Rethinking the “Buy and Hold” Strategy

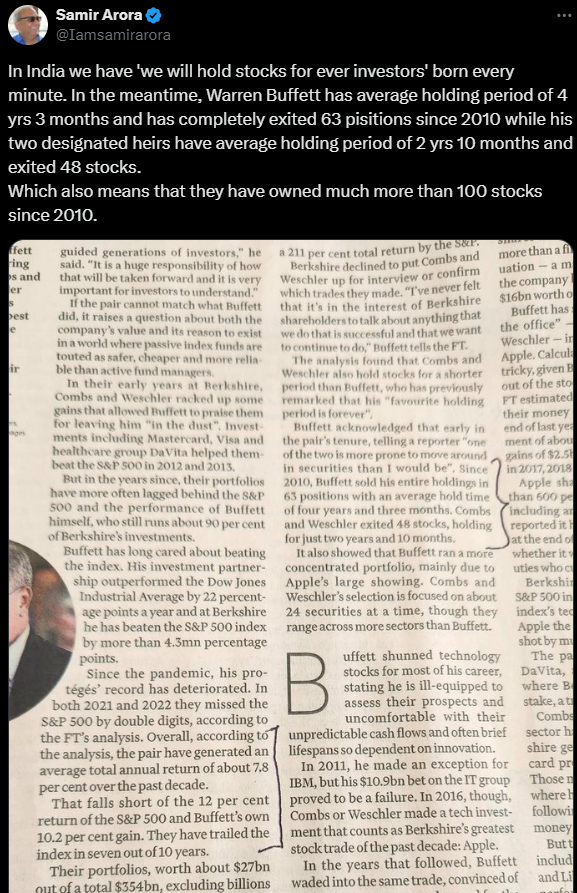

A recent tweet by Sameer Arora shed light on Warren Buffett’s investment approach, challenging the conventional wisdom of buy-and-hold strategies. While many investors advocate holding onto stocks for the long term, Buffett’s actions reveal a different story. Over the past decade, Buffett and his team have sold their entire holdings in 63 positions, with an average hold time of just four years and three months.

The Illusion of Perpetual Holding

Contrary to the popular belief that successful investing means never selling stocks, Buffett’s actions suggest otherwise. Despite the common narrative of holding onto stocks indefinitely, the reality is that market conditions change, requiring investors to adapt and make strategic decisions about their portfolios.

Adapting to Market Dynamics

In today’s rapidly evolving world, holding onto stocks without reassessment can be detrimental to investment success. Factors such as government policies, technological advancements, and competition necessitate a dynamic approach to investing. Simply put, what may be a top stock today could face challenges in the future.

Avoiding Investment Pitfalls

Investing based on hearsay or following generic advice from media outlets can lead to poor investment decisions. Instead, investors should devise their own strategies based on thorough analysis and metrics. Blindly following popular slogans like “buy when there’s blood on the street” or “sell when others are greedy” may sound appealing but often fail to deliver real results.

While it’s important to listen to investment advice, it’s equally crucial to discern between what sounds good and what actually works. The market is full of catchy phrases and anecdotes, but successful investing requires more than just slogans. By focusing on actionable strategies backed by sound principles, investors can navigate the complexities of the market with greater confidence and success.

Disclaimers and disclosures : https://tinyurl.com/2763eyaz

If you have any questions, please write to support@weekendinvesting.com