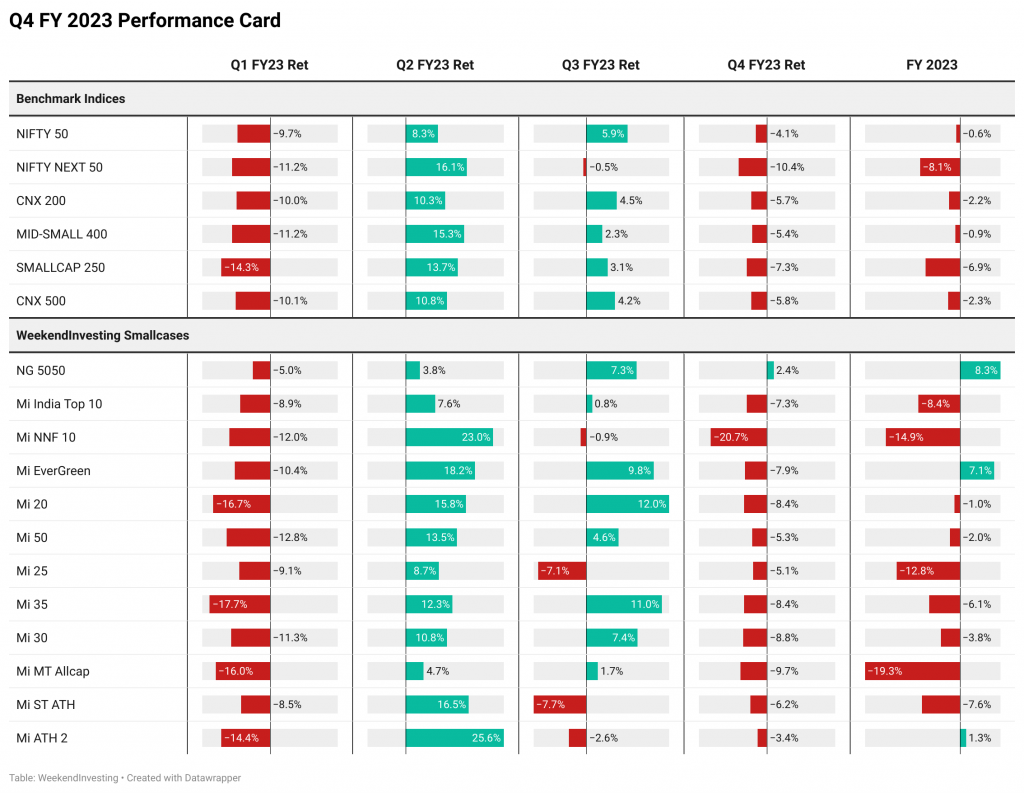

The down move that started in Dec 22 in the Q3FY23 quarter continued unabated into the entire Q4FY23 period. There was no respite with the indices making lower lows and lower highs incessantly. FIIs sales did not reduce during the quarter clocking nearly INR 50000 cr of outgo in this period. The period was also marred towards the latter half with bank failures and concerns over sticky inflation with the US FED virtually running out of higher interest rate ammunition. In some ways the FED is trapped given that there is no room to hike rates (so it seems) and no good has come around with the hikes so far.

India has been quite immune to the global fall in the FY23. Nifty Bank Nifty, CNX500 and many broad indices are very favorably placed versus global peers having fallen much less in comparison. It seems like India market is awaiting global head winds to abate and that structurally there is no major issue with the internal economics. The only party pooper can be oil, which can flare up later in 2023 given that OPEC and other interested nations are cutting supplies and a proxy war is on between the two global blocks for control of the oil market.

Nifty lost 4.1% this quarter, with mid and Smallcap index down 0.9% and the Smallcap 250 down 6.9%. Within Weekendinvesting strategies notably, the Mi Evergreen was up 7.1% given the robust performance of Golf, while most other strategies were down with the markets.

Our belief in the concept of BBC (Bhav Bhagwan Che), a Gujarati saying which means that “Price is God” helps us follow the markets in a non-discretionary manner and we allow the markets to do the talking. This has been our sole mantra in the last 7+ years that we have been offering these services. Our non-discretionary approach at times can lag the markets when markets make trend changes but over time, we have seen this perform much better than many other styles of investing. The historical CAGR returns are a testimony to this claim

Inflation worries continue to be the top concern for all markets and India in that context is the prettiest of them all. Certainly, the markets are looking very edgy the world over. India markets while outperforming have somewhat corrected from the high valuations and are looking more palatable vs other emerging markets and due to our robust growth outlook especially in comparison with others, we may continue to enjoy these premium valuations for a long time to come. We will continue to do what we have been doing without worrying too much about these forecasts as we believe our strategies over a long course of time are self-correcting and will come around strongly after any volatile year that we may face as has been the history so far. The overall demand and credit growth in the economy remains robust, the narrative of global fund managers on India for the path forwards remains positive and the domestic flows remained largely unaffected despite global headwinds of recession

This quarter we have upgraded our newly launched website at weekendinvesting.com which enables the users to deep dive into strategy analytics and also analyze bouquets of various weekendinvesting strategies. We hope all these efforts towards a better informed and better user along with all support at the click of a button will empower Weekend investors to have more confidence in momentum investing and to make the core of their investing around this theme.

We strongly believe in the long term India story and we believe that momentum strategies will ensure that we are riding the winners when the turnaround does come around.

All the best.

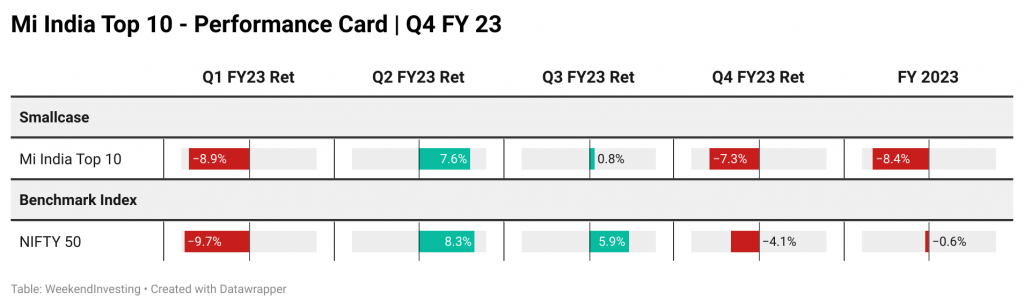

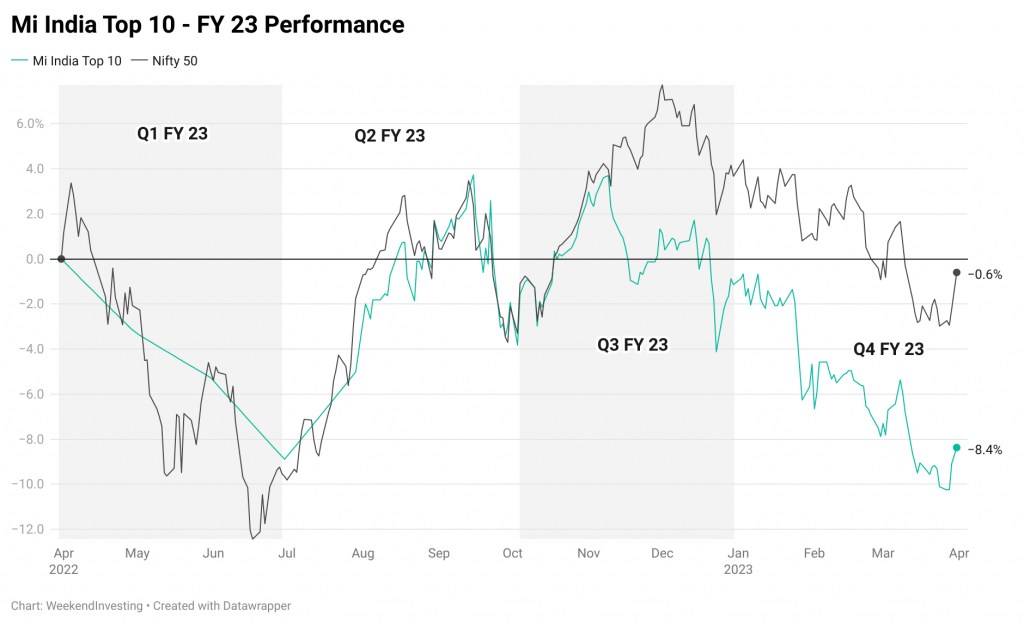

Mi India Top 10 Performance

Mi India Top 10 is a Low Churn – Monthly Rebalanced – Rotational Momentum strategy that invests in Top 10 trending stocks from the robust Nifty 50 Universe. Nifty 50 is India’s premier benchmark index for stocks that are ranked as Market Cap of 01st to 50th on the NSE and is rebalanced twice a year. This strategy does not go to cash like other strategies in a downturn but attempts to extract some more beta from this group by staying with the strength within this group. The strategy allocates 10% weight at the beginning of each month to its ten constituents and rebalances it each month. The strategy is available in the smallcase format.

While the strategy mirrored it’s benchmark till about mid Q3 FY 23, the performance after that juncture took a dip and ended up underperforming Nifty by about 8%. Q4 ended up being a bad one for Mi India Top 10.

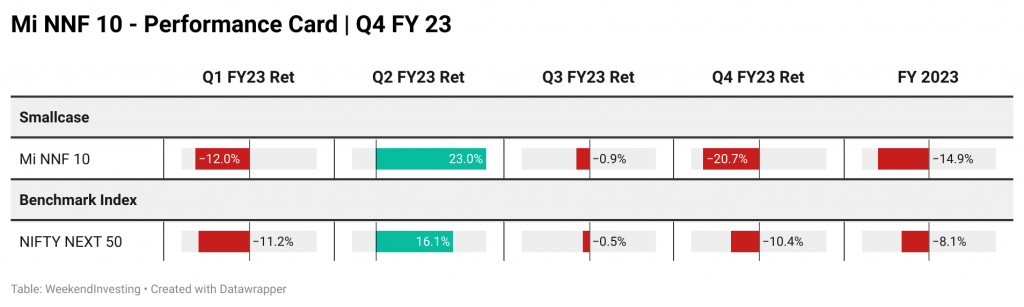

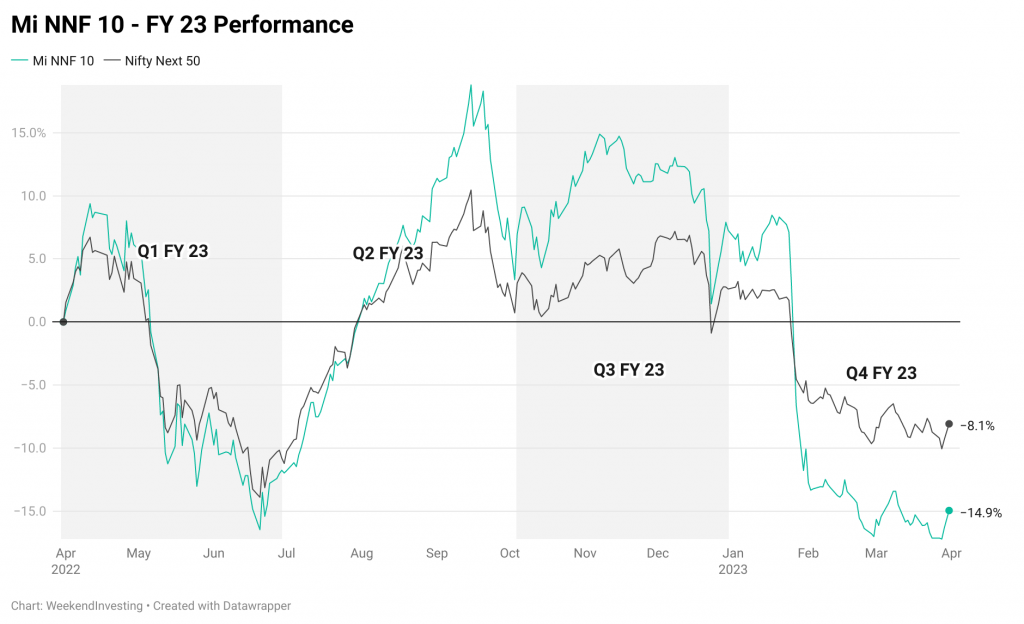

Mi NNF 10 Performance

Mi NNF10 is a rotational momentum strategy based on the Nifty Next 50 large cap index. It is a great substitute for capital that seeks investing in the indices. Nifty Next 50 is an index for stocks that are ranked as Market Cap of 51st to 100th on the NSE and is rebalanced twice a year. These large cap stocks have a higher volatility than the Nifty stocks. This strategy does not go to cash like other strategies in a downturn but this strategy is able to extract some more beta from this group by staying with the strength within this group. The strategy allocates 10% weight at the beginning of each month to its ten constituents and rebalances it each month. The strategy is available in the smallcase format.

The strategy started off quite well tracking it’s benchmark and even outperformed the Nifty Jnr till about early Jan 2023 but an unexpected correction in ADANI group saw the strategy giving up all the gains. Q2 was exceptional for the strategy clocking 22% but a big drop in Q4 FY 23 of (-20%) resulted in poor result for the entire FY. Mi NNF 10 continues to remain robust and has done exceedingly well since launch back in Nov 2020. We are optimistic about it’s prospects going forward.

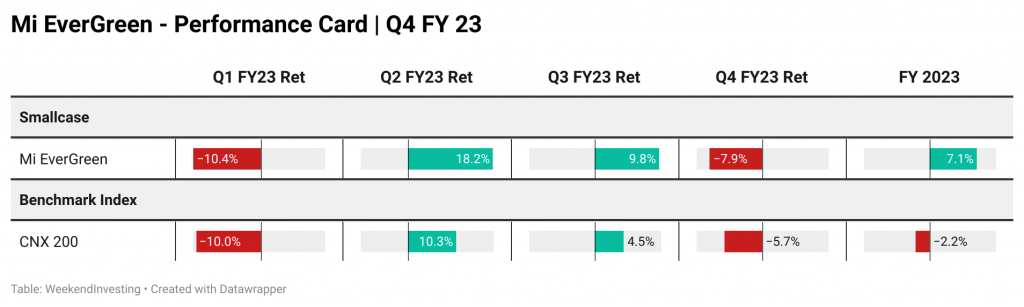

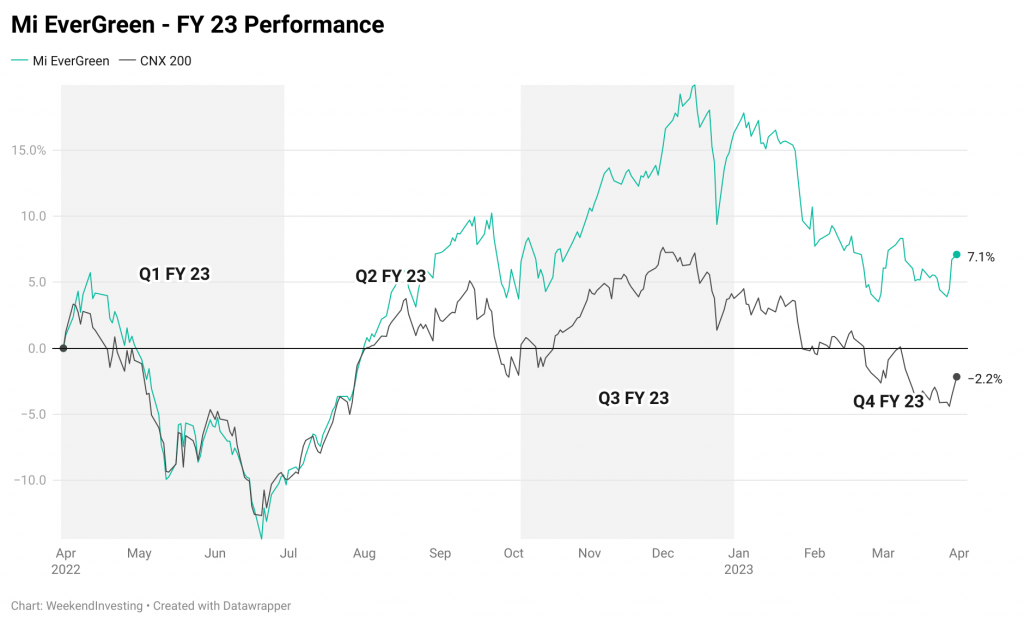

Mi EverGreen Performance

Mi Evergreen is a dynamic strategy which aims to outperform the underlying benchmark CNX200. This index comprises 200 large and mid-cap names which are the top-quality stocks in the markets. This product is suitable for use in all stages of the market cycles as it is designed to invest in the strongest stocks in the pack at any point. Additionally, there is a permanent hedge of Gold available here.

Mi EverGreen has been one of our best performing strategies this FY – thanks to its allocation to GOLD. The strategy did witness an incredible run from Jun 2022 & was almost up 20% by end of Dec but a sharp round of selling in the markets resulted in the strategy giving up some of it’s gains to end FY 23 at a very respectable 7%.

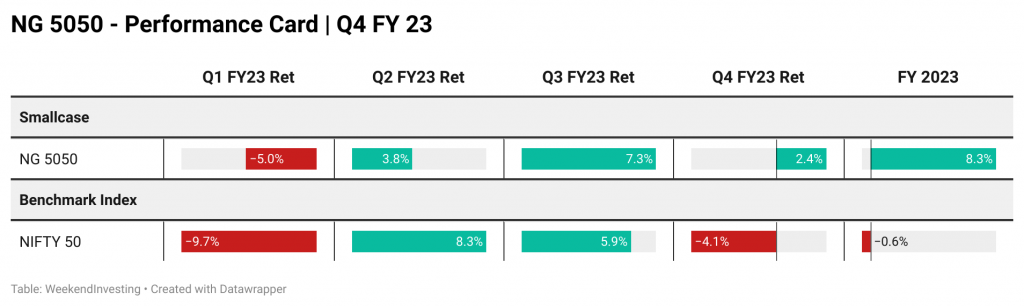

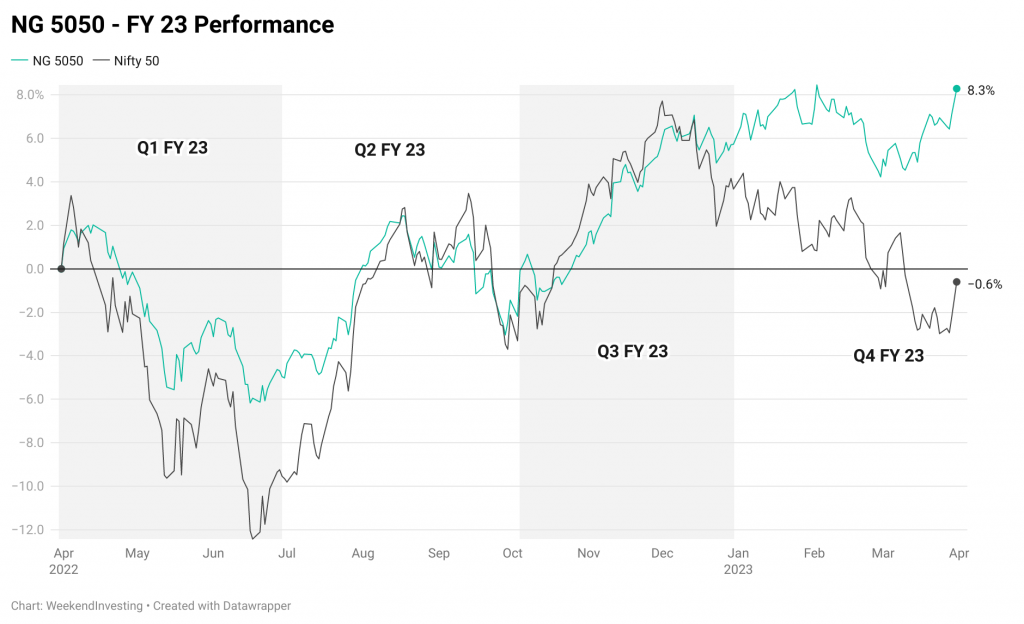

NG 5050 Performance

This portfolio invests in Nifty and Gold ETF in equal proportion and balances the weights every month. It is designed as a FREE alternative to market instruments that despite having higher risk are unable to deliver appropriate returns.

The strategy highlights the high inverse correlation between Nifty and Gold and how combining the two can result in a very low volatility outcome with superior returns than most low risk strategies. The strategy allocates equally to the two asset classes and rebalances it at the end of each month. The strategy is available only in the smallcase format.

NG 5050 is one of the most stable yet simple strategies that you shall find out there in the markets. This strategies allocates to Nifty and Gold in equal proportion and you can clearly see how stable the combination has been throughout this volatile year. Q1 FY 23 saw the strategy outperforming on the downside and Q4 was a spectacular turning point where the strategy clocked (+2.4%) compared to (-4%) on Nifty. Overall, NG 5050 was the best performer in FY 23 clocking a handsome 8.3% once again proving it’s stable nature.

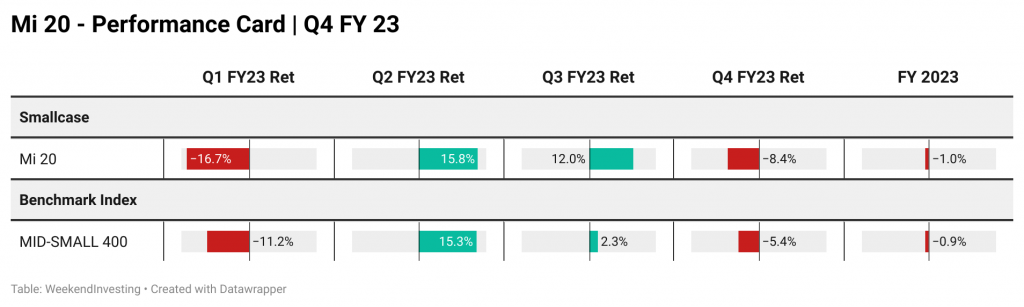

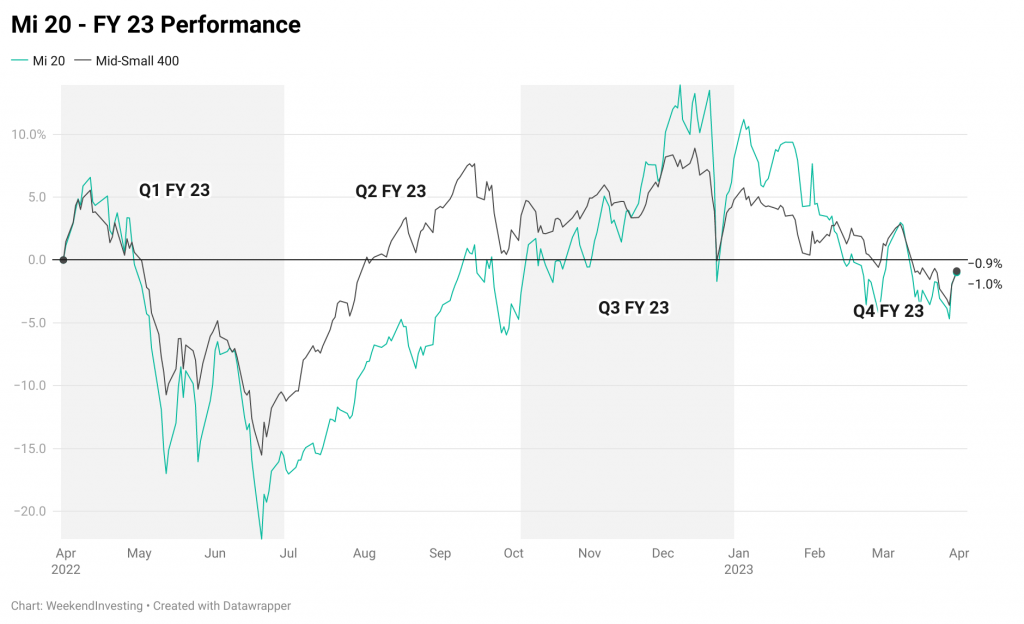

Mi 20 Performance

The Mi 20 is a portfolio of up to 20 stocks that aims to create sizeable alpha with trending stocks from the Mid-Small Cap 400 Index using the principles of Rotational Momentum. The strategy is rebalanced weekly and allocates 5% to each new entrant. The strategy is only available in the smallcase format.

After a poor start in Q1, Mi 20 did very well in Q2 & Q3 and ended the FY on par with it’s benchmark, the Mid-small 400 index. After a superb rally from Jun 2023 that lasted for about 6 months, markets have corrected quite a bit and we hope Mi 20 will put up a good performance once we hit another leg of uptrend.

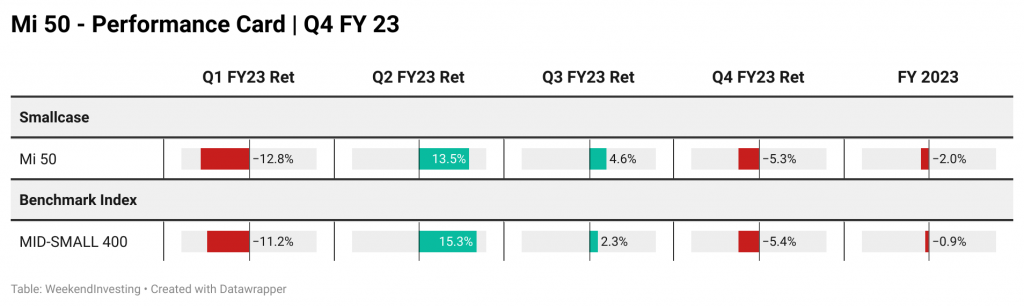

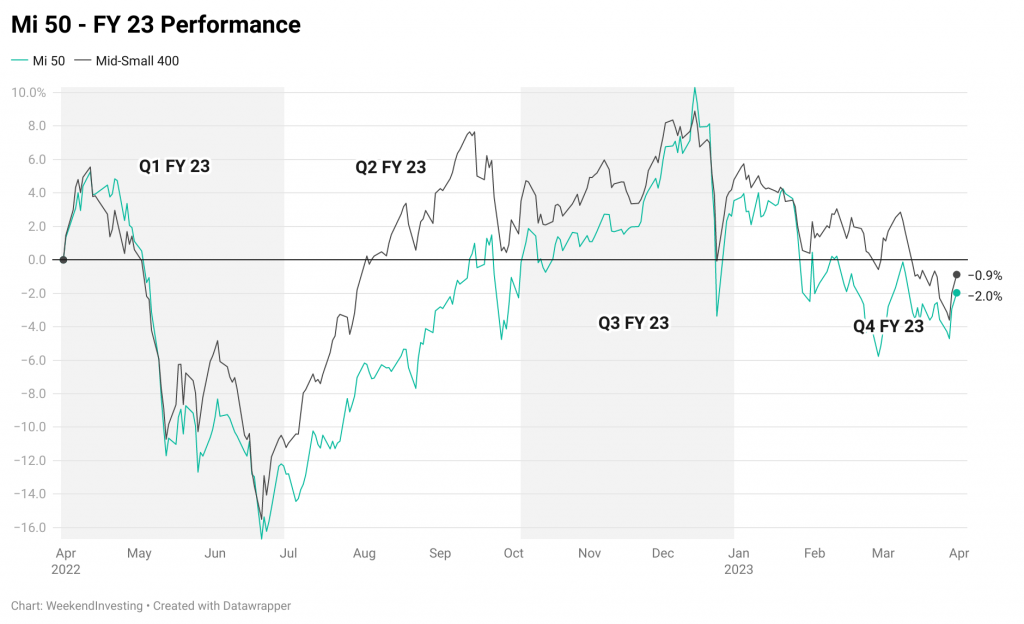

Mi 50 Performance

The Mi 50 is an up-to 50 stock weekly rebalanced portfolio that follows momentum trends among small cap and mid cap stocks only. These stocks are filtered for average min volume and market capitalization above 1000 crores only. The stocks that are picked are allocated an exposure of 2% per stock in the portfolio. This is one of our very popular portfolios and it has consistently outperformed the benchmark index by a wide margin despite the large diversification. This strategy is balanced weekly and is available in both the Universal and the smallcase format.

Mi 50 tracked it’s benchmark throughout FY 23 as you can see from the quarterly chart above. This strategy is a flagship which has recorded consistent performance year after year. The CAGR of Mi 50 stands at a respectable 23% with a max drawdown of 25%.

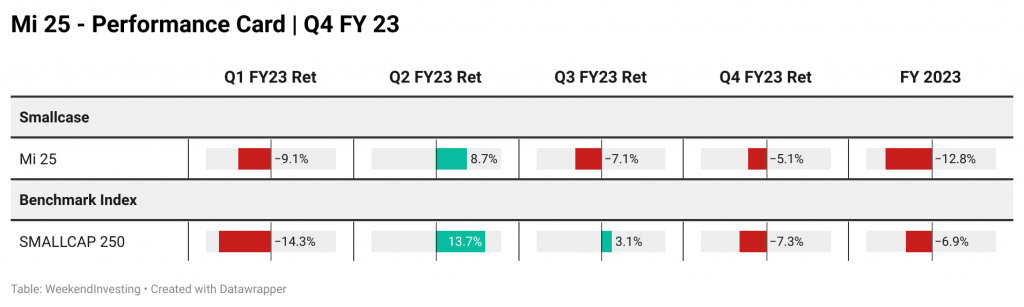

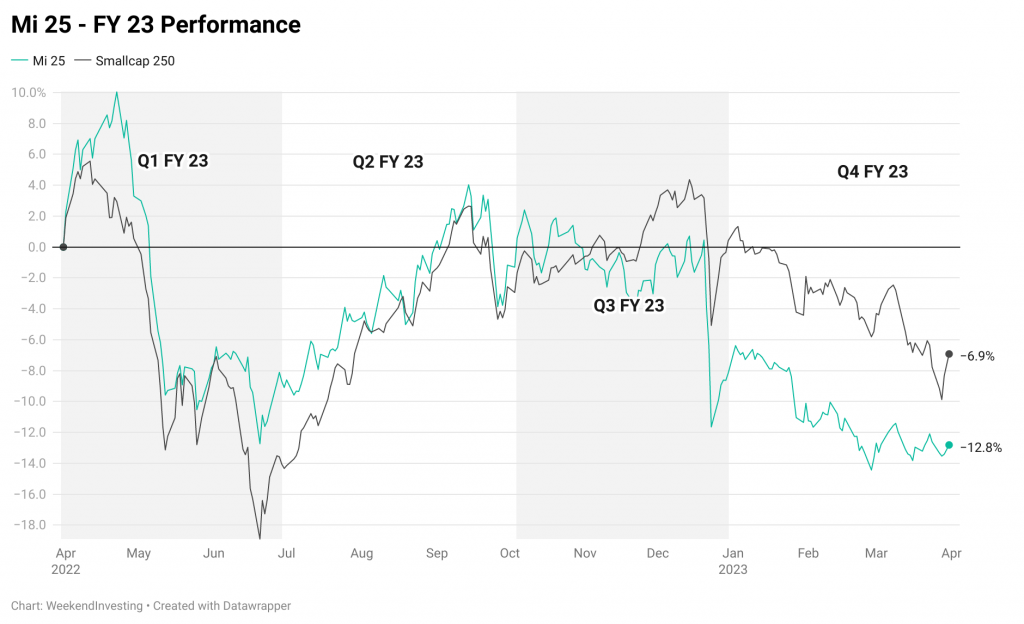

Mi 25 Performance

The Mi 25 is an up-to 25 stock weekly rebalanced portfolio that follows momentum trends among small cap stocks only. These stocks are filtered for average min volume and market capitalization above 1000 crores only. The stocks that are picked are allocated an exposure of 4% per stock in the portfolio. This is one of our very popular portfolios and it has consistently outperformed the smallcap index by a wide margin. This strategy is balanced weekly and is available only in the smallcase format.

Mi 25 did quite well to mirror it’s benchmark till the end of Q3 FY 23 but a steep correction towards end of Dec 2022 did not auger well for the strategy which ended up returning (-12.8%) compared to (-6.9%) on the benchmark. We hope the strategy does well when we get some uptrends.

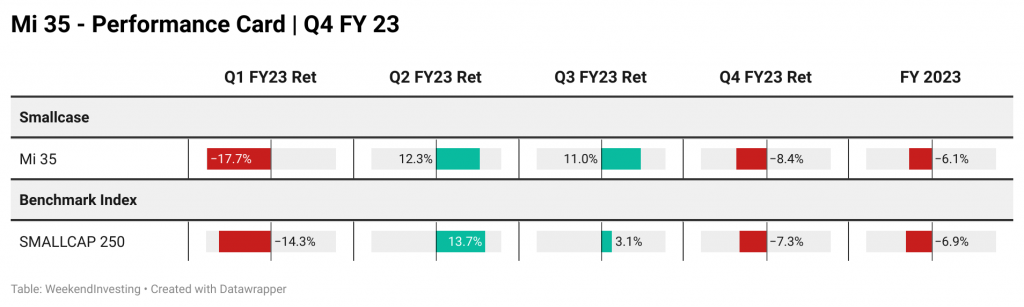

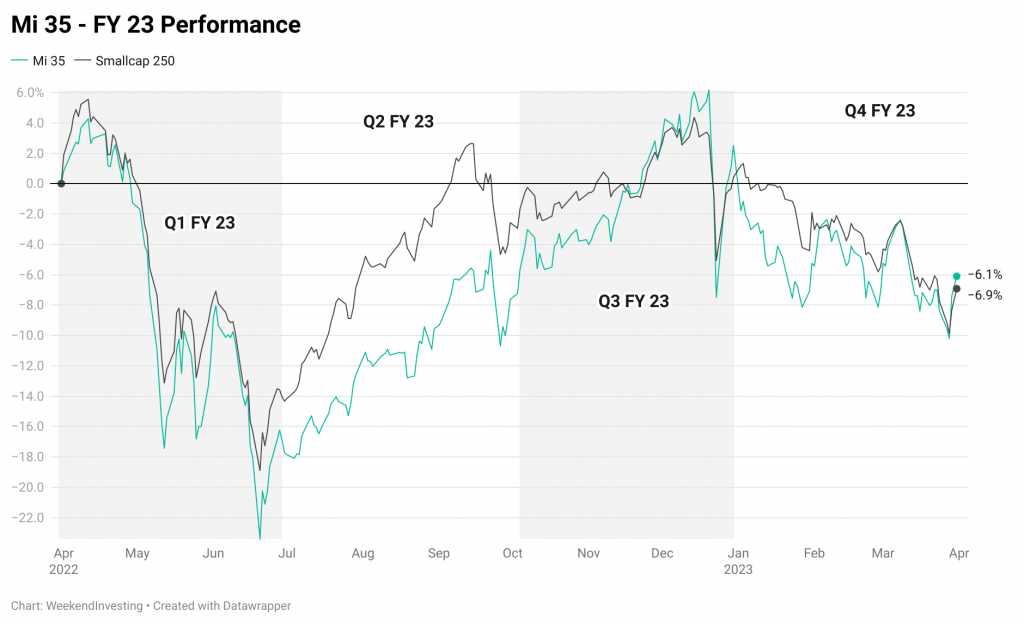

Mi 35 Performance

Mi35 is a dynamic strategy which aims to outperform the underlying benchmark Smallcap250 index. These are the 251st -500th stocks in the market place. This product is suitable for use in all stages of the market cycles as it is designed to remain invested in the strongest 35 stocks in the pack regardless of market conditions

Mi 35 had a remarkable Q3 FY 23 but an average outing in the rest of the period ended up making the strategy close out with a poor (-6%) despite staying on par with the Smallcap 250 index.

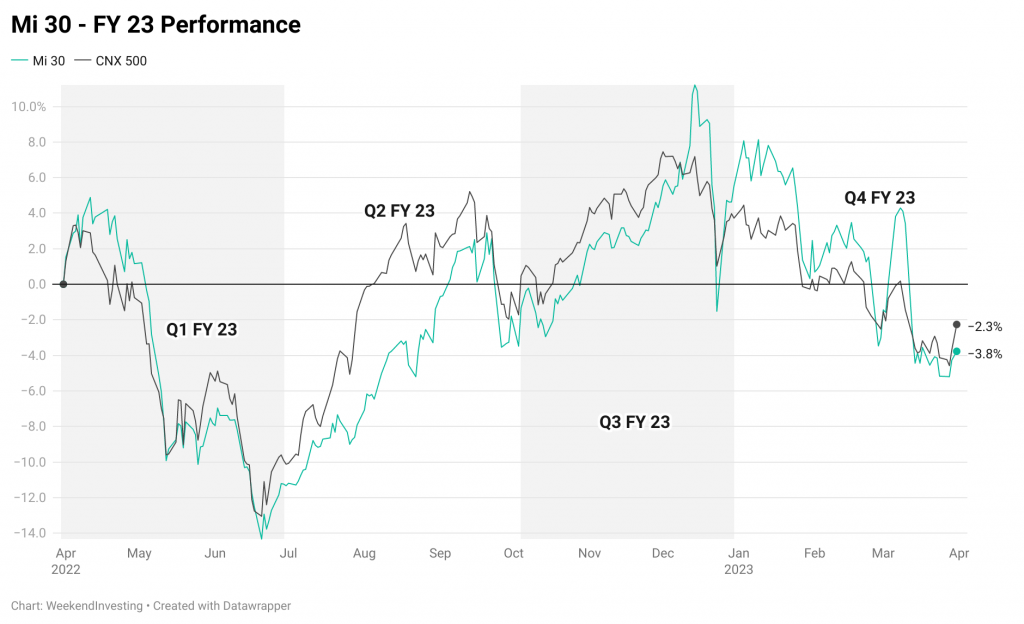

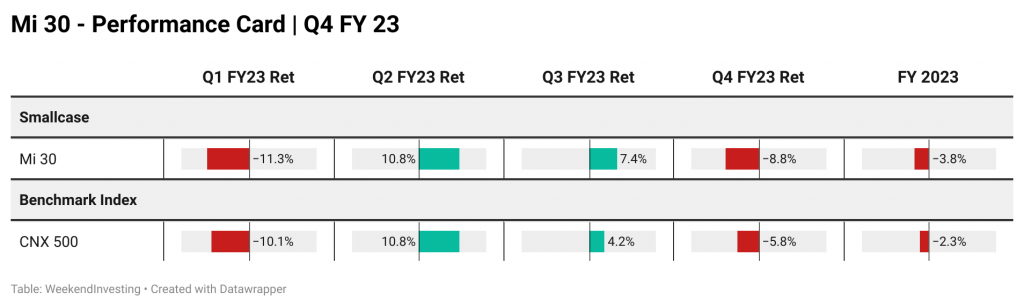

Mi 30 Performance

The Mi 30 is an up-to 33 stock weekly rebalanced portfolio that follows momentum trends among constituents of the CNX500 index. The CNX500 index comprises the largest 500 stocks in the NSE universe. These stocks are filtered for average min volume and market capitalization above 1000 crores only. The stocks that are picked are allocated an exposure of 3% per stock in the portfolio. This is one of our very popular all cap portfolios and it has consistently outperformed the underlying index by a wide margin. This strategy is balanced weekly and is available in both the Universal and the smallcase format.

Nothing much to report as Mi 30 also exactly mirrored it’s benchmark , the CNX 500 returning a flat performance in FY 23.

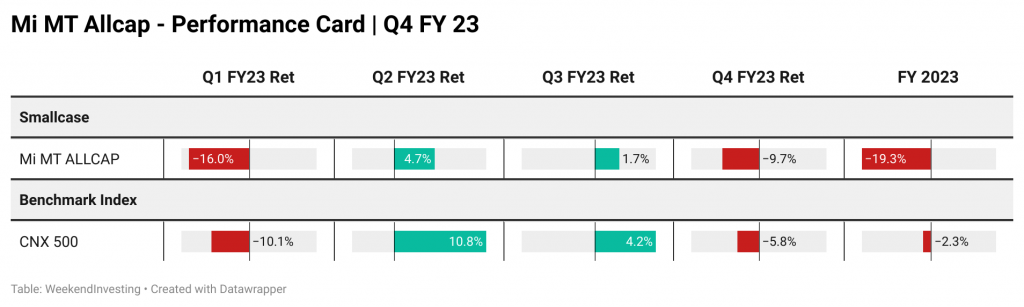

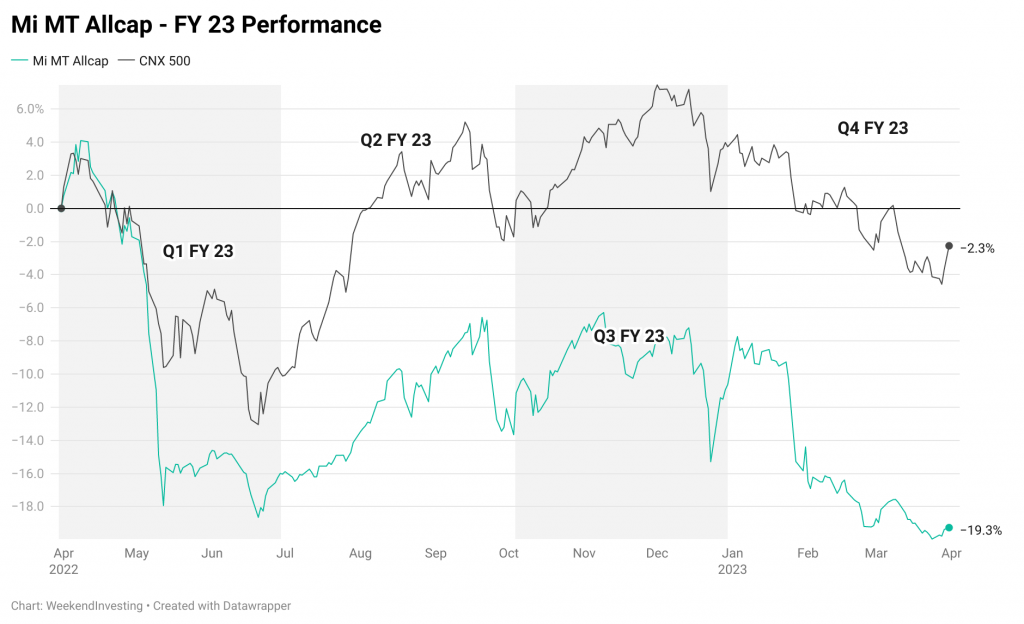

Mi MT Allcap Performance

The Mi MT Allcap is a 20 stock weekly rebalanced portfolio that follows momentum trends among all listed NSE stocks. These stocks are filtered for average min volume and market capitalization above 1000 crores only. The stocks that are picked are allocated an exposure of 5% per stock in the portfolio. This is one of our very popular portfolios and it has consistently outperformed the benchmark index by a wide margin.

Barring a good run in Q2 FY 23, Mi Allcap had a poor run this year. It is also to note that the strategy has had an average cash holding of 33% throughout this FY. A bad Q4 especially after coming fully out of cash hit the strategy’s overall performance. Nevertheless, Allcap is a rock star strategy which can be a great companion for your long term financial goals !

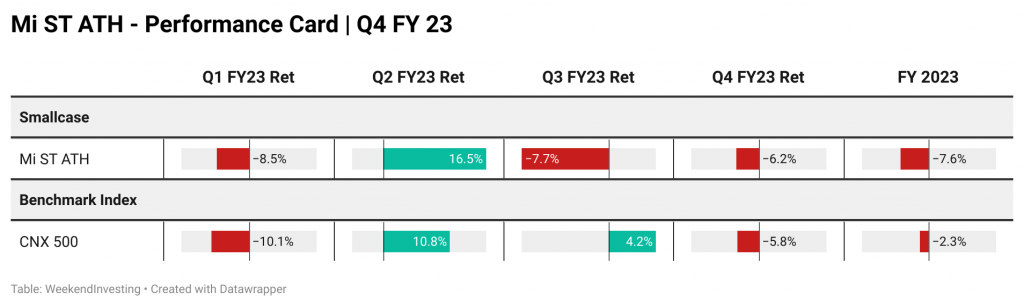

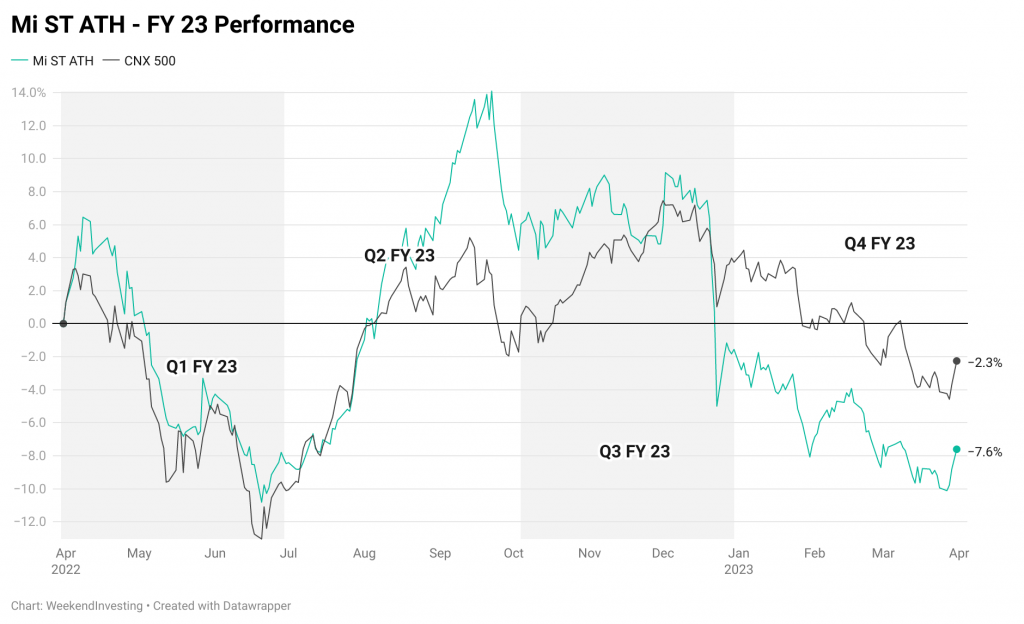

Mi ST ATH

Mi ST ATH is a firebrand upto 10 stock portfolio that follows the short term momentum trends among all listed NSE stocks above market capitalization of INR 1000 cr and chases stocks hitting All Time Highs or multi year highs. The strategy is nimble footed and can have a higher churn.

Mi ST ATH also mirrored it’s benchmark almost for the entire period of FY 23 but for a poor Q4 where the strategy lost 8%. ATH is a strategy that predominantly requires stronger up trends which is in turn capitalized to extract some alpha while choppy markets will frustrate a bit. The CAGR is still spectacular at 34% compared to 12% on the CNX 500 index.

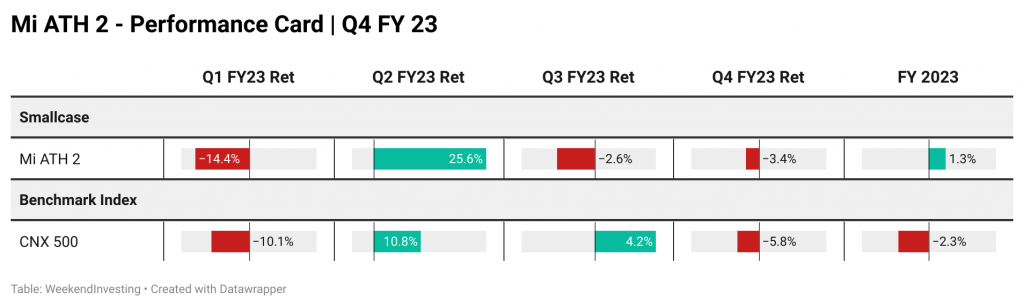

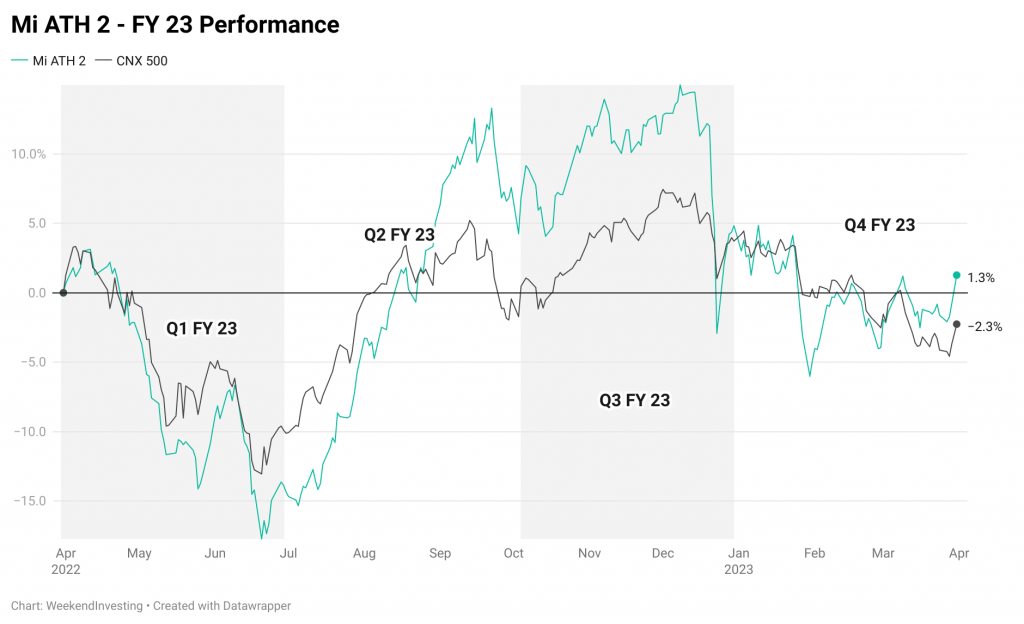

Mi ATH 2 Performance

Mi ATH 2 is a high risk , up to 10 stocks strategy that aims to create sizeable alpha by chasing stocks near their all time or multi year highs from the all listed NSE stocks above Market Cap of 500 crore. The strategy is nimble footed as it seeks to minimize losses by quickly exiting stocks that fail to trend up.

Mi ATH 2 also has a story that is similar to Mi ST ATH. Brilliant performance all the way till end of Dec 2022 before giving it all up in the last quarter of this FY. The spirited run of 25.6% generated in Q2 is a testament to the kind of alpha this strategy can extract when we get continuous trending markets.

If you have any questions , please send us an email to support@weekendinvesting.com