SIP Growth in the Market

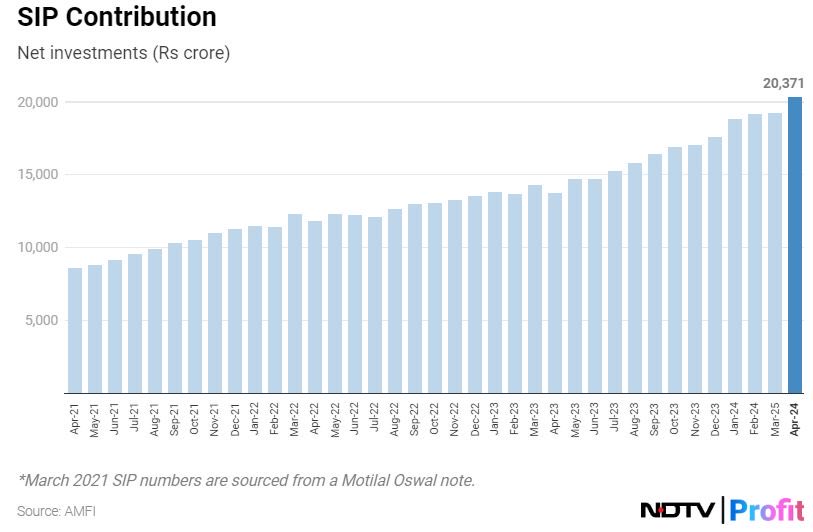

As of April 2024, the contribution of Systematic Investment Plans (SIPs) in the market has seen significant growth. SIPs have increased from nearly 8,500 crores in April 2021 to about 20,000 crores per month in April 2024. This remarkable growth, almost tripling in three years, was not observed in the three or six years prior to April 2021. This surge indicates a positive trend where more people, especially the new workforce, are realizing the value of equity investments.

Impact of Regular Investments

Regular and gradual investments over a career can make a substantial difference in the long run. For instance, an acquaintance who never invested in equities feels left out as he nears retirement without a substantial portfolio. This example underscores the importance of consistent investments, highlighting how SIPs can play a crucial role in building wealth over time.

Potential Market Effects

There are two ways to interpret the current trend in SIP growth. One perspective is that the continuous influx of 20,000 plus crores every month can irrationally fuel the markets. This fresh money, regardless of valuations or earnings, can help stocks hold their ground at higher levels. This steady stream of investments can provide a strong foundation for the market, ensuring stability and growth.

Risk of Market Corrections

On the flip side, the rapid influx of money could lead to a significant market correction. The new investors who have entered the market in the last three to four years have not experienced any substantial downturns. Since COVID, there hasn’t been even a 5-6% correction. Historically, markets experience down cycles every decade, with 20-30% declines over one to three years. When this correction happens, many new investors may panic, leading to further market instability.

Domestic Counterbalance to FIIs

One positive aspect of the increasing SIP contributions is that it provides a counterbalance to Foreign Institutional Investors (FIIs). Previously, the market was highly influenced by the whims of FIIs. Now, with a strong domestic investment base, the market can achieve greater stability and resilience against external influences. This shift towards a more balanced investment environment is encouraging for long-term market health.

Challenges for New Investors

However, the rise in SIPs has also brought in about ten crore new investors who have not faced a typical market down cycle. This inexperience could lead to panic and irrational decisions during market corrections. As these new investors encounter their first significant downturn, their reactions could impact the overall market sentiment and performance.

Overall Positive Trend

Despite the potential risks, the overall trend of increasing SIP contributions is positive. The growth in SIPs signifies a growing awareness and participation in the equity market among the general population. This increased participation can lead to a more robust and resilient market in the long run.

Disclaimers and disclosures : https://tinyurl.com/2763eyaz

If you have any questions, please write to support@weekendinvesting.com