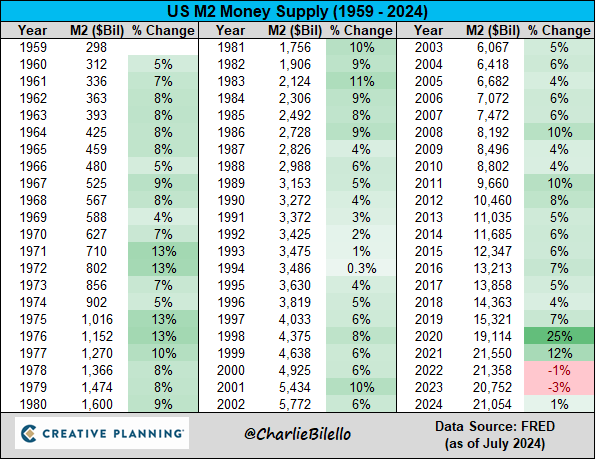

Understanding the US Money Supply and Inflation

The US money supply, known as M2, includes all the liquid money in circulation, such as cash and digital forms of currency. Over the past 65 years, M2 has steadily increased, reflecting the rise in money issued by the central bank. For example, in the 1950s and 1960s, the money supply was around $300 billion. Over time, this has increased, often by 5-7% per year, though some years saw larger jumps, especially during crises like wars or economic downturns.

Impact of COVID-19 on Money Supply

In 2020, during the COVID-19 pandemic, the US money supply saw an unprecedented increase. At the start of the year, there was $15 trillion in circulation. However, within just one year, 25% more currency was added to the economy. Over the span of two years, a total of 37% more money was pumped into circulation, pushing the total to nearly $22 trillion. This massive increase in money supply came from government stimulus programs and 0% interest rate borrowing.

Inflation and Its Causes

The significant increase in money supply during COVID-19 caused inflation to rise sharply. With so much more money available in the economy, the value of each dollar decreased. Essentially, the same amount of goods and services now required more money to purchase. This influx of money doesn’t disappear; it remains in circulation, affecting prices and purchasing power. As a result, inflation occurs, with the prices of assets and goods rising across the board.

Real Returns vs. Money Supply Growth

One important thing to understand is that when the money supply grows, it impacts real returns on investments. For example, over the last 65 years, the US money supply has grown at a compound annual growth rate (CAGR) of 6.5%. This means that if an investment like the S&P 500 generates returns of 9.5%, the real return is only around 3%, because the rest is offset by the increasing money supply. Therefore, while investments may appear to be growing, in reality, they may not be increasing as much as we think.

The Illusion of Wealth Growth

Many people feel wealthier as they see their assets grow year after year. For instance, if you had one crore last year and now have one crore ten lakhs, it might feel like you are doing better. However, much of this increase is simply due to the growing money supply, not real growth. Central banks across the world manage this by printing more money while ensuring inflation stays within a manageable range, creating the illusion that assets are increasing in value.

The Need to Outpace Money Supply Growth

To truly move ahead financially, it is essential to invest in assets that grow faster than the rate at which money is being created. Whether it’s through stocks, gold, or other investments, your goal should be to outpace the growth of the money supply. This ensures that you are not just keeping up with inflation but actually gaining real wealth. If your investments grow at a rate higher than the money supply, you are effectively increasing your purchasing power and securing a better financial future.

Mi EverGreen’s Subscription Fee goes up on 10 Sep 2024

Effective 10 Sept 2024 , Mi EverGreen’s subscription fee will be increased for the first time since launch.

Old Pricing : Rs 2,499 (Quarterly) | Rs 7,499 (Annual)

New Pricing : Rs 4,999 (Quarterly) | Rs 14,999 (Annual)

For Current Subscribers of Mi Evergreen

Nothing changes for current subscribers at all. You shall continue to enjoy access to the strategy at your current subscription fee as long as you do not break your subscription loop. Kindly ensure that you keep your auto renew ON and renew your subscription on time.

For those who haven’t subscribed yet

This is a great opportunity to subscribe to Mi Evergreen at its current pricing. Use the link given below to subscribe

Disclaimers and disclosures : https://tinyurl.com/2763eyaz

If you have any questions, please write to support@weekendinvesting.com