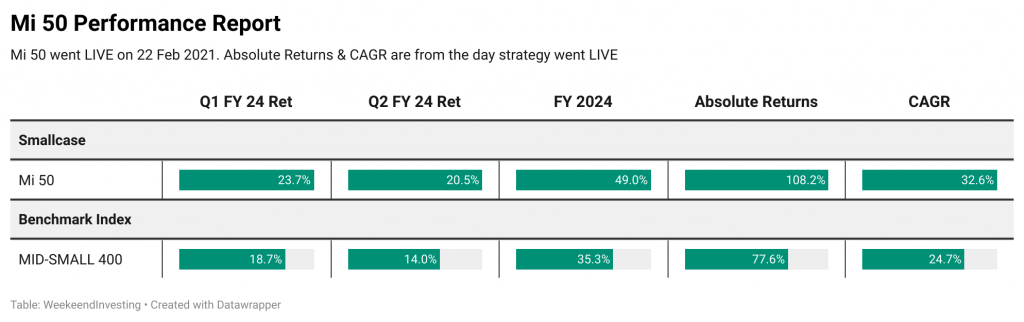

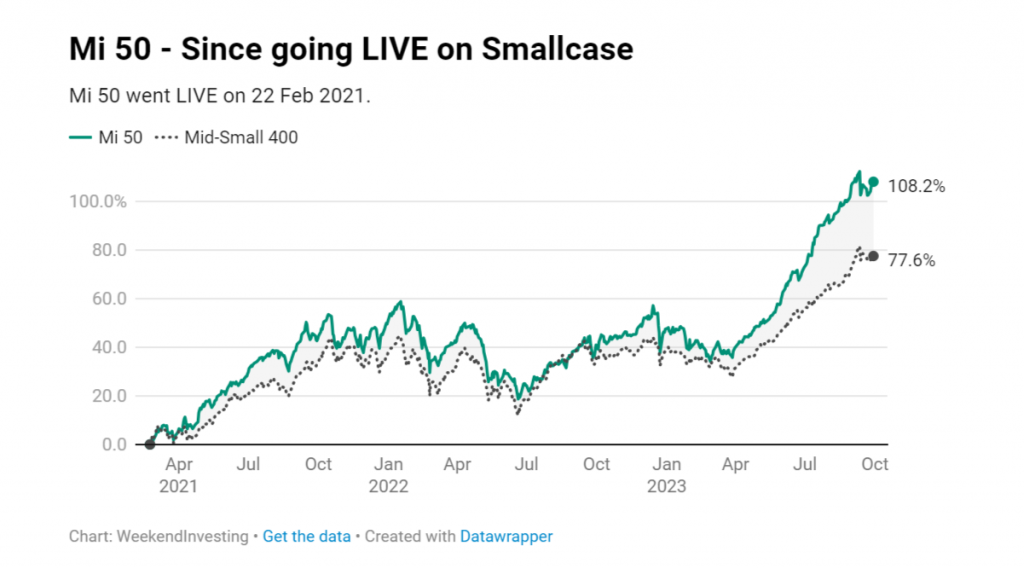

Mi 50 Performance

The Mi 50 is an up-to 50 stock weekly rebalanced portfolio that follows momentum trends among small cap and mid cap stocks only. These stocks are filtered for average min volume and market capitalization above 1000 crores only. The stocks that are picked are allocated an exposure of 2% per stock in the portfolio. This is one of our very popular portfolios and it has consistently outperformed the benchmark index by a wide margin despite the large diversification. This strategy is balanced weekly and is available in both the Universal and the smallcase format.

- Mi 50 is one of our oldest running – vastly diversified strategies & has continued to do really well on a consistent basis. The strategy has recorded 20% against 14% on the mid-small 400 index. Overall, the strategy has recorded a solid 49% this FY 24 against 35.3% on the mid-small 400 index.

- Absolute Returns : Mi 50 has put on a superb show since going LIVE on the Smallcase platform clocking 108% compared to 77% on the mid-small 400 index.

- CAGR of Mi 50 since going live on Smallcase is exceptional at 32.6% compared to 24.7% on the mid-small 400 index.

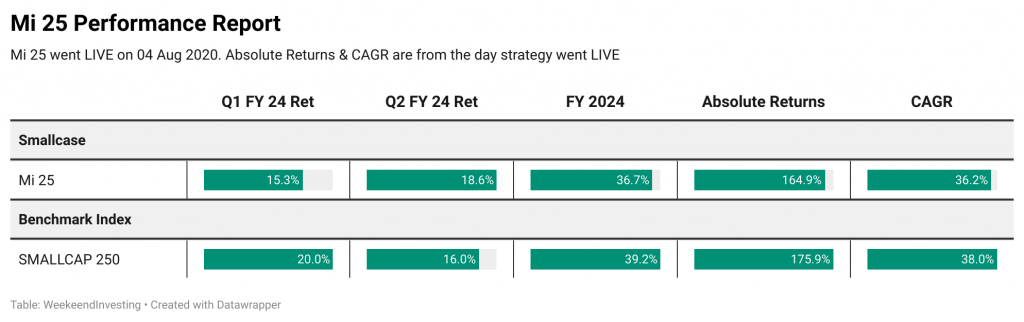

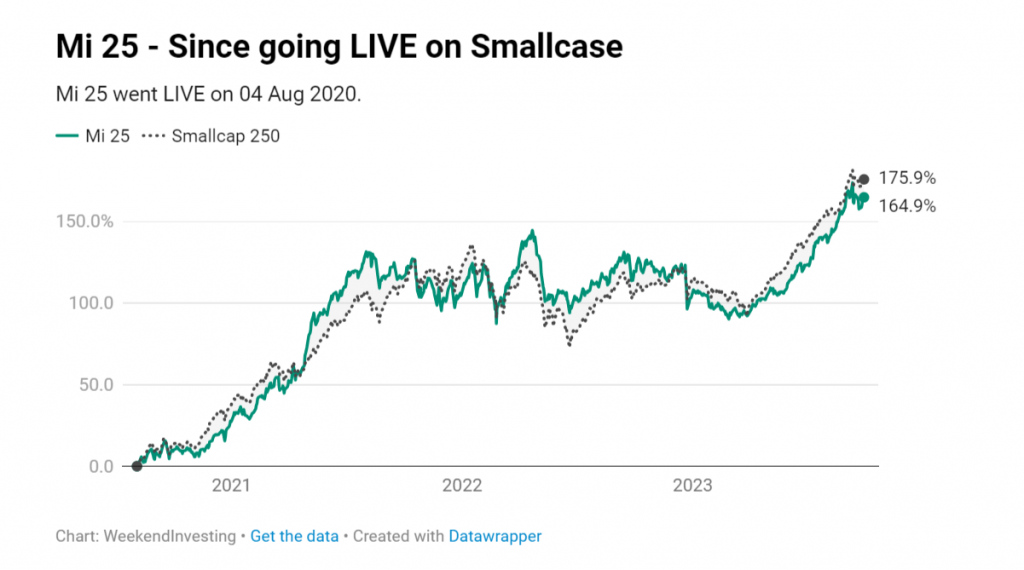

Mi 25 Performance

Mi 25 is an up-to 25 stock weekly rebalanced portfolio that follows momentum trends among small cap stocks only. These stocks are filtered for average min volume and market capitalization above 1000 crores only. The stocks that are picked are allocated an exposure of 4% per stock in the portfolio. This is one of our very popular portfolios and it has consistently outperformed the smallcap index by a wide margin. This strategy is balanced weekly and is available only in the smallcase format.

- After lagging the benchmark in Q1, Mi 25 has done reasonably well in Q2 FY 24 to clock 18.6% compared to 16% on the smallcap 250 index.

- Absolute Returns : The strategy has clocked 165% compared to 175% on the smallcap 250 index since going live on the smallcase platform on 04 Aug 2020.

- CAGR since 04 Aug 2020 stands at 36% compared to 38% on the smallcap 250 index. The strategy has slightly underperformed the benchmark but we hope that we shall observe recovery in the times to come.

Mi 25 Intro Video | Mi 25 Blog Post | Mi 25 Consolidated Document

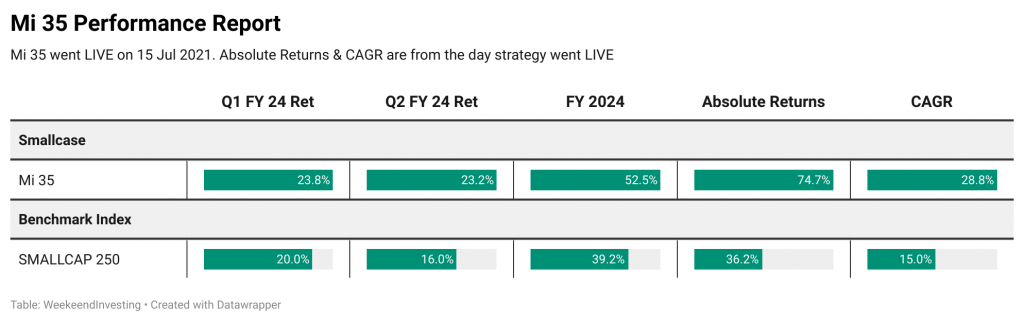

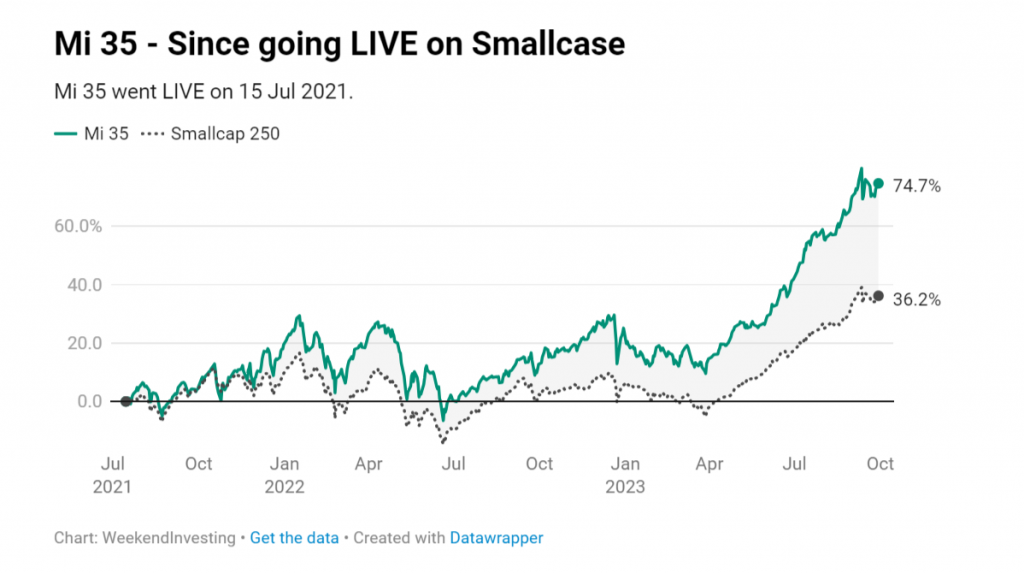

Mi 35 Performance

Mi 35 is a dynamic strategy which aims to outperform the underlying benchmark Smallcap250 index. These are the 251st -500th stocks in the market place. This product is suitable for use in all stages of the market cycles as it is designed to remain invested in the strongest 35 stocks in the pack regardless of market conditions

- Mi 35 has been a consistent performer for WeekendInvesting having shown remarkable outperformance since going live in July 2021. The strategy has done very well in Q2 FY 24 recording gains of 23% compared to 16% on the smallcap 250 index.

- Absolute Returns : The strategy has recorded an impressive 74% compared to 36% on the smallcap 250 index in a period of 2 years and 3 months.

- CAGR : The CAGR of Mi 35 has been superb at 28% compared to 15% on its benchmark.

Mi 35 Intro Video | Mi 35 Blog Post | Mi 35 Consolidated Document

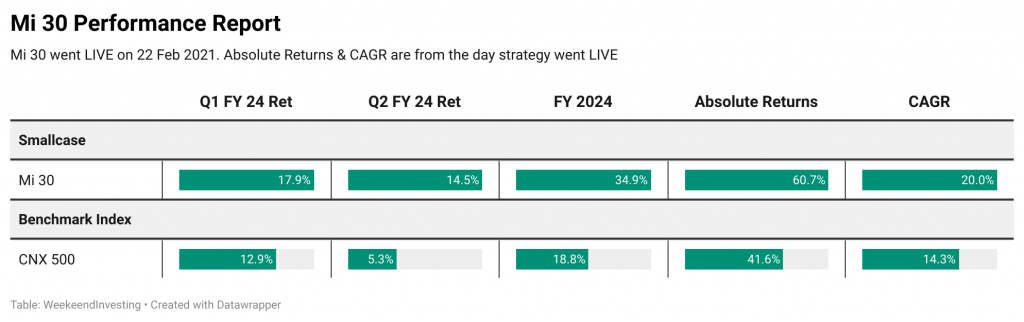

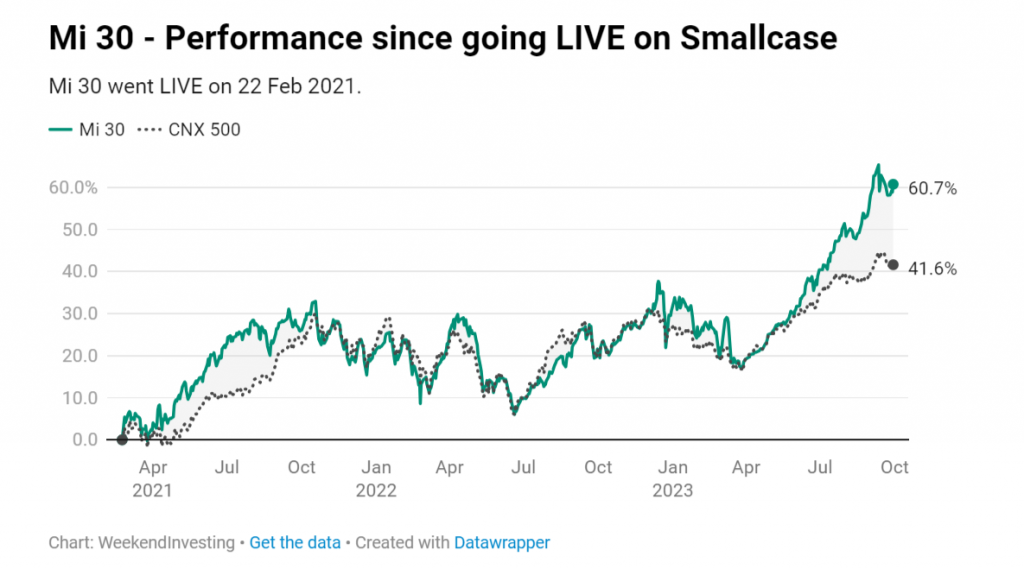

Mi 30 Performance

Mi 30 is an up-to 33 stock weekly rebalanced portfolio that follows momentum trends among constituents of the CNX500 index. The CNX500 index comprises the largest 500 stocks in the NSE universe. These stocks are filtered for average min volume and market capitalization above 1000 crores only. The stocks that are picked are allocated an exposure of 3% per stock in the portfolio. This is one of our very popular all cap portfolios and it has consistently outperformed the underlying index by a wide margin. This strategy is balanced weekly and is available in both the Universal and the smallcase format.

- Mi 30 has also been solid in both Q1 & Q2 FY 24 recording gains of 18% and 14.5% against 13% and 5% on the CNX 500 index respectively.

- Mi 30 has taken off in the last 5 months after tracking its benchmark for almost 2 years since going live on the smallcase platform. The absolute returns stands at 60% in 2 years and 7 months compared to 41% on its bncmark, the CNX 500 index.

- Mi 30 has a put up a reasonably healthy CAGR of 20% as compared to 14.3% on the CNX 500 index. The best part about this strategy is its impeccable control on drawdowns at 22% compared to 39% on its benchmark (since Apr 2016).

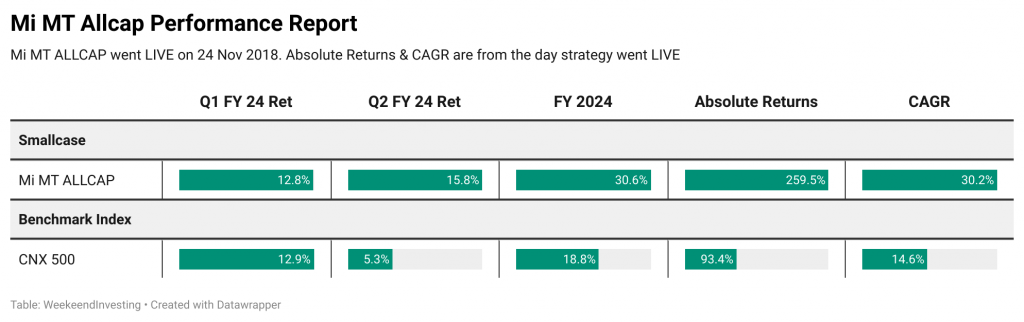

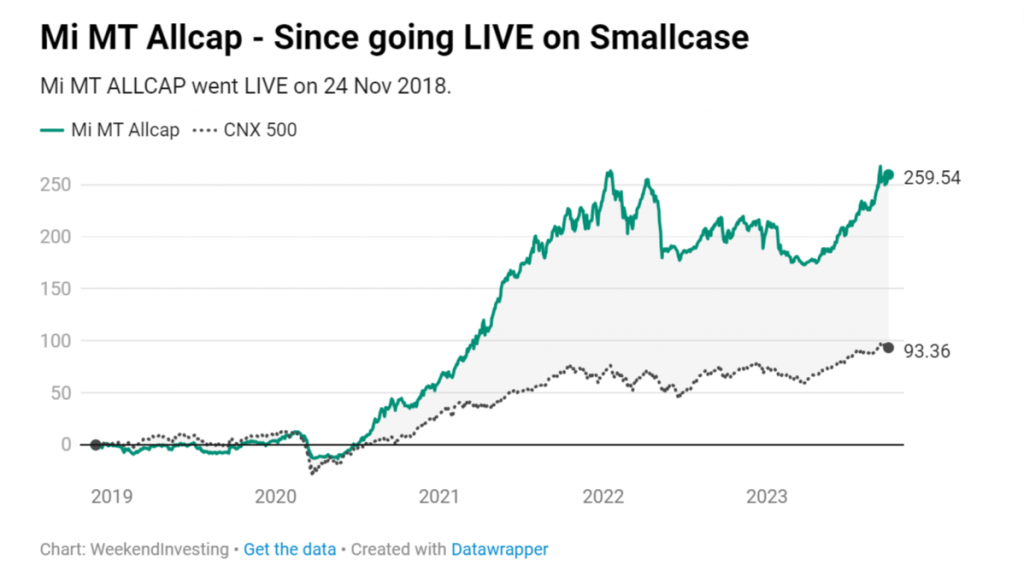

Mi MT Allcap Performance

The Mi MT Allcap is a 20 stock weekly rebalanced portfolio that follows momentum trends among all listed NSE stocks. These stocks are filtered for average min volume and market capitalization above 1000 crores only. The stocks that are picked are allocated an exposure of 5% per stock in the portfolio. This is one of our longest running portfolios and has also consistently outperformed the benchmark index by a decent margin.

- Mi MT Allcap is one of our most popular & loved strategies right since it went live back in Nov 2018. The strategy went into a bit of drawdowns in the past couple of years after seeing remarkable gains in FY 20 & FY 21 but has put up a fantastic show in the last 6 months to recover well. Mi MT Allcap has clocked 16% in Q2 FY 24 against 5.3% on the CNX 500 index

- Absolute Returns : Mi MT Allcap has returned a phenomenal 259% compared to 93% on the CNX 500 index.

- The CAGR of the strategy stands at a superb 30% compared to 15% on its benchmark

Mi MT Allcap Intro Video | Mi MT Allcap Blog Post | Mi MT Allcap Consolidated Document

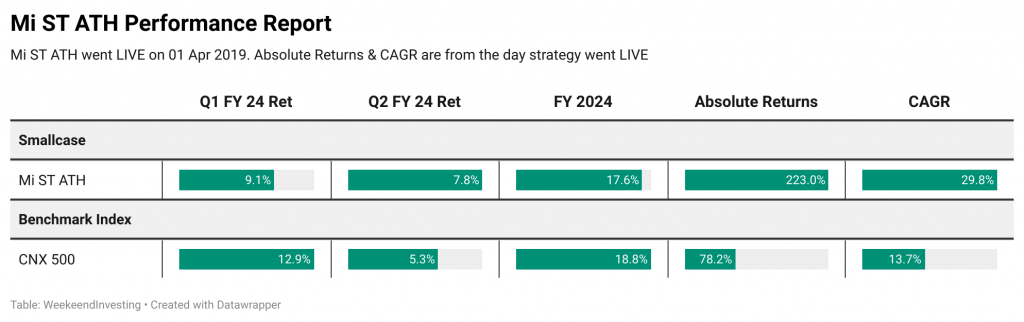

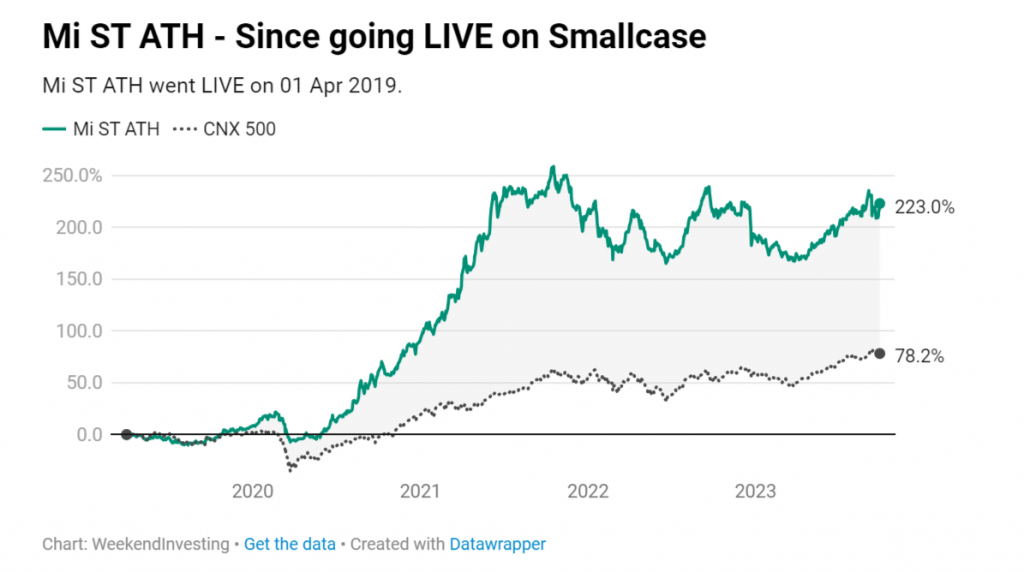

Mi ST ATH Performance

Mi ST ATH is a firebrand upto 10 stock portfolio that follows the short term momentum trends among all listed NSE stocks above market capitalization of INR 1000 cr and chases stocks hitting All Time Highs or multi year highs. The strategy is nimble footed and can have a higher churn.

- This is yet another popular strategy from the house of WeekendInvesting that has garnered love and appreciation from several investors. The strategy has been consolidating after a meteoric run post COVID till about end of 2021 but the last couple of quarters have ensured a bit of recovery.

- Q2 FY 24 saw Mi ST ATH outperforming its benchmark, the CNX 500 index clocking 7.8%.

- The absolute returns of Mi ST ATH stands at a superb 223% since 01 Apr 2019 compared to 78% on CNX 500 index. The CAGR has also been exceptional at almost 30% compared to 13.7% on CNX 500 index.

Mi ST ATH Intro Video | Mi ST ATH Blog Post | Mi ST ATH Consolidated Document

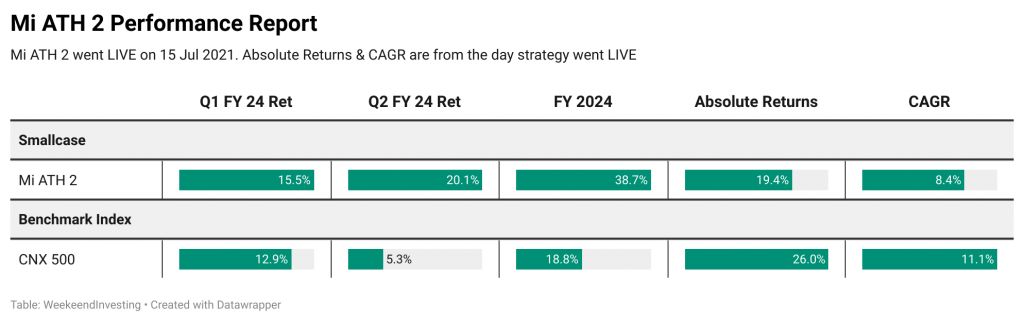

Mi ATH 2 Performance

Mi ATH 2 is a high risk , up to 10 stocks strategy that aims to create sizeable alpha by chasing stocks near their all time or multi year highs from the all listed NSE stocks above Market Cap of 500 crore. The strategy is nimble footed as it seeks to minimize losses by quickly exiting stocks that fail to trend up.

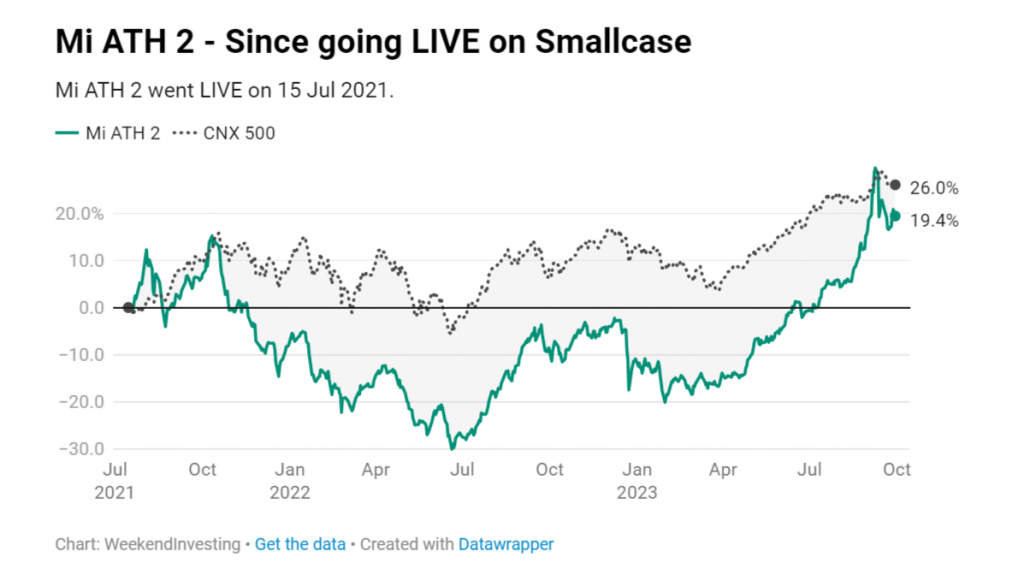

- Mi ATH 2 is also a high risk portfolio like Mi ST ATH chasing top 10 stocks from above 500 crore market cap universe. After underperforming for almost 18 months since going live back in July 2021, the strategy has staged a solid comeback in the last couple of quarters to emerge one of the best performers for us.

- Q2 FY 24 saw Mi ATH 2 cocking a fantastic 20% compared to only 5.3% on the CNX 500 index thus achieving two consecutive quarters of outperformance. The strategy has also fully recovered from its drawdowns recently.

That’s a wrap on Q2 FY 24 report.

If you have any questions , please send us an email to support@weekendinvesting.com