The unpredictability of financial markets often catches investors off guard, challenging their assumptions and preconceptions. In this discussion, we shed light on the importance of avoiding complacency and adapting to evolving market dynamics. Historical trends are no guarantee of future performance, as demonstrated by recent anomalies across various asset classes.

Surprising Commodity Trends

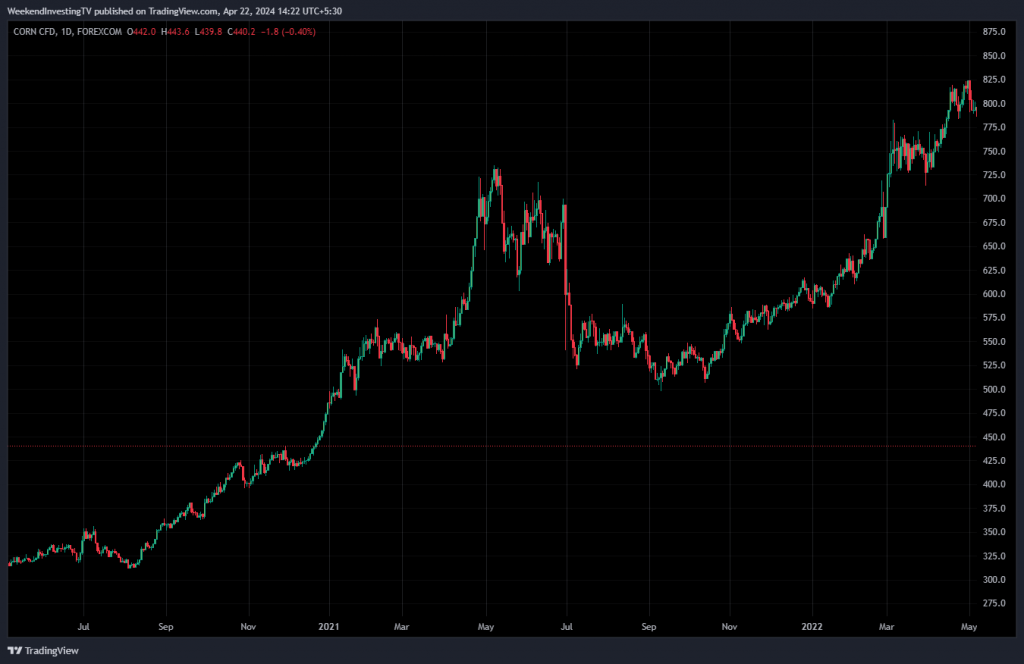

Take, for instance, corn futures traded in the US market. Within a mere year and a half after 2020, corn prices surged from $300 to over $800 per unit. Such a drastic threefold increase in a staple commodity like corn defied conventional expectations, leading to significant disruptions in industries reliant on corn-derived products.

Cocoa’s Unprecedented Rally

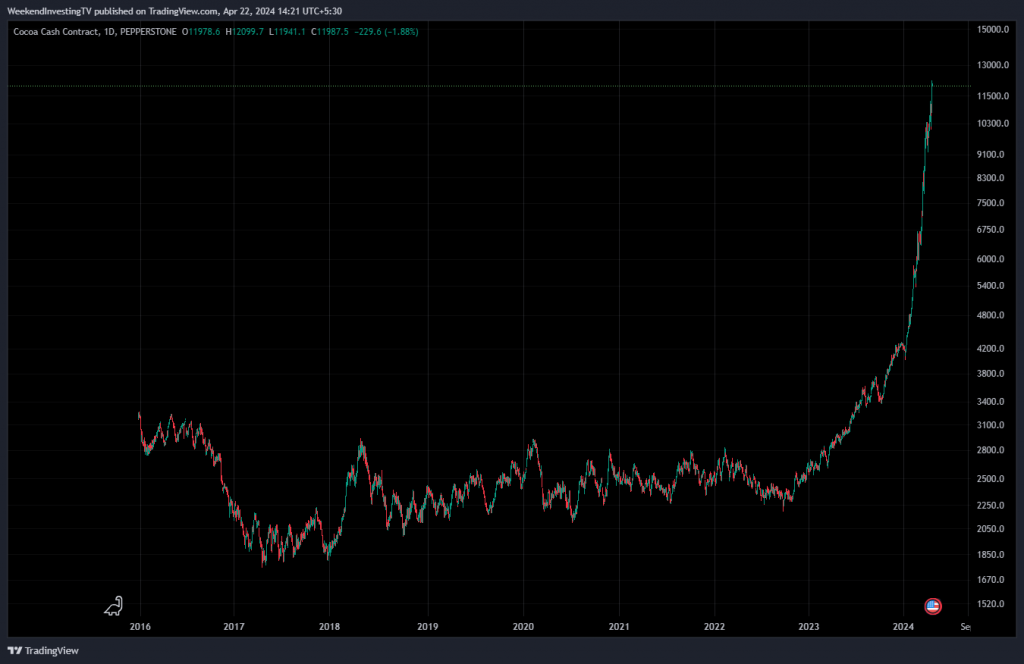

Similarly, cocoa prices experienced an unprecedented surge, soaring from $2,000 to nearly $12,000 per ton in the aftermath of 2022. This sixfold rise shattered previous price ceilings, catching many traders off guard. Those accustomed to playing within a certain price range found themselves exposed to substantial losses as market dynamics swiftly shifted.

Lessons from Crude Oil

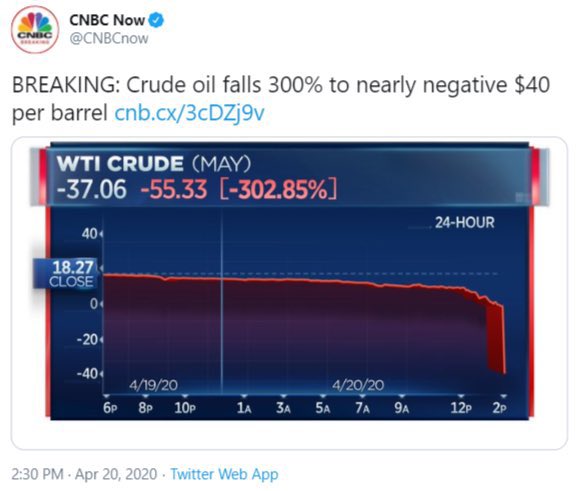

Perhaps one of the most striking examples is the historic plunge of crude oil futures in April 2020, when prices briefly turned negative, plummeting to -$40 per barrel. This unexpected turn of events left many traders reeling from substantial losses. The incident serves as a stark reminder of the inherent volatility and unpredictability of financial markets.

Beware of Recency Bias

Recency bias, wherein investors place undue emphasis on recent market trends, can cloud judgment and lead to erroneous decision-making. Just because a stock or index has followed a certain trajectory in the recent past does not guarantee its future direction. Case in point: Yes Bank’s precipitous decline from Rs. 400 to Rs. 10, defying conventional expectations and highlighting the need for vigilance amidst changing market conditions.

To navigate the uncertainties of the market effectively, investors must develop a disciplined and adaptable strategy. Rather than relying on outdated assumptions or succumbing to recency bias, it’s crucial to have a well-defined plan of action. Whether the market is trending up or down, having a clear strategy in place ensures prudent decision-making and mitigates the risk of significant losses.

WeekendInvesting Strategy Spotlight – It isn’t always about the multibaggers !

There has always been a frenzy in the stock market around multibaggers.

You will often come across stories that go like this – “Oh I bought this stock when it was trading around Rs 25 and today it is trading at Rs 250”. “I made a handsome 10x on this stock”

But, people seldom discuss negative outcomes or stories of their failure. Aspects like risk mitigation, position sizing & opportunity cost often take a back seat paving way for cooler discussions around multibagger stocks.

Consider the case of “VEDL”. After making a high of Rs 484, the stock has virtually remained flat for 14 long years. One may wonder whether it is even possible to successfully navigate through the troubled waters of a choppy stock like this one but that is where the beauty of momentum lies.

VEDL entered Mi NNF 10 back in Apr 2021 at a time when most might wonder “Why now”. The stock may not have gone on to become a multibagger for the portfolio but just the fact that a rule based approach could successfully maneuver through a stock like this without having to face a loss & instead to come out with a reasonable gain of 50% speaks volumes about the ability of momentum investing to keep you calm and composed at all times without having to worry about the outcomes too much.

So multibagger is not the only thing that sounds cool,

Identifying and extracting momentum in a stock that has remained stagnant for 14 years is also a story worthy of a discussion.

Disclaimers and disclosures : https://tinyurl.com/2763eyaz

If you have any questions, please write to support@weekendinvesting.com